Acquiring an entire company — or even part of one — can take millions of dollars.

You won’t find that money digging in couches.

Investors, private equity companies and other businesses need help raising that kind of capital.

This is where investment banks come into play.

Investment banks are financial service companies that advise and help finance large stock purchases and mergers and acquisitions (M&As). They are intermediaries in complex corporate transactions.

Using Adam O’Dell’s six-factor Green Zone Ratings system, I found an investment bank with strong financials and top-tier momentum that led to a 100% jump in its stock price over the last 12 months. And I think it has room to run even higher.

We are “Strong Bullish” on this investment bank stock, which means it is poised to outperform the broader market by at least three times over the next 12 months.

Let’s see why investors should act quickly to capitalize.

Investment Banks Score Big With Mergers & Acquisitions

The bread and butter of any investment bank is mergers and acquisitions.

Banks earn fees for advising on these deals. They earn even more money if the bank helps finance a merger.

The U.S. saw consistent growth in mergers and acquisitions from 2009 to 2015 — when the value of M&A deals set a record of $1.9 trillion.

The market cooled in 2016 and 2017 before picking up steam into 2019.

But investors and companies were skittish about buying up or merging with companies during the COVID-19 pandemic in 2020. The financial world was on hold awaiting the outcome of the health crisis.

Now, in 2021, the value of M&A deals has nearly surpassed all of 2020 — and we have more than two months left in the year.

M&A activity is making a comeback and investment banks are growing their bottom line because of it.

Investors can find big profits in this growing trend.

An Investment Bank Stock and Much More: Piper Sandler Cos.

Piper Sandler Cos. (NYSE: PIPR) is an investment bank that works with corporations, private equity groups, public entities and institutional investors internationally. It is headquartered in Minneapolis, Minnesota.

In addition to serving as an investment bank, Piper Sandler provides other investment services to its clients:

- Advice on M&As.

- Raising capital though equity and debt financing.

- Underwriting debt issuance.

- Research services.

These are all fancy ways of saying the company helps other businesses raise a lot of money, invest a lot of money and spend a lot of money.

It has been a good run for Piper Sandler.

M&As, special purpose acquisition (SPAC) financing and a bull run in the stock market has led to strong growth for the company.

Institutional investors have poured more money into the market and the value of M&A deals has risen. In 2020, the value of M&A deals was $1.2 billion. So far, in the first 10 months of 2021, that value is $1.5 billion — with nearly 8,000 fewer deals so far this year.

It means while there are fewer actual deals, the value of M&A activity is 25% higher in 2021. This means a lot more reliance on investment banks for capital.

Since 2018, the total annual revenue for Piper Sandler has grown from $741 million to nearly $1.8 billion — a 138% increase.

Piper Sandler Stock Hits 52-Week High Last Week

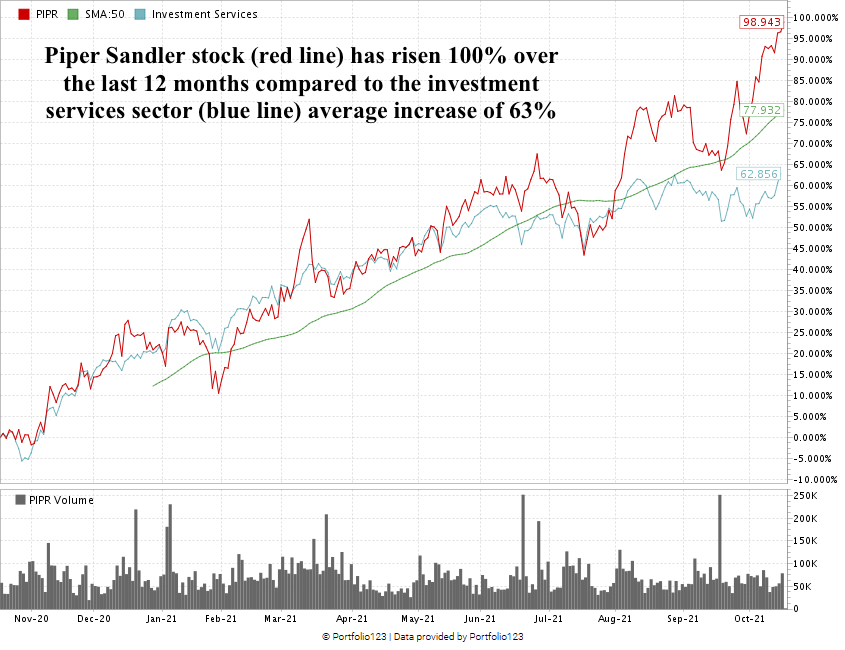

Piper Sandler’s stock momentum has been strong over the last year. It reached its 52-week high last week … and continues to move higher.

In the last 12 months, the stock has jumped 100% higher — from $80 per share to $160 following Monday’s opening bell.

Piper Sandler’s Stock Rating

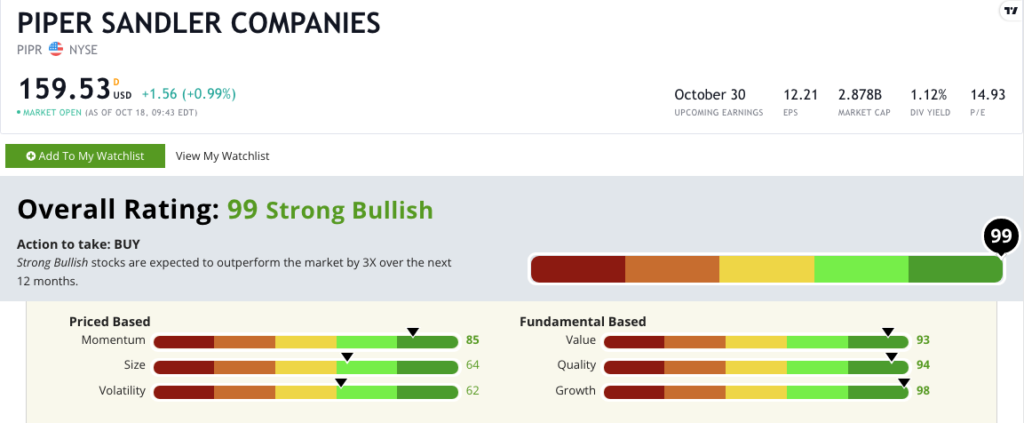

Using Adam’s six-factor Green Zone Ratings system, Piper Sandler scores a 99 overall. That means we are “Strong Bullish” on the stock and expect it to outperform the broader market by three times in the next 12 months.

Piper Sandler’s Green Zone Rating on October 18, 2021.

Piper Sandler stock rates in the green in all of our six factors:

- Growth — The company has a one-year annual sales growth rate of 48.7% and a trailing 12-month earnings per share growth rate of 331%! Piper Sandler earns a 98 on growth.

- Quality — The company’s returns on assets, equity and investments all exceed the investment services industry average — including a 20.4% return on equity compared to the industry average of 13%. Piper Sandler earns a 94 on quality.

- Value — The company’s price-to ratios (earnings, sales, book and cash flow) are in line or below the industry average. It trades with a 1.62 price-to-sales ratio which is lower than the 7.04 industry average. Piper Sandler earns a 93 on value.

- Momentum — Adam loves to find stocks that exhibit “maximum momentum,” and I’d say Piper Sandler fits the bill. PIPR has risen nearly 100% in the last 12 months and that movement has only come with three slight downturns. The company earns an 85 on momentum.

- Size — With a market cap of $2.9 billion, Piper Sandler is a great size for stocks we rate. It earns a 64 in this metric.

- Volatility — Piper Sandlers' stock momentum experienced minor resistance — once each in February, July and September. It earns a 62 on this metric.

Bottom line: As M&A deals start to pick up steam after the COVID-19 pandemic, investment banks are going to profit in a big way.

Fees and financing grow with the size of the deal.

With a strong bottom line, stock growth and maximum momentum, Piper Sandler is an investment bank stock you should seriously consider for your portfolio.

P.S. Live on November 4, my colleague Adam O’Dell will reveal how millions of new investors have accidentally opened a perfect trading window, and the system he designed to exploit this anomaly for massive gains. To sign up for the live event, go here.

Safe trading,

Matt Clark, CMSA®

Research Analyst, Money & Markets

Matt Clark is the research analyst for Money & Markets. He is a certified Capital Markets & Securities Analyst with the Corporate Finance Institute and a contributor to Seeking Alpha. Prior to joining Money & Markets, he was a journalist and editor for 25 years, covering college sports, business and politics.