I’m a tactical investor, which means I follow the trends.

I’m not overly strategic when it comes to long-term bets on sector performance.

But if I were a calculated strategist, I’d place my long-term bets in technology, health care and data.

These broad sectors shape the future:

- Technology dictates innovation.

- Health care influences our livelihoods.

- Data measures and communicates vital information.

This week, I focused on a company that spans these three sectors.

Zepp Health Corp. (NYSE: ZEPP) is a Chinese health care technology provider. It provides data services as well.

Zepp Health’s most well-known gadget is its smartwatch. It’s similar to a Fitbit or Apple Watch — tracking the wearer’s heart rate, steps per day and even sleep cycles.

But Zepp isn’t just creating smart tech. It’s an ever-expanding entity.

The company is building an empire of proprietary data. In short, it collects and stores users’ data, and that data is worth a lot of money.

Insurance companies, health care providers and governments value biometric data and will pay up to acquire it.

Because of this opportunity, I expect further growth once Zepp’s stock starts its bullish uptrend.

Zepp Stock’s Green Zone Rating

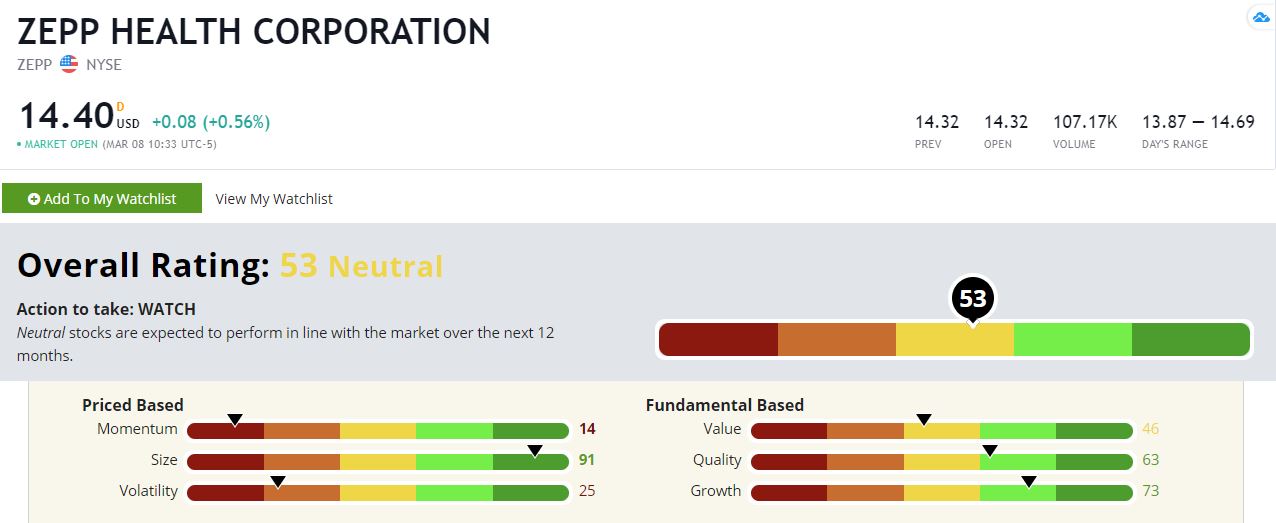

ZEPP rates 53 overall on my Green Zone Ratings system, which means this stock is on our watchlist.

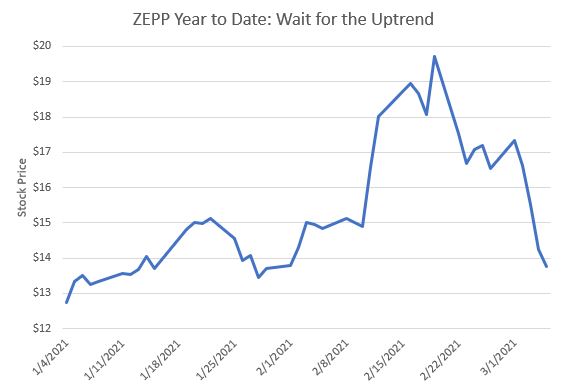

It’s been volatile in recent weeks, as you can see in the chart below:

I follow what I call the Momentum Principle: Buy high … sell higher.

I urge you to keep an eye on this stock and be ready to pounce when the rally starts.

Take a look at how it rates:

Zepp Health‘s Green Zone Rating on March 8, 2021.

Size — ZEPP rates a 91 on size. This is a small stock. Its market value (number of shares times share price) is just, $440 million, making it is one of the smallest stocks we’ve covered.

Growth— Due to its double-digit sales and earnings growth, ZEPP rates a 74 on the growth metric.

Quality — Scoring a 63, ZEPP is a high-quality stock. This score is rooted in the company’s strong foothold in the data market and its strong reputation as a health tech provider.

Bottom line: ZEPP had a strong start this year, but then it faltered. Keep an eye on it. As soon as the rally starts, I recommend you buy before it saturates the market.

And if you like this analysis of ZEPP but want more information about stocks to buy today, click here to find out about my Millionaire Master Class. In addition to my top investing secret, you’ll get my and Charles Sizemore’s top highly rated stock to buy each month. Several of our recommended companies are screaming buys today!

To good profits,

Adam O’Dell

Chief Investment Strategist

Adam O’Dell is the chief investment strategist of Money & Markets and has held the title of Chartered Market Technician for nearly a decade. He is the editor of Green Zone Fortunes, the trend and momentum options-trading powerhouse Home Run Profits and the time-tested switch system 10X Profits.

P.S. Check out The Bull & The Bear podcast every week for more picks from Adam, Charles and me. You can listen on Apple Podcasts, Spotify, Amazon and Google Podcasts. You can also catch episodes on our YouTube channel here.