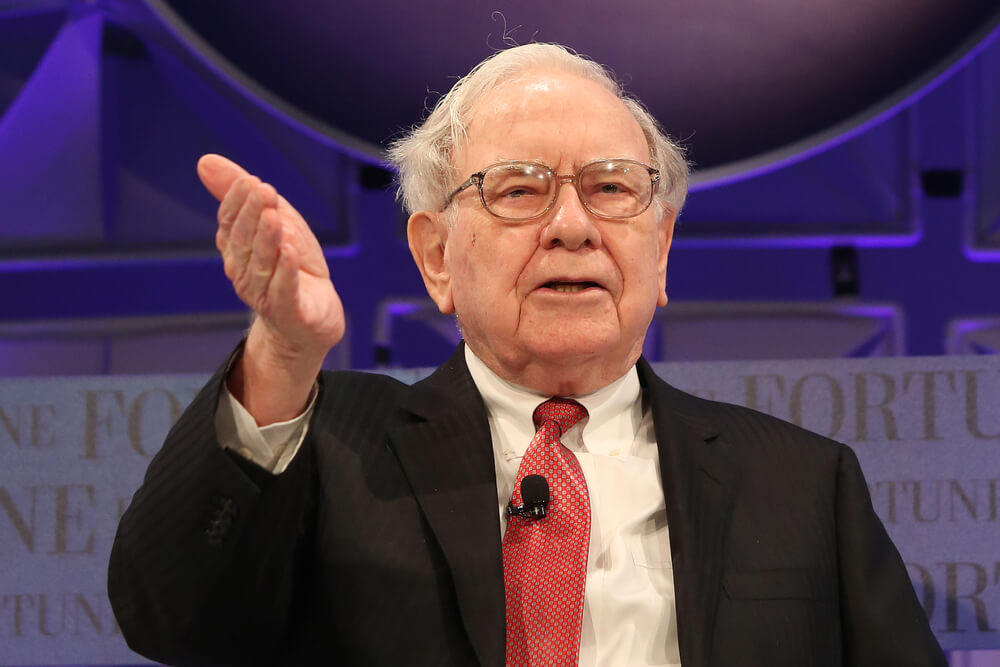

Investor Warren Buffett’s company added to its stakes in Apple and Israeli drugmaker Teva Pharmaceuticals in the second quarter while tweaking several of its other stock investments.

Berkshire Hathaway Inc. filed an update on its U.S. stock portfolio with the Securities and Exchange Commission on Tuesday.

Berkshire held nearly 252 million Apple shares at the end of June, up from 239.57 million in March.

The Teva investment was just disclosed earlier this year and has grown to 43.2 million shares from 40.5 million in the first quarter.

Berkshire had said Monday that it reduced some of its investments in airline and banking companies, such as American Airlines and U.S. Bancorp, because it seeks to own no more than 10 percent of any firm and those companies have been repurchasing stock.

Berkshire added to its investments in Southwest and Delta airlines while trimming its stakes in American and United Continental.

Berkshire said those decisions to reduce some of its holdings to under 10 percent don’t reflect how it feels about those companies.

Investors follow what Berkshire buys and sells closely because of Buffett’s successful track record. Berkshire officials don’t generally comment on these quarterly filings.

And the quarterly filings don’t make clear who made all the investments. Buffett handles the biggest investments in Berkshire’s portfolio, such as Coca-Cola, Apple and Wells Fargo. He has said that investments of less than $1 billion are likely to be the work of Berkshire’s two other investment managers.

Berkshire made several other moves during the quarter:

— Increased its Goldman Sachs investment to 13.3 million shares, from 11 million shares.

— Reduced its Charter Communications investment to 7.5 million shares from 8.2 million.

— Cut its Phillips 66 investment to 33.9 million shares from 45.7 million shares in March.

Besides investments, Berkshire owns more than 90 companies, including insurance, retail, manufacturing, railroad and candy companies.

© The Associated Press. All rights reserved.