Municipal bonds are the perfect play for this trade-war obsessed market — they’re far more stable than your typical stock and they pay bigger dividends, too.

And today I’m going to show you how to tap the very best “munis” for a 4.3% average dividend yield.

That’s just the start.

One of the three “steady Eddie” buys I’ll show you below even pays an outsized 4.7% dividend. Plus, it trades at a discount to its “true” value, adding to its already legendary stability and setting us up for some nice gains, too.

Turning a 4% Yield Into 5.8%

Here’s something that’s often overlooked about muni bonds: Their payouts are tax-free to most Americans.

This makes a huge difference: For instance, a 4% tax-free muni-bond yield is the same as a 5.8% taxable yield for a married couple with a household income of $120,000 and filing jointly in California.

Now there is one small “snag” here. When it comes to munis, individual investors like you and me often get the scraps — the big institutional players get first dibs, because they’re the ones who get the call when municipalities issue a fresh round of bonds.

But we can get around that by outsourcing our muni buys to a pro with a big financial institution behind them. The key is to buy our munis through closed-end funds (CEFs) like the three I’ll reveal shortly.

Besides CEF managers’ expertise and market clout, we get two other big benefits:

- More upside: CEFs tend to trade at a discount to NAV — more on this shortly — so you get your bonds on sale.

- Bigger yields: CEFs tend to have bigger tax-free yields than other kinds of muni-bond funds. While the iShares National Municipal Bond ETF (MUB) pays out a paltry 2.4% dividend, many muni-bond CEFs pay a lot more, like that 4.3% I mentioned earlier (before the tax benefit), and some pay upward of 6%.

But how do we pick the right muni-bond funds? Because munis are known for stability, one mistake investors often make is to simply pick the fund with the biggest yield.

You might, for example, be attracted to the PIMCO CA Municipal Income Fund (PCQ) because of its 4.7% yield and annualized 12.2% return over the last decade. But PCQ also trades at a nosebleed 38.3% premium to NAV.

With a run like that and its big premium, PCQ is clearly overvalued.

So you and I are going to go further and find the real bargains in the big world of muni-bond CEFs. Let’s do that now, with three underpriced, high-yielding muni-bond funds that give us tax-free dividends and portfolio stability.

Muni-Bond CEF Pick No. 1: BlackRock California Municipal Income Trust (BFZ)

BFZ trades at an 11.2% discount to NAV, despite its long-term average discount of 4.6% and its strong, steady performance:

BFZ Just Starting to Take Off

While this fund has the lowest yield of the CEFs I’ll show you, at just 3.7%, it’s seeing higher income from the bonds in its portfolio, suggesting a dividend hike might be around the corner.

Most importantly, BlackRock, the fund’s manager, is the largest and most powerful muni-bond investor in the world, with over $6 trillion in assets under management.

That means, as I said above, they get first pick of the best muni-bond issuances as they are initially offered in the bond markets. This first-mover advantage, plus the fund’s outsized discount, sets us up for more upside and gives us some downside “insulation” in the months ahead.

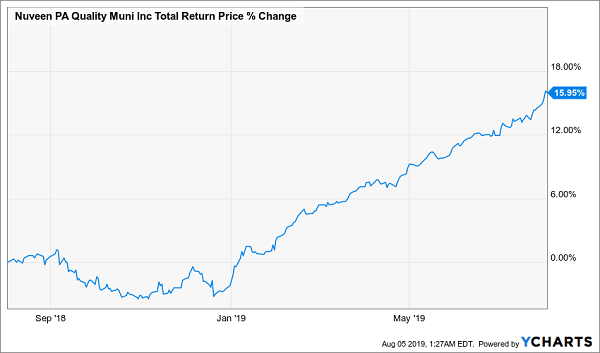

Muni-Bond CEF Pick No. 2: Nuveen Pennsylvania Quality Municipal Income Fund (NQP)

Just like BFZ, NQP has had a strong year, and investors are taking notice:

NQP Soars

This is par for the course, since NQP has a 7.1% annualized return over the last decade that’s on the higher end for muni-bond CEFs. Yet NQP still trades at a 10.9% discount.

This is ridiculous for a couple reasons. For one, NQP has a strong income stream: 4.3% yields flow to shareholders, and as with BFZ, this dividend stream looks ready to rise, thanks to growing income flowing into the fund from its bonds.

But NQP also has a portfolio of high-quality bonds (it focuses on the highest-rated bonds it can get, hence the “Quality” in the name), which makes it one of the less-volatile and lowest-risk muni-bond CEFs on the market.

Finally, Nuveen is another significant player in the bond market, and NQP is ideally positioned to get the best issuances from Pennsylvania before they’re released to the broader market.

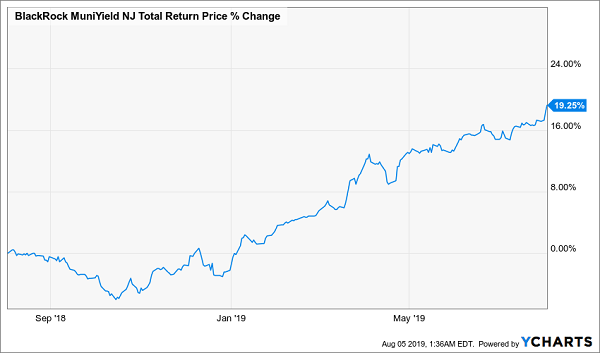

Muni-Bond CEF Pick No. 3: BlackRock MuniYield New Jersey Fund (MYJ)

With MYJ, you’re getting the best of all worlds: strong management, a great discount and big income.

Let’s start with the yield: An outsized 4.7% dividend stream that is entirely sustainable, thanks to MYJ’s diverse portfolio of New Jersey bonds bought during market panics of years past. That portfolio has done this in the last year:

A Quick Recovery for MYJ

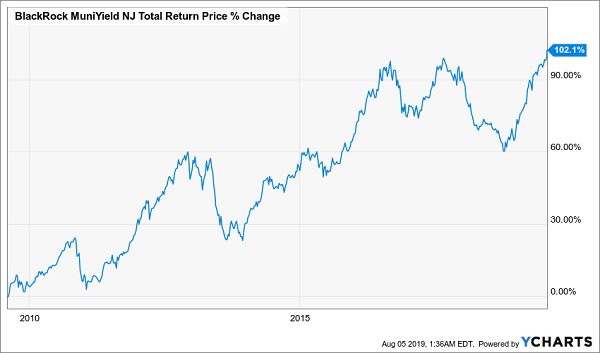

And that’s nothing compared to its long-term performance:

Double Your Money With a Safe Tax-Free Yield

MYJ trades at a respectable 5.1% discount to NAV, and its managers, BlackRock once again, get to choose the best issues from New Jersey’s massive and diversified economy, thanks to their big presence in the state and heft in municipal-bond markets. Own MYJ and you can capitalize on that unique market access.

This Bizarre Muni CEF Crushed the Market — and It’s Just Getting Started

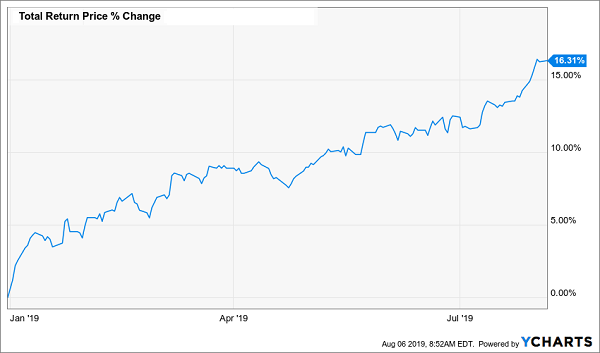

My favorite muni-bond CEF now just did something “stodgy” income plays like this aren’t supposed to do: Crush the market!

And it did so with far less volatility than your typical S&P 500 investor had to stomach this year …

Would You Rather Own My Top Muni CEF …

… Or This?

I’ve never seen a clearer picture of what we aim to do at CEF Insider: shift your portfolio from the market’s manic swings to the placid, dividend-driven returns available in CEFs.

Here’s the best part: This “no drama” fund trades at a 9% discount to NAV! That will help steady it in the next selloff and tee up further upside, too. All while we enjoy its 4% dividend (which could be worth 5.8% or more to you, depending on your tax situation).

It wouldn’t be fair to CEF Insider members if I revealed this fund’s name here, but I still want to share it with you, because this fund is the answer to today’s volatile market.

So here’s what I’m going to do.

When you click right here, you’ll pull up a special investor report giving you my full CEF-picking strategy and 5 CEFs yielding 8%+ (with 20%+ price upside) that the big financial firms are deliberately hiding from you. You’ll also be able to grab a 60-day trial to CEF Insider with no risk and no obligation whatsoever.

That trial gives you VIP access to the CEF Insider portfolio, where you’ll find this “must-buy” muni-bond CEF pick!

Taken together, this unique wealth-building package is the answer to market volatility, and I can’t wait to give you a tour. Don’t miss out!

To learn more about generating monthly dividends as high as 8%, click here.

• This article was originally published by Contrarian Outlook. You can learn more about Brett Owens and Contrarian Income Report right here.