The results are in!

If you participated in our Money & Markets Daily survey, I want to kick this off with a big: “Thank you!”

Your responses are already helping us tailor this newsletter into your go-to for all things money and markets (See what I did there?!).

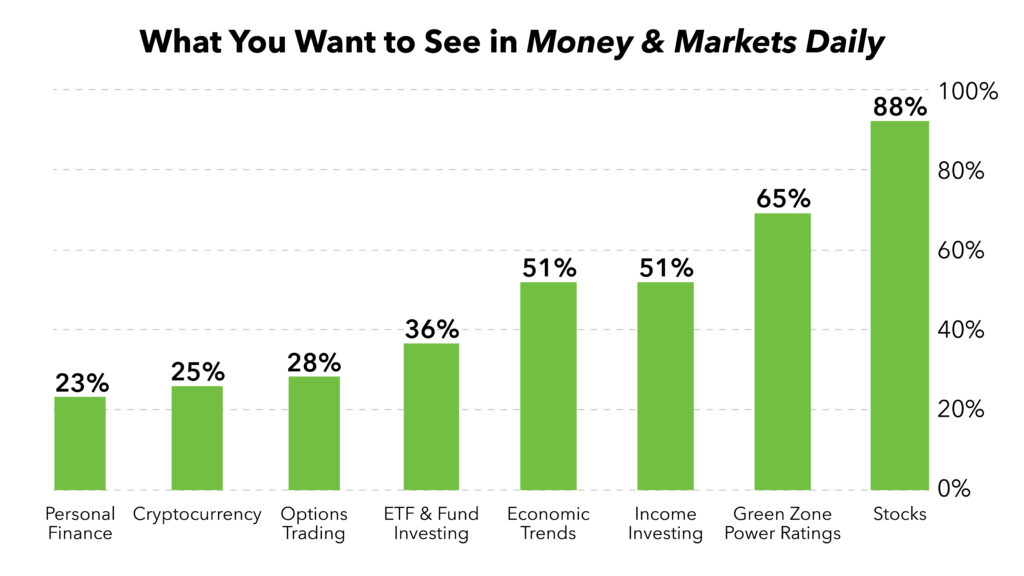

Here’s a breakdown of how you voted:

You all know what you want! More stock analysis (88%) and Green Zone Power Ratings (65%) were the big two. And then half of you voted for more coverage of income investing and economic trends.

We’re working on how to touch on economic trends more often (stay tuned). But income is a perfect road to go down in today’s Money & Markets Daily. I’ll throw in a healthy dose of stock analysis and Green Zone Power ratings as well.

Let’s get into it…

Comcast Stock’s Dividend Tailwind

I’ll be honest, my relationship with Comcast Corp. (Nasdaq: CMCSA) is tenuous at best. You may be able to relate.

I’ve used the telecom’s internet service provider, Xfinity, for years now. That’s mostly due to a lack of better or more affordable options.

The internet service is fine, so long as I don’t have to have to contact customer service…

What piqued my interest in CMCSA was its blockbuster Wednesday earnings report. The company’s earnings per share and revenue crushed Wall Street expectations.

The cherry on top was news that Comcast is raising its dividend by 7%, or $0.08, to $1.24 per share annualized for 2024.

Since income investing and Green Zone Power Ratings were the most voted-on survey answers, I thought this was the perfect stock to highlight today.

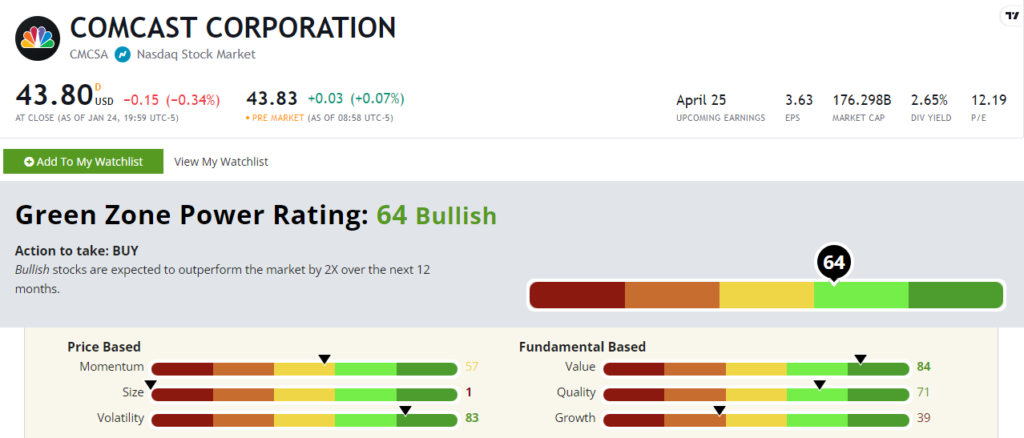

And CMCSA looks favorable in Adam O’Dell’s system right now.

Comcast stock rates a “Bullish” 64 out of 100 in Green Zone Power Ratings. Bullish-rated stocks are set to outperform the broader market by 2X over the next year. If this S&P 500 hits its average 10% annual return, CMCSA should gain 20% or more.

I want to focus on its Value rating of 84. Unlike many of the tech stocks I’ve covered recently, Comcast boasts much healthier valuations. That’s due in part to its industry. Communications services don’t draw the same fervor as high-growth tech.

I brought Chief Research Analyst Matt Clark into the fold here, and he pointed out a metric you may want to add to your investing arsenal.

CMCSA’s total enterprise value/EBITDA, which factors in both a company’s equity and debt to determine a stock’s value, is sitting at 7.1X as I write. The lower the better here. Its peer average is much higher at 12.8X. Paramount Global (Nasdaq: PARA), a chief competitor in the streaming space, is sitting at 51X!

On the Volatility front, this is a pretty steady stock. A rating of 83 means it’s less volatile than all but 17% of more than 6,000 stocks rated in Adam’s system. While investors do tend to react on earnings, with larger intraday swings post-quarterly call, Comcast is one of the largest communications companies in the U.S. That grants it a degree of stability that many smaller stocks can’t manage.

Now, let’s talk dividends…

Income and Green Zone Power Ratings

I’ll be frank, Green Zone Power Ratings does not take dividends into account when establishing a stock’s rating.

But that’s not a bad thing.

If you find a stock that rates well, that extra dividend yield acts as a bonus. You’re buying a stock that’s set to outperform, and getting an extra quarterly, annual or even monthly payout depending on the company.

And the fact that Comcast increased its dividend by 7% is a fantastic sign. Leadership is confident about the company’s future, and it’s rewarding investors along for the ride.

At the end of the day, Comcast stock is trading at a good value, comes with a bonus payout (even if its current 2.6% dividend yield isn’t even beating inflation) and is set to outperform by Green Zone Power Ratings standards.

That doesn’t sound too bad to me!

Again, if you did already, thank you for taking our Money & Markets Daily survey. If you haven’t, you still can here if you’d like!

We are working hard to give you the financial insights you want — and that’s not going to change from here.

Have a great weekend!

Until next time,

Chad Stone

Managing Editor, Money & Markets

P.S. Comcast’s high-growth days are likely behind it. It’s a steady stock with a massive market cap, and there’s nothing wrong with that.

But there are many smaller stocks that are set to absolutely crush CMCSA’s gains over the next year. Adam is ready to help you invest in the best of the bunch in 10X Stocks. Click here to see how you can follow him now and set yourself up for an incredible 2024!