After suffering through one of the strangest years in living memory, the theme of today’s dividend stock is “no drama.”

We’re going to take a look at a dividend stock so staid and boring you’d be almost embarrassed to bring it up at a cocktail party.

When the COVID-19 pandemic really started to explode in March, I joked with colleagues that this was the ultimate pandemic stock. After all, what could be better for flu-like symptoms than a piping hot bowl of chicken noodle soup?

I’m talking about Campbell Soup Company (NYSE: CPB).

The soup joke was a ridiculous oversimplification, of course. But Campbell does benefit from the general trend of avoiding restaurants and eating at home — a trend that I don’t expect to break any time soon.

The real selling point of Campbell is its lack of volatility. Its beta is less than 0.5.

Beta can be a tricky concept to understand. Think of it like this: A beta of 0.5 means a stock moves only about half as much as the broader market. So Campbell’s stock is less prone to big stock swings in the long run.

In Campbell, you get a reliable 3% dividend. That’s not a mouth-watering yield by any stretch, but it’s more than three times the yield of the 10-year Treasury note. And unlike the semi-annual coupon on that bond — which will never change as long as you own it — Campbell’s quarterly dividend should rise over time, even if just modestly.

Campbell’s Stock Rating

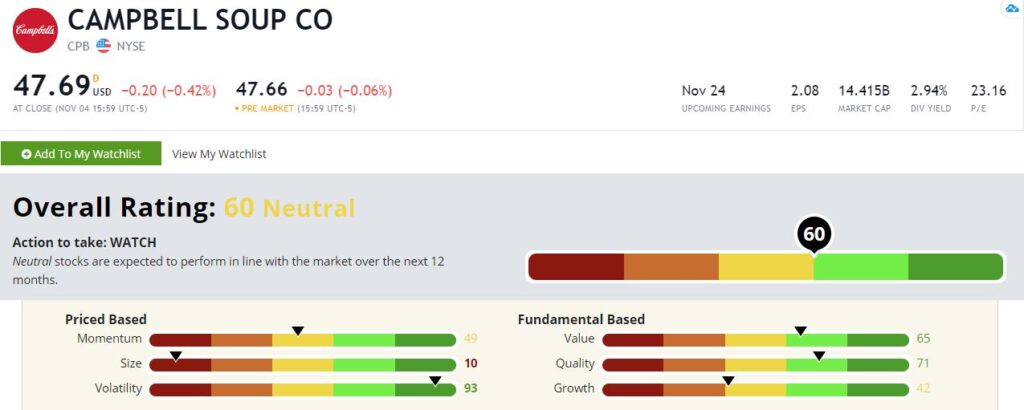

Campbell sports a score of 60 in our Green Zone Ratings system, which lands it at the top of our “Neutral” rating.

Campbell’s Green Zone Rating on November 5, 2020.

But it’s within a hair’s breadth of “Bullish” territory (ratings of 61 or higher are considered Bullish in our system), so I consider it “good enough for government work.”

Let’s see what drives Campbell’s stock rating.

Volatility — Not surprisingly, Campbell rates high in volatility at 93. That means the stock is actually less volatile. Historically, low-volatility stocks outperform high-volatility stocks. In fact, you could argue that the secret to Warren Buffett’s success over the years was simply buying and holding low-volatility stocks with Berkshire Hathaway’s insurance float. Campbell won’t make you filthy rich. But you’d be hard-pressed to find a lower-stress dividend stock to hold.

Quality — Campbell also rates highly on quality at 71. This means that only 29% of all stocks in our universe rate higher. Quality might sound like a subjective term, but for us, it comes down to numbers. We measure quality using profitability and balance sheet strength. For a stodgy old soup company, Campbell generates a return on equity of 32%. That’s not too shabby.

Value — With a value score of 65, Campbell is reasonably cheap. It trades for 24 times trailing earnings and 16 times expected forward earnings, which is close to the cheapest it’s been in a decade. In a pricey market, Campbell isn’t looking too bad.

Momentum — As an exceptionally low-volatility stock, you wouldn’t expect Campbell to rate highly based on momentum. But at 49, it’s pretty close to the average for our universe (50). Given the conservative nature of this stock, I’m quite happy to see a momentum score that high.

Growth – Along the same lines, Campbell rates in the middle of the pack on growth, scoring a 42. We wouldn’t expect a high number here. It’s a soup company, for crying out loud.

Size — Campbell is a large-cap stock that’s been around forever. It’s not some new up-and-coming growth dynamo. Campbell rates a 10 based on size.

Bottom line: I don’t expect anyone to get rich in this stock. But our model suggests that it should perform more or less in line with the broader S&P 500. And in a low-yield world, you collect a reliable 3% yield.

If you’re looking for a dividend stock that lets you sleep easily at night, this is it.

Money & Markets contributor Charles Sizemore specializes in income and retirement topics. Charles is a regular on The Bull & The Bear podcast. He is also a frequent guest on CNBC, Bloomberg and Fox Business.

Follow Charles on Twitter @CharlesSizemore.