Over the weekend, I went to one of my favorite beaches down here in South Florida for some rest and relaxation.

As I stared out over a calm Atlantic Ocean, my eyes turned to the number of boats at sea.

Not just the small pleasure boats, but huge vessels carrying shipping containers in and out of the Port of Miami.

I was at the same beach last year and didn’t see nearly the same amount of traffic.

So, as usual, my mind went into work mode.

When I got home, I researched and found an interesting trend in container shipping. It led me to today’s stock.

I used Adam O’Dell’s six-factor Green Zone Ratings system and found a shipping company that specializes in ocean transportation — specifically in the Pacific Ocean. It’s one we are “Strong Bullish” on.

The underlying shipping stock is in good shape to outperform the broader market by at least three times over the next 12 months.

And this shipping trend will elevate this company even higher.

Ocean Shipping Rules Trade

In 2020, the biggest ocean trade route was the trans-Pacific (think moving goods between the U.S. and China). More than 25 million twenty-foot equivalent units (TEUs) of cargo moved back and forth along that route, according to the United Nations.

Container shipping on the high seas is big business … and it’s only getting bigger.

In 2019, the global container shipping market was valued at $8.7 billion.

By 2027, that market could reach a value of more than $12 billion, according to Allied Market Research. That’s a 39% increase in market value, and a huge boon for shipping stocks.

I found a company that is positioned to take a good chunk of that increase and line shareholder’s pockets with nice gains.

Smack In the Middle of the Pacific: Matson Inc.

Matson Inc. (NYSE: MATX) is a Pacific Ocean transportation company based in Honolulu, Hawaii.

It runs routes between Long Beach, California and China. But it also brings goods to Hawaii, Alaska, Guam and islands in Micronesia.

Pro tip: This isn’t the first time I’ve written about Matson. I recommended the stock on September 9, 2020. Since then, the company has gained almost 50%!

In 2019, the company reported $2.2 billion in total revenue.

That is expected to jump to nearly $3.4 billion by the end of 2021 — a 55% increase in top-line revenue.

It is capitalizing on the increase in transporting goods between the U.S. and China.

Matson Stock Trend

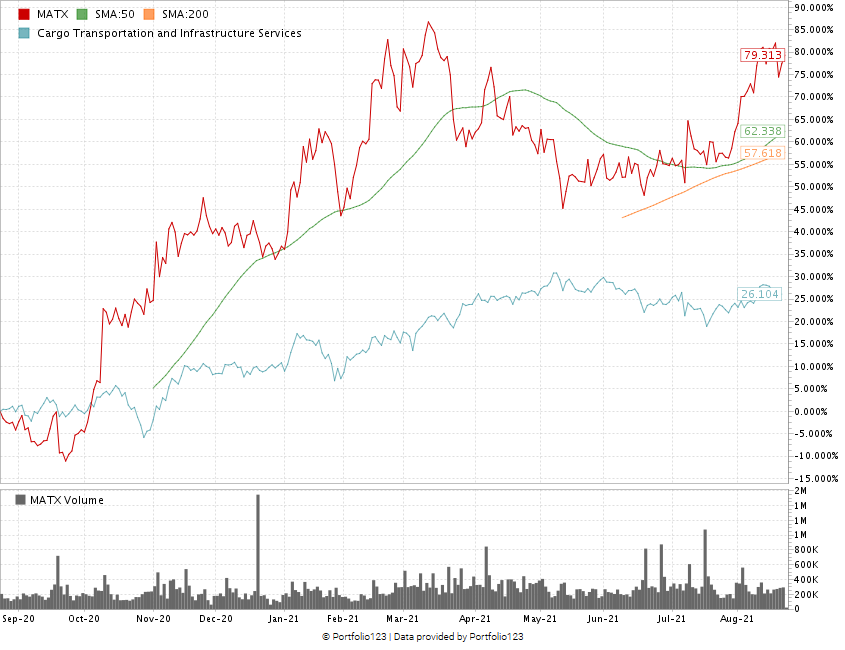

That's led to a great upward trend for Matson's stock since August 2020.

Matson Stock Is Trending Higher

From Aug. 4, 2020, to March 11, 2021, Matson stock climbed 118% to a new 52-week high of $76.91.

It pared those gains back and traded relatively flat from May through July.

Now, Matson stock is showing solid upward momentum — gaining 22% from its 2021 low of $59.81 set back in May.

Green Zone Ratings: Matson Shipping Stock

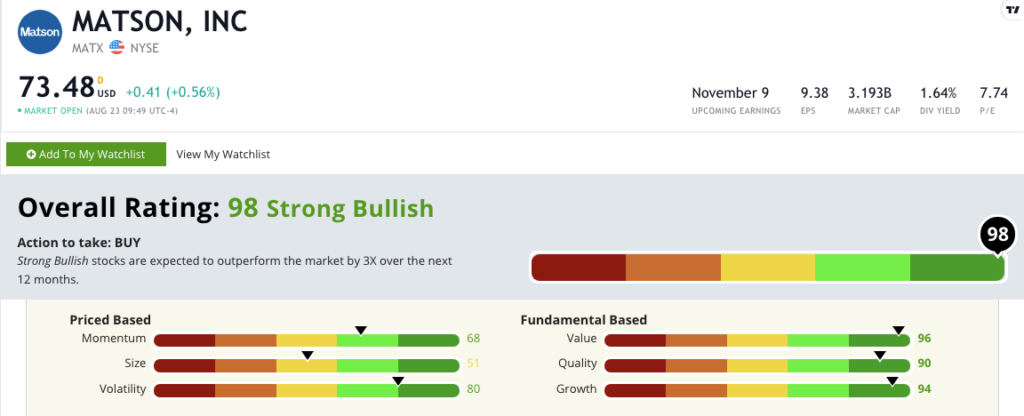

Using Adam’s six-factor Green Zone Ratings system, Matson Inc. scores a 98 overall. That means we are “Strong Bullish” on this shipping stock and expect it to outperform the broader market by three times in the next 12 months.

Matson rates in the green in:

- Value — Matson trades with a price-to-earnings ratio of 7.87 compared to the cargo transportation industry average of 20.75. Its next-12-month price-to-sales ratio is 0.99 compared to 1.38 for the industry. That makes it a great value stock, and its 96 value score reflects that.

- Growth — Quarterly sales for Matson grew from $712 million in the first quarter of 2021 to $875 million in the second quarter — a 23% increase quarter-over-quarter. The company’s earnings-per-share grew from $1.99 to $3.71 during the same time — an 86% jump. It earns a 94 on growth.

- Quality — Matson’s returns on assets, equity and investments are either double or triple the cargo transportation industry average. Its net margin of 14% is double the industry average of 7.1%. It earns a 90 on this metric.

- Volatility — After trading sideways from May to July, the stock has seen very little resistance in its latest uptrend. It scores an 80 on volatility.

- Momentum — The stock has been in a strong, confirmed uptrend since the end of July. Matson earns a 68 on momentum.

The stock rates a 51 on size. But with a $3 billion market cap, it is right in the middle of where we like to see high-rated stocks.

Matson’s dividend is a nice little bonus as well. Its forward dividend yield is about $1.20 per share, or 1.64%.

Bottom line: When I recommended Matson in September, I said the need for reliable shipping between the U.S. and China was only going to increase amid the ongoing trade war (yes, that’s still happening).

A return to normalcy after the COVID-19 pandemic will push that demand even higher.

That’s why Matson Inc. is a stock worth considering for your portfolio.

Safe trading,

Matt Clark, CMSA®

Research Analyst, Money & Markets

Matt Clark is the research analyst for Money & Markets. He is a certified Capital Markets & Securities Analyst with the Corporate Finance Institute and a contributor to Seeking Alpha. Prior to joining Money & Markets, he was a journalist and editor for 25 years, covering college sports, business and politics.