Caterpillar stock (NYSE: CAT) is a popular blue chip with dividend potential. How does it rate within our proprietary Stock Power Ratings system?

For investors looking for a reliable, long-term dividend stock, Caterpillar is an excellent choice.

With more than 90 years of expertise in the construction and mining industries, Caterpillar has become a global leader in heavy equipment manufacturing and has maintained a strong presence in the market.

But what does the company’s future look like?

Let’s take a closer look at Caterpillar’s business outlook for 2023 through the lens of Stock Power Ratings.

Caterpillar’s Current Situation

Caterpillar currently operates in three main segments:

- Construction industries.

- Resource industries.

- And energy and transportation.

In 2020, the company saw considerable growth in its construction and energy segments due to increased demand from China. The resource industry segment also performed well thanks to higher commodity prices.

As of 2023, Caterpillar continues to benefit from Chinese demand as well as other markets such as Europe and North America. But demand looks to be slowing with the overall economy.

Future Outlook

Caterpillar is expecting further growth in its construction industry segment over the next few years thanks to increased investment in infrastructure projects globally.

In addition, the company expects demand for its products to remain strong in the resource industry segment as commodities prices remain high.

Furthermore, increasing demand for electric vehicles may drive growth in its energy and transportation segment as well as provide an opportunity for new product development.

For a clearer picture of where Caterpillar stock is headed next, let’s look at CAT within Stock Power Ratings.

Caterpillar Stock Power Ratings

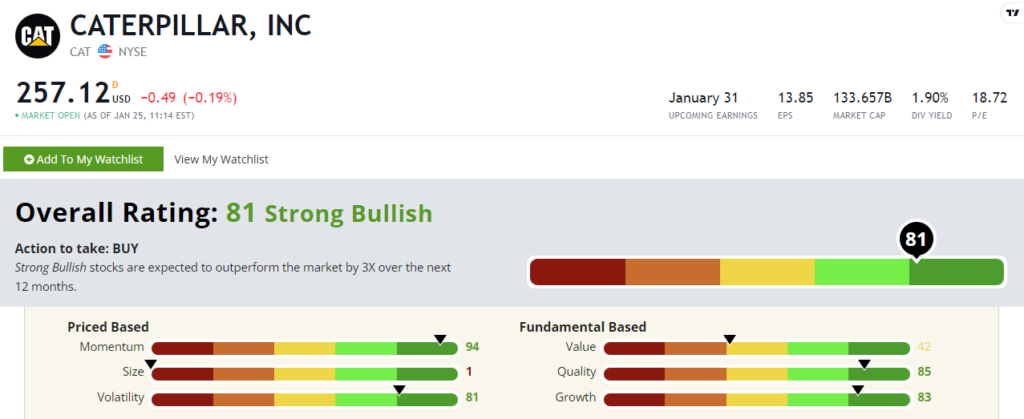

Caterpillar stock rates a “Strong Bullish” 81 out of 100. That means our system expects the stock to outperform the broader market by 3X over the next 12 months!

CAT boasts an incredible momentum factor rating at 94 out of 100.

The stock has gained more than 20% over the last 12 months, while the broader S&P 500 has lost almost 8% of its value over the same time frame.

Zooming in, Caterpillar stock’s momentum over the last six months is even better. It’s gained more than 42%.

We call that “maximum momentum” here at Money & Markets — and it gives us a chance to “buy stocks high and sell them even higher.”

CAT also rates well on quality at 85.

Its return on assets has steadily grown since the start of 2022. They grew from 8.3% in the second quarter of 2022 to 9.12% in the following quarter! The company will report fourth-quarter numbers next week.

Caterpillar also pays out a decent dividend that yields 1.86% as I write.

Bottom Line: Caterpillar is one of the most established companies operating within the heavy equipment manufacturing sector today.

And Stock Power Ratings shows this stock is set to outperform from here.

Bonus: We have everything you need to start up — or bolster — your income portfolio now. Time to put dividend compounding into action!

We’ve expanded our scope in Green Zone Fortunes, and we now offer an entire income model portfolio. You can see what some of our absolute favorite dividend-paying stocks are and add them to your portfolio right now.