The cannabis sector hasn’t taken off as investors expected.

Just a few years ago, investors salivated over the potential of massive gains, which put the stocks in high demand.

The gains didn’t happen for many of those stocks.

The Global Cannabis Index (GCI) from New Cannabis Ventures tracks the prices of 37 marijuana stocks. It reached a high of $180.02 back in 2018. Now, that index is at $18.99 — an 89% drop in just two years.

However, cannabis companies are back in the news as the prospects of more states legalizing, and even U.S. federal legalization, come into focus.

The GCI has climbed back to 31.62 — a 66% bounce from its lowest point in March 2020.

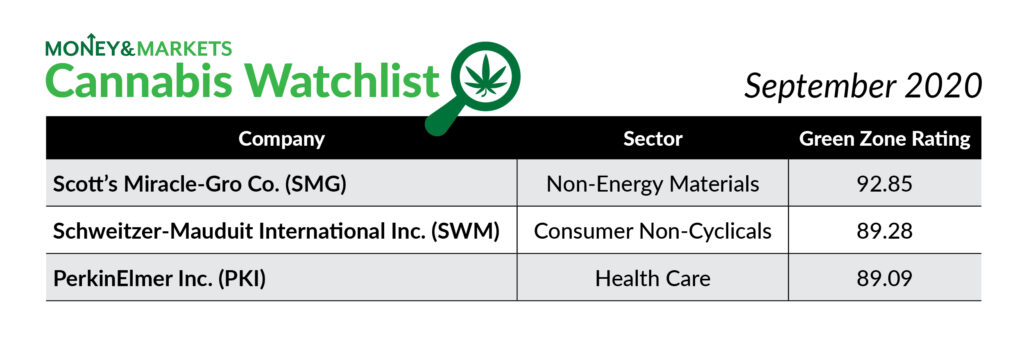

We’ve created a new monthly feature at Money & Markets … the cannabis watchlist … to zero in on the top cannabis stocks.

We use Chief Investment Strategist Adam O’Dell’s Green Zone Ratings system to compile a list of cannabis stocks and filter them through Adam’s proprietary system.

From there, we’ll give you the three highest-rated stocks in the cannabis sector at the beginning of each month.

This works in concert with our Marijuana Market Update videos, which highlight cannabis stocks you want to know about.

Cannabis Watchlist Stock No. 1: Scotts Miracle-Gro Co. (92.85)

The first company on our cannabis watchlist doesn’t harvest or sell cannabis.

Instead, Scotts Miracle-Gro Co. (NYSE: SMG) produces consumer lawn and garden products — like the popular Miracle-Gro fertilizer — which cannabis cultivators use.

Another connection is the company’s vocal support for legalizing cannabis — including providing state and federal lobbying support.

We are strongly bullish on stocks rated between 81 and 100.

Using Adam’s Green Zone Ratings system, the company rates a 93 overall — meaning only 7% of all other stocks rated are better.

For reference, we are strongly bullish on stocks rated between 81 and 100. We consider these stocks a “buy,” as we expect them to outperform the market by three times over the next 12 months.

Scotts ranks high in quality (90), volatility (90), growth (86) and momentum (86).

Scotts’ Momentum

Since hitting a March 2020 low of $74.83 per share, SMG has bounced an impressive 122%. And it’s still 17% off its 52-week high.

The company’s returns on assets, equity and investments are outpacing the rest of the specialty and performance chemicals industry.

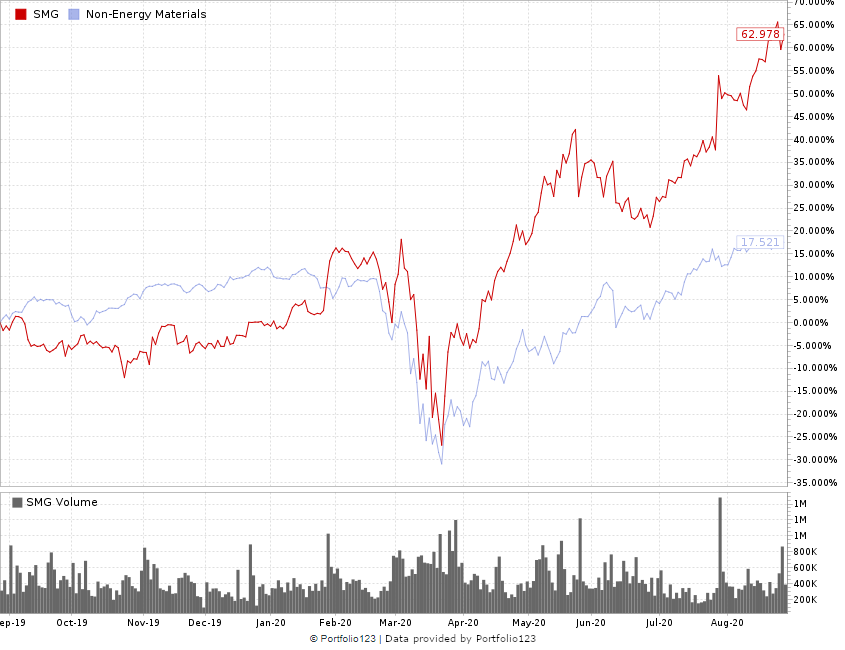

Cannabis Company No. 2: Schweitzer-Mauduit International Inc. (89.28)

The next company on our cannabis watchlist got its start in the tobacco industry.

However, due to the decline in tobacco consumption in the U.S. and Europe, Schweitzer-Mauduit International Inc. (NYSE: SWM) has pivoted. It now produces rolling papers used in the cannabis industry.

More specifically, in 2019, the company started to invest more in lower ignition propensity (LIP) papers — to ensure that cigarettes and other products extinguish themselves when no one is smoking them.

While the company has struggled during the coronavirus pandemic, its LIP paper sales helped contribute to a 13.2% positive operating margin.

SWM Looking For Its Highs

After hitting a low of $20.42 per share in March 2020, SWM stock has jumped 54% and still has room to grow — share are 52.5% off their 52-week high.

Adam’s Green Zone Ratings system gives SWM an 89 overall. Its highest marks are in value (92) and quality (89).

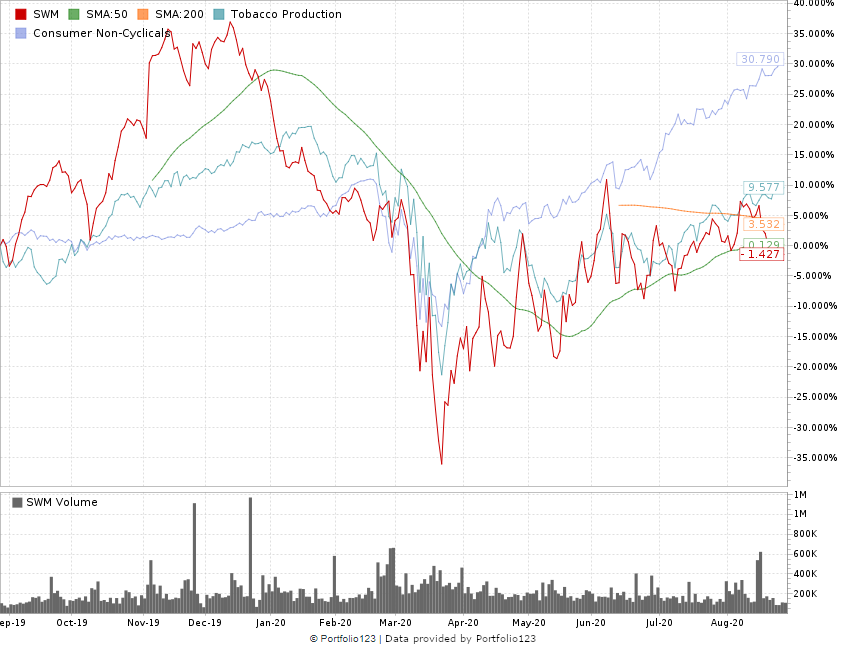

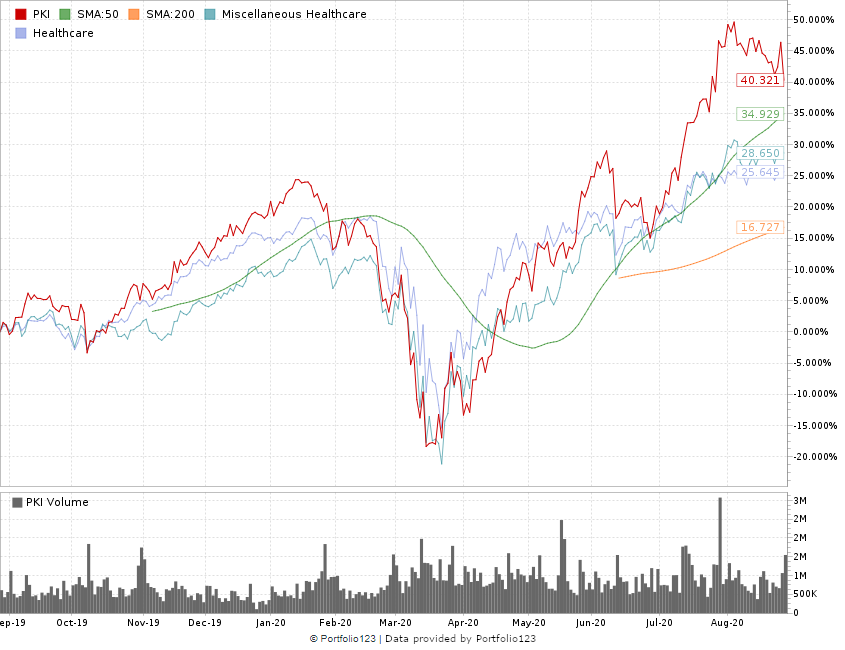

Cannabis Company No. 3: PerkinElmer Inc. (89.09)

The last company on our list doesn’t produce or sell cannabis either … it tests it.

PerkinsElmer Inc. (NYSE: PKI) is a Massachusetts-based diagnostics company that develops imaging and detection technology to scientists and laboratories.

Its products test cannabis for pesticides, heavy metals and minerals, and potency.

The company’s revenue in the second quarter of 2020 jumped 12% from the same quarter a year ago and its earnings per share nearly doubled.

PerkinsElmer Stock on the Move

The company’s stock has rebounded nicely following a drop in March 2020. As I write, its share price has jumped 71% from that March low.

PKI ranks an 89 overall on Adam’s Green Zone Ratings system. Its momentum (97), growth (91), quality (85) and volatility (85) drive that bullish rating.

We Love Your Feedback

Your feedback on our weekly YouTube series has been fantastic!

Ben wrote:

I saw your video on Cresco it was great. I’d like to see:

- Trulieve

- Green Thumb

- Innovative Industrial Properties

- Curaleaf

- Delta 9 Cannabis (VRNDF)

Thanks, Ben

I’ve covered Curaleaf Holdings Inc. (Over-the-Counter: CURLF) and Innovative Industrial Properties Inc. (NYSE: IIPR) in recent updates.

I encourage you to check those out here and here.

Ben, we’ll definitely get to the others on your list as well as those that your fellow viewers suggested.

In the meantime, if you have a particular stock or subject related to cannabis you’d like me to cover, email our team at feedback@moneyandmarkets.com.

I’d love to hear what you’d like to discuss.

Until next time …

Safe trading,

Matt Clark

Research Analyst, Money & Markets

Matt Clark is the research analyst for Money & Markets. He’s the host of our podcast, The Bull & The Bear, as well as the Marijuana Market Update. Before joining the team, he spent 25 years as an investigative journalist and editor — covering everything from politics to business.