I spent the first 25 years of my life in Kansas. It’s where I started my dream profession as a newspaper journalist.

Then, I got the opportunity to be editor of a daily newspaper. But the job was half the country away in North Carolina.

I took the plunge. I packed all my things and moved more than 850 miles from my home to the Appalachian Mountains of Western North Carolina.

My first night in my new home was daunting. I didn’t know anything about my surroundings.

The adventurous part of me decided to strike out and explore.

What I found changed how I lived for the next five years in North Carolina.

So, when the company at the core of my discovery popped up on chief investment strategist Adam O’Dell’s Green Zone Ratings system back in October, I couldn’t help but dive in and find out more.

I ended up recommending the company’s stock as a buy a couple of months ago due to its strong financials and an 85% jump in its stock price over the previous 12 months.

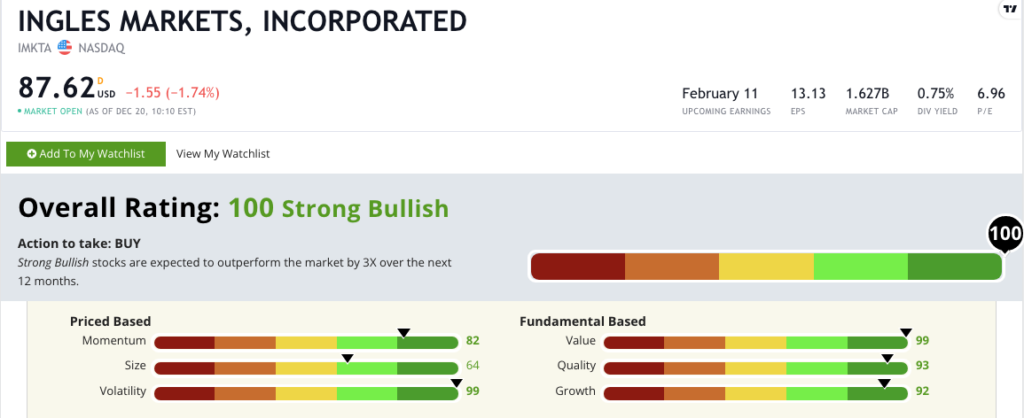

Its “Strong Bullish” rating meant it was poised to outperform the broader market by at least three times over the next 12 months.

And it hasn’t disappointed. In fact, this grocery stock looks even better today.

Comfort in a Grocery Store

The stock I recommended in October was Ingles Markets Inc. (Nasdaq: IMKTA).

The company operates a chain of supermarkets in the Southeast U.S. and is headquartered in Asheville, North Carolina.

Its locations not only offer the usual supermarket products, but it also boasts pharmacies and gas stations.

That first night in North Carolina opened my eyes to a palace.

I walked into the local Ingles, and my eyes got as big as saucers. It was a one-stop shop for everything I needed. The grocery store had any food I could ever need. The gas station and pharmacy were a huge bonus.

I had never seen anything like it back home in Kansas.

But that’s not why I recommended Ingles. I recommended it because the trend in grocery store revenue pointed to a strong recovery from the COVID-19 pandemic.

After suffering a 14% drop in revenue from 2019 to 2020, supermarket revenue is projected to climb 27% to reach new highs by 2024.

Despite the drop in 2020, Ingles’ revenue hit a new high last year.

Those factors, plus its perfect 100 rating on our Green Zone Ratings system compelled me to recommend Ingles as a grocery stock you should buy again today.

Grocery Stock: Ingles’ Performance Has Not Disappointed

In the 12 months leading to my initial recommendation, IMKTA jumped 85%, demonstrating that “maximum momentum” Adam, Charles and I look for in a stock.

It hasn’t slowed down since.

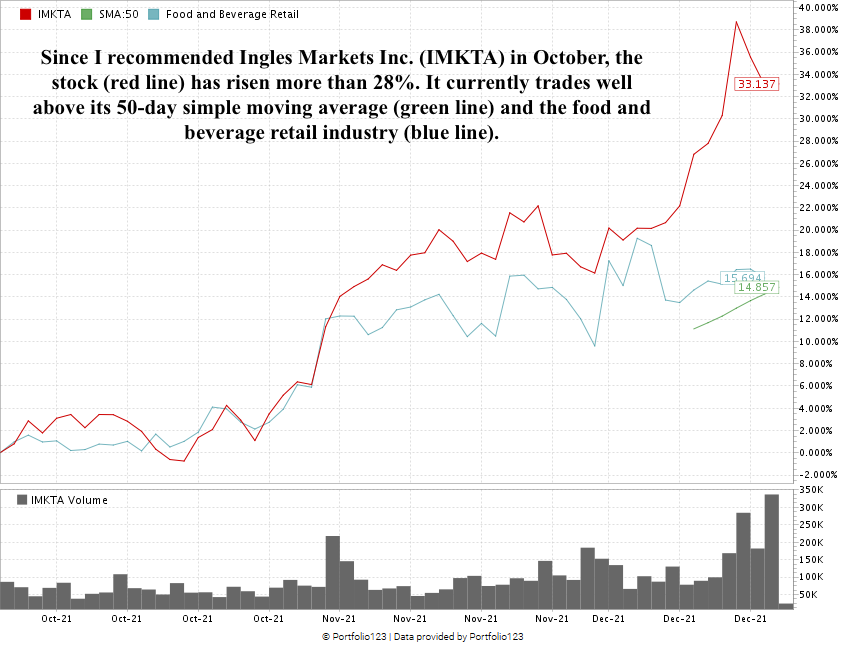

Ingles’ Stock Jumps 28% Since My Recommendation

The food and beverage retail industry has gained a little more than 15% since the middle of October.

However, Ingles Markets has almost doubled the industry average, gaining more than 28%.

What’s more, the S&P 500 has only gained about 6% since I recommended Ingles. Ingles’ stock is beating the broader market by four times since October 12.

The stock’s price surge was fueled by a recent quarterly statement where Ingles reported increased net sales by 11.6% for the quarter ending September 25. Gross profit for the quarter was 25.6% of sales.

Ingles’ Green Zone Rating Is Still Superb

When I recommended Ingles in October, its Green Zone Rating was 100 overall. It scored in the green in all six of our metrics used to compile the overall rating.

Over the last two months, that rating has not changed, meaning we are still “Strong Bullish” on IMKTA and expect it to outperform the broader market by three times over the next 12 months.

IMKTA’s metric ratings all remain in the green (and some have even increased since my recommendation):

- Value — IMKTA’s price-to ratios (earnings, sales, book and cash flow) all remain below the industry average. Its price-to-earnings ratio is 6.8 compared to the industry average of 18.1. It scores a 99 on value (down from 100 in October).

- Volatility — The company’s stock price momentum continues to meet with very little resistance as it hit a new 52-week high on December 15. IMKTA scores a 99 on volatility (unchanged from October).

- Quality — IMKTA’s returns on assets, equity and investment are all positive by double digits. The industry averages are all negative by double digits. Ingles’ quality scores improved to 93.

- Momentum — As the broader market experienced a big sell-off after the Thanksgiving holiday, IMKTA continued to reach a new 52-week high two weeks later in December. The company earns an 82 on momentum (up two points from October).

- Size — Ingles’ market cap went from $1.26 billion in October to $1.62 billion today. It scores a 64 on size due to its higher market cap, but Ingles’ size rating is still ”Bullish” (down from 71 in October).

Bottom line: Most supermarket chains are not making as big a comeback from COVID-19 as Ingles.

IMKTA showed strength during the Black Friday sell-off and continues to push forward as the broader market takes a downturn toward the end of the year.

Its continued resolve amid market panic is one reason why Ingles Markets is a grocery stock worth adding to your portfolio.

Note: Did you buy Ingles when I originally talked about it in October? Email Feedback@MoneyAndMarkets.com to let us know how your investment is doing!

Safe trading,

Matt Clark, CMSA®

Research Analyst, Money & Markets

Matt Clark is the research analyst for Money & Markets. He is a certified Capital Markets & Securities Analyst with the Corporate Finance Institute and a contributor to Seeking Alpha. Prior to joining Money & Markets, he was a journalist and editor for 25 years, covering college sports, business and politics.