While the smartphone is now the easiest way to record your family outings, camera companies are still kicking. Let’s see how Canon stock (NYSE: CAJ) looks as 2023 carries on.

Canon, one of the world’s leading tech companies, has been a major player in the media industry for decades.

The company is well-known for its high-end cameras, printers and scanners, but it also makes medical equipment and office automation products.

In recent years, Canon has focused on expanding its presence in new markets such as cloud technology and artificial intelligence (AI).

Here’s what investors can expect from the Japanese tech giant over the next few years and how it scores within our proprietary Stock Power Ratings system.

Canon’s Growth Strategy

Canon began developing its growth strategy for 2023 back in 2019.

The goal is to become a global leader in imaging solutions by leveraging its expertise in areas such as digital imaging, optical engineering and software development.

To do this, Canon plans to invest heavily in research and development and expand into new markets such as cloud computing and AI.

The company also plans to focus on providing solutions to customers’ needs rather than simply selling products.

This means that it will offer its customers more than just hardware; it will provide complete solutions that include software packages, services and support.

By doing this, Canon hopes to build long-term relationships with customers that will lead to increased loyalty and revenue growth over time.

In addition to expanding into new markets, Canon also plans to increase its focus on other economies such as India and China.

This will help it tap into new customer bases while still maintaining their core markets in Europe and North America.

Finally, the company is committed to reducing its environmental footprint by investing in renewable energy sources and implementing green initiatives at all levels of their operations.

Is that a good sign for Canon stock in 2023? Let’s see what Stock Power Ratings says.

Canon Stock Power Ratings

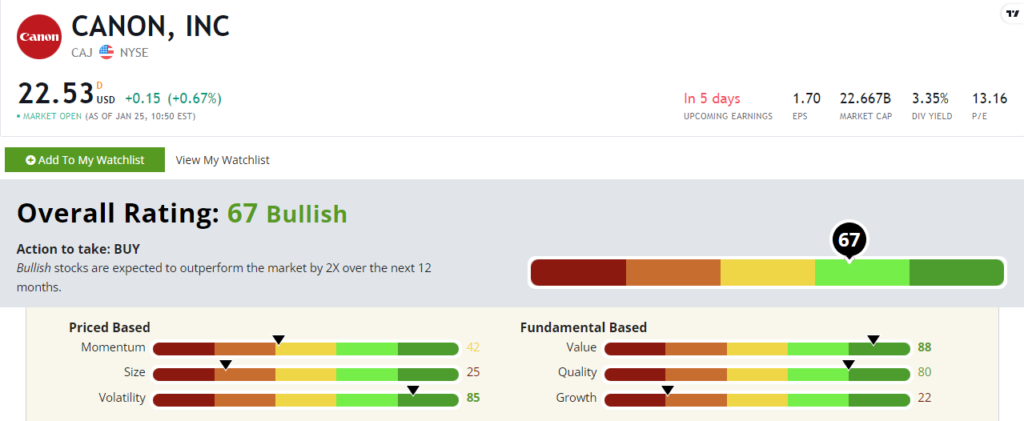

Canon stock rates a “Bullish” 67 out of 100. That means our system expects the stock to outperform the broader market by 2X over the next 12 months!

Canon stock sports a strong rating on our value factor at 88 out of 100.

A look at some of its price-to ratios tells the story well. CAJ’s price-to-earnings ratio sits at 13.16 as I write. That’s well below the broader S&P 500, which currently trades at a 20.85 P/E ratio.

Canon wins on price to sales as well. Its P/S ratio is 0.74 right now, which is less than a third of the S&P 500’s P/S of 2.41.

Bottom Line: Investors should be optimistic about Canon’s outlook for 2023 given the company’s ambitious growth strategy and commitment to innovation.

As always though, it is important for investors to do their own research before investing in any company or stock — especially ones like Canon that have been around for decades!

But that’s what Stock Power Ratings and Money & Markets is for.

And our proprietary system says Canon stock is set to outperform from here.