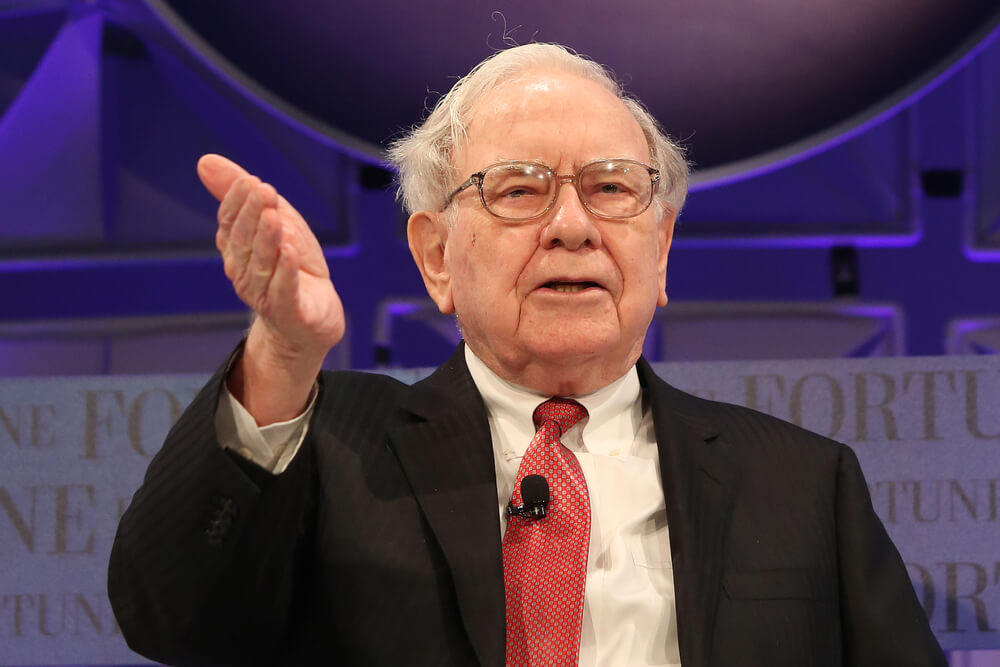

Warren Buffett, the world’s third-richest person with about $86 billion in net wealth, is known as one of the most successful stock market investors of all time.

“Warren Buffett is still having difficulty in finding value in U.S. — and perhaps global — stocks.”

Buffett started buying stocks when he was 11 years old, and he filed his first tax return at the ripe old age of 13.

Now 87 and the founder and CEO of Berkshire Hathaway, Buffett has dialed back his company’s investments the past couple of years.

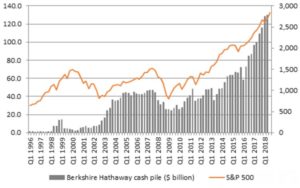

At the end of the second quarter, Berkshire Hathaway had $111 billion in cash on hand, the most in the company’s history — and his company’s reluctance to invest that money could be seen as a bad sign for the market as a whole, according to Business Insider.

Considering his company’s reluctance to invest much since 2017 and Buffett’s market expertise, it could be a sign that stocks are currently riding too high and too expensive.

Valuations have only gotten more stretched over that period (since 2017), suggesting that an already tenuous situation has worsened.

Russ Mould, an investment director at AJ Bell, has taken notice. He’s wary of the speculative deal fervor he sees accompanying record stock prices.

“M&A tends to peak when animal spirits are running high and often when executives feel their own shares are expensive enough to make them a valuable acquisition currency,” Mould wrote in a client note. “Warren Buffett is still having difficulty in finding value in U.S. — and perhaps global — stocks.”

Mould points out — and indicates in the chart above — that Berkshire Hathaway’s cash balance has been an effective proxy for market levels over history. As you can see, Buffett held comparatively high levels of cash in the periods preceding the two most recent market crashes, in 1999 and 2007.

Of course, this doesn’t mean the market is set to crash tomorrow, but it is a question investors should weigh when deciding how, when and where to spend their money as we approach the mark for the longest bull market run on record, a mark that could soon be coming to an end.