It’s hard to beat a hot cup of Campbell’s chicken noodle soup on a cold winter day. But does a strong brand and product translate into a good rating for Campbell Soup stock?

Campbell Soup Co. (NYSE: CPB), founded in 1869, has long been one of the most successful and recognizable food brands in the world.

Over the years, Campbell’s has expanded its product offerings beyond soup to include everything from canned vegetables to fruit snacks. The company is now looking to the future and what it can do to continue growing in 2023 and beyond.

Let’s take a look at some of its plans and how Campbell Soup stock rates using our proprietary Stock Power Ratings system.

CPB’s Future Growth

The company’s growth strategy for the next three years focuses on five key areas: innovation, efficiency, cost management, targeted marketing and acquisitions.

In terms of innovation, Campbell’s is investing heavily in new products such as organic soups and vegan options that are designed to appeal to today’s health-conscious consumers. It is also exploring new ways of packaging its products that make them easier to store and transport.

To achieve greater efficiency, Campbell Soup plans to streamline its supply chain operations by introducing automated systems that reduce waste and boost productivity.

It’s also working to reduce costs by increasing its economies of scale through mergers and acquisitions.

Finally, it intends to increase its marketing efforts through more targeted campaigns that focus on specific customer segments with tailored messaging that resonate with them.

In addition to these initiatives, Campbell’s also has plans for expanding into new markets outside North America such as Asia-Pacific where there is a growing demand for convenience foods.

It also intends to capitalize on the rising trend of “foodie culture.” People have become increasingly interested in unique flavors and ingredients used in their meals. Campbell soup wants to hit on that demand.

With these strategies in place, Campbell’s expects its growth rate will remain steady over the next three years or even accelerate if all goes according to plan.

Campbell Soup Stock Power Ratings

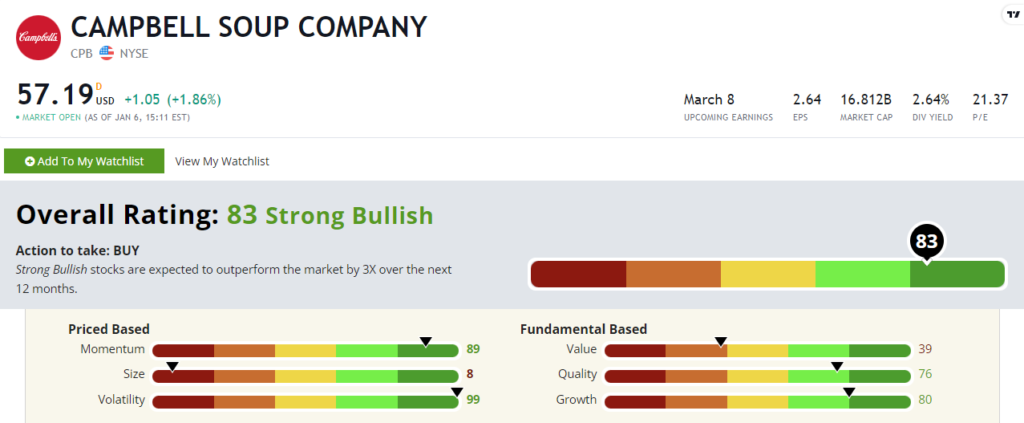

Things are looking good for Campbell Soup stock. It rates a “Strong Bullish” 83 out of 100 within our Stock Power Ratings system. That means we expect it to outperform the broader market by 3X over the next 12 months.

Investors have been jumping into CPB for a while now. Strong brands and established companies tend to do well amid sell-offs because people want to hold stocks that are less prone to massive losses.

That’s why Campbell stock rates an 89 on the momentum factor. It’s gained 23% over the last year, while the broader S&P 500 is down 16%.

It also rates well on quality (76) and growth (80) because it has been able to pass along some increased costs due to inflation onto consumers. It’s pulling in more profits because people are OK with paying a higher price for a name they know.

That’s where its status in the supermarket pays off.

Bottom Line: Campbell Soup stock could be a great buy if you follow our Stock Power Ratings system. And if you want to see how ratings change within the system, click here to read Charles Sizemore’s analysis from October 2021.