If I could buy and hold forever I would.

I’d be just fine cashing dividend checks until the cows come home…

But sometimes it pays to be a tactical investor.

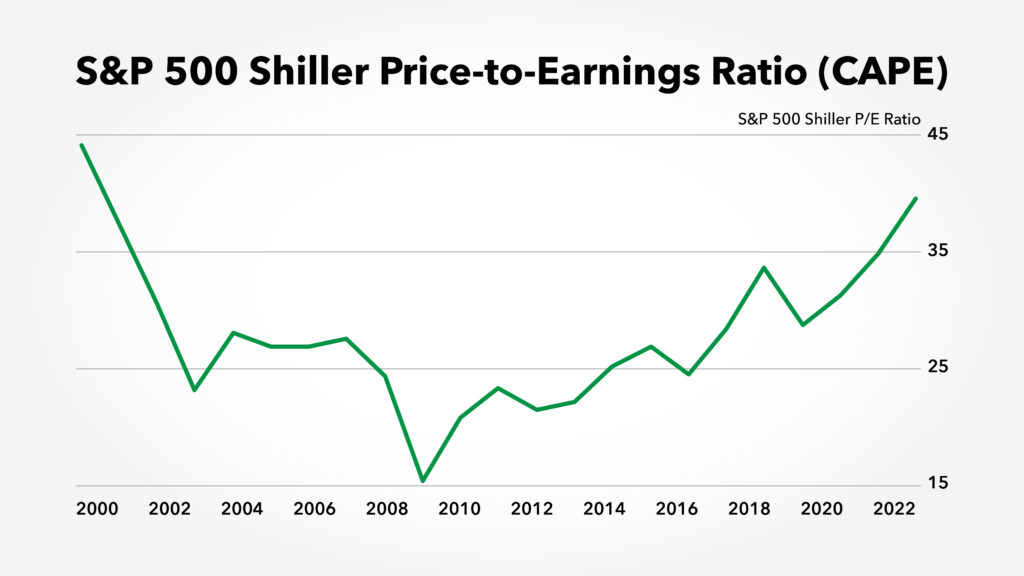

The CAPE Ratio Reveals the Market’s True Value

As a case in point for today’s market, take a look at the cyclically-adjusted price-to-earnings ratio (CAPE), also called the CAPE ratio or the Shiller P/E after Yale professor Robert Shiller. It’s been around at least since the heyday of Benjamin Graham in the 1930s, but Shiller popularized it (and gave its namesake) in the late 1990s.

The traditional P/E ratio values stocks by comparing current share prices to current-year earnings. The problem is that earnings can swing wildly from year to year. And disruptions like recessions or the COVID-19 pandemic only make things worse.

The CAPE ratio gets around that problem by comparing today’s stock prices to a 10-year average of earnings. This smooths out the ups and downs of the economic cycle.

CAPE Ratio for Today’s Market

Well, in looking at the CAPE on the S&P 500 below, I can’t say that stocks are expensive. That’s an understatement.

They’re in nosebleed territory!

The CAPE today sits at 39, which is right below the all-time peak set during the 1990s dot-com mania.

“But Covid…”

No! Remember, the CAPE ratio is specifically designed to smooth out the effects of disruptions like the pandemic. Stocks are that expensive — no ifs, ands or buts.

Analysts cherry picking data to prove a point is a pet peeve of mine, so I won’t do that.

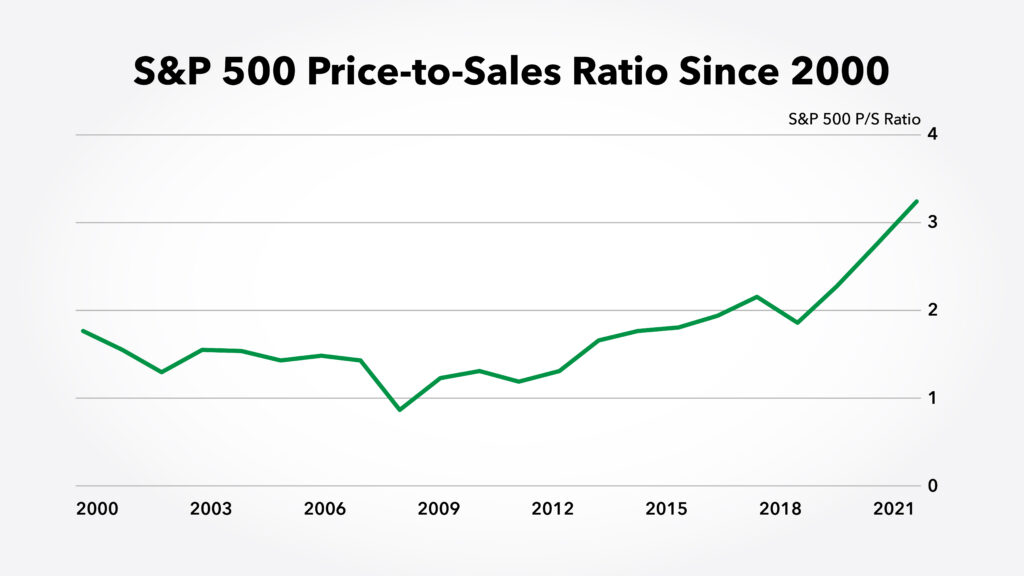

Instead, let’s look at another popular metric, the price-to-sales (“P/S”) ratio.

Sales tend to fluctuate less than earnings, so the P/S ratio is an effective way to view the market’s valuation over time.

And it’s the same pattern here. The S&P 500’s P/S ratio is nearly double its 2000 level. That’s double the levels of what was, at the time, the biggest speculative bubble in history.

I could pick other metrics — dividend yield, price-to-cashflows, etc. — but you’re going to see the same result.

Bottom line: Stocks are expensive.

So, What Can You Do About It?

I’m not a doom and gloomer. You won’t see me cashing out my investments and stocking my Idaho bunker with shotgun shells and canned goods.

But I am making some changes. I recommend you do the same.

To start, I’m focusing more on shorter-term investment strategies these days. This is where my colleague Adam O’Dell really excels, and contrary to popular belief, short-term trading is NOT inherently more risky than long-term buy and hold. If you keep your position sizes reasonable and use proper risk management, it’s actually less risky.

Think about it. The S&P 500 lost half its value in the 2000-2002 tech bust. It lost more than half its value again during the 2008 meltdown. It wasn’t until 2013 that the S&P 500 rose above and stayed above its old 2000 high.

Thirteen years is a long time to wait for a return. You simply won’t take those kinds of losses in a shorter-term trading strategy if you manage your risk appropriately.

And speaking of short-term strategies, Adam has you covered with his Wednesday Windfalls premium trading research service.

Each week, Adam recommends a trade on Monday, and his readers are out again 48 hours later on Wednesday. Click here to see how you can make this short-term strategy part of your trading game plan for 2022.

One Last Thing…

Before I sign I off, I’m going to nag you.

If you haven’t already, please take a moment to review your 401(k) contributions for 2022.

If you want to max out your contributions for the year, it’s a lot easier when you start early. Here are the guidelines for 2022:

- You can contribute a full $20,500 this year.

- You can contribute up to $26,000 if you’re 50 or older.

So again, if you want to hit those thresholds, make sure you’re taking enough out of your paychecks now!

To safe profits,

Charles Sizemore

Co-Editor, Green Zone Fortunes

Charles Sizemore is the co-editor of Green Zone Fortunes and specializes in income and retirement topics. He is also a frequent guest on CNBC, Bloomberg and Fox Business.