Every day, I’m amazed at what my smartwatch can accomplish.

It tracks all kinds of information: current stock market conditions, workouts, weather… It’s all on this tiny device on my wrist.

Remember this relic of the past?

That’s a far cry from the must-have device of my childhood: the Casio calculator watch.

My smartwatch works within the Internet of Things (IoT). It sends and receives thousands of data points because it’s connected to the internet 24/7 … either through Wi-Fi or a cellular data connection.

Using Chief Investment Strategist Adam O’Dell’s proprietary six-factor Stock Power Ratings system, I found a “Strong Bullish” stock that provides IoT products and services around the world:

- It just reported record quarterly revenue of $95 million.

- The stock hit a 52-week high at the beginning of June.

- We expect it to beat the market by 3X over the next 12 to 24 months.

Here’s why this IoT stock I’m sharing with you today will continue its strong performance well into the future.

Internet of Things Market Continues to Grow

The IoT consists of physical objects that connect and exchange data with other devices or systems over the internet.

Sensors are placed in cars, lights, refrigerators and countless other devices. These sensors allow each device to “talk” to other devices on the network.

And the market for this innovative tech is expanding at a rapid pace:

The chart above shows the annual revenue of the IoT market worldwide through 2030.

IoT global annual revenue was $440.9 billion in 2021. That’s expected to more than double to $1.1 trillion by 2030!

Bottom line: With outstanding growth like this, companies producing IoT components will expand rapidly.

Incredible IoT Growth in One Stock: Digi International Inc.

Your fridge or smartwatch requires specialized sensors in order to communicate with the internet and other devices.

This is where Digi International Inc. (Nasdaq: DGII) comes into play. The Minnesota-based company produces cellular modules which connect IoT sensors to the internet.

The company recently unveiled its Digi IX30 cellular router, which can survive in the harshest environments. It’s the perfect solution for manufacturing floors and for devices that need to be outside.

Even in today’s rough tech market, DGII has strong revenue growth:

In 2020, DGII’s total annual revenue totaled $254.2 million. That grew 32.7% to $337.2 million in 2021.

By 2023, the company’s annual revenue is estimated to jump to $415.3 million — a 63.4% increase over 2020!

Now, let’s look at how this IoT stock has performed.

DGII Touches New 52-Week High

In the last 12 months, DGII stock is up The stock gained 38.4% from its 52-week low in May 2022 to its high set at the beginning of June.

Despite a recent downturn due to broader market headwinds, the stock is still trading more than $2 above its 50-day simple moving average.

And DGII continues to outperform its communication equipment industry peers — up 3.1% over the same 12 months.

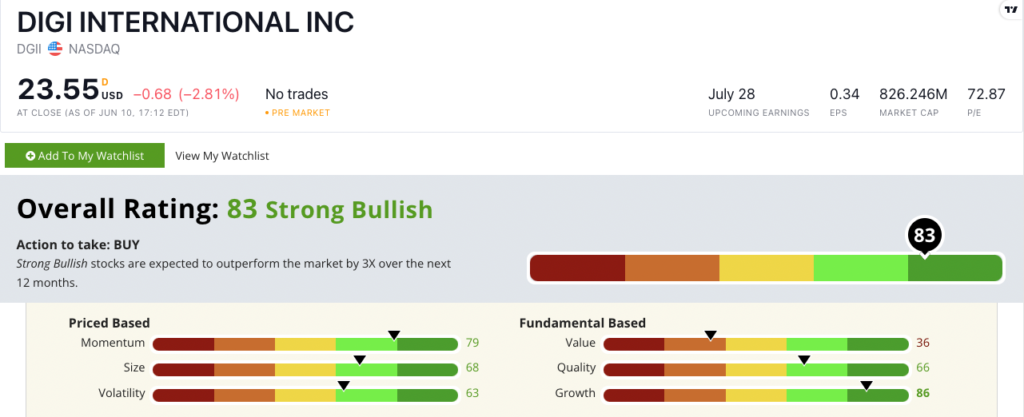

Digi International Inc. Stock Rating

Using Adam’s six-factor Stock Power Ratings system, Digi International Inc. stock scores an 83 overall.

That means we’re “Strong Bullish” on the stock and expect it to beat the broader market by at least three times over the next 12 months.

Digi International Inc.’s Stock Power Rating on June 13, 2022.

DGII rates in the green on five of our six factors:

- Growth — DGII scores an 86 on value, with a one-year earnings-per-share growth rate of 9% and a 22.5% growth in sales from its last quarter.

- Momentum — Since this time a year ago, Digi’s stock price is up more than 18%. DGII scores a 79 on momentum.

- Size — With a market cap of $826.2 million, DGII is right in the middle of the pack on size, where it scores a 68.

- Quality — Returns on assets, equity and investment are all flat or negative in the communication equipment industry, but Digi has positive wins on the three metrics. DGII scores a 66 on quality.

- Volatility — Market headwinds pushed Digi stock lower, but it recorded a 38% run from its 52-week low in May 2022 to its high a month later. DGII scores a 63 on volatility.

DGII earns a 39 on value, but its price-to-book value ratio is 1.75, compared to its industry peer average of 2.24.

Bottom line: The Internet of Things market is in its infancy and growing every day.

As the market grows, so will the need for sensors and communication equipment to make these products work properly.

This is why DGII is a must for your portfolio.

Safe trading,

Matt Clark, CMSA®

Research Analyst, Money & Markets

Matt Clark is the research analyst for Money & Markets. He is a certified Capital Markets & Securities Analyst with the Corporate Finance Institute and a contributor to Seeking Alpha. Prior to joining Money & Markets, he was a journalist/editor for 25 years, covering college sports, business and politics.