With income inequality being a major issue in the United States, a vast majority of Americans agree that the rich should pay more in taxes.

How much more is certainly up for debate and it’s a central topic in the race for the Democratic nomination.

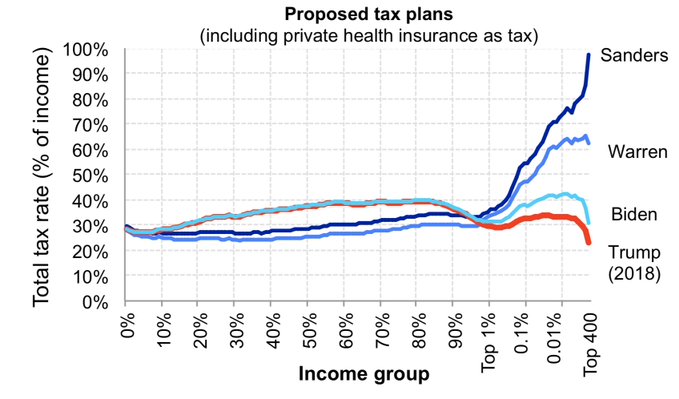

One chart analyzing the 2020 primary candidates’ tax plans shows a couple of stark differences when it comes to two particular candidates: Sens. Bernie Sanders and Elizabeth Warren, and how much the want to soak the rich with extreme wealth taxes.

Economists Gabriel Zucman and Emmanuel Saez, who have been advising both the Warren and Sanders campaigns, determined the effective tax rate each income group would pay under their proposals, taking into account all of the information the three big front-runners, including former Vice President Joe Biden, along with incumbent President Donald Trump. It gathers data from their websites, on the campaign trail and so far while in office.

Note how Warren ans Sanders actually cut taxes for the bottom 95%

That’s because they abolish mandatory private health insurance premiums, which are in effect a huge poll tax

Learn more: https://t.co/v6LPTxDRce pic.twitter.com/uQktVnfLNz

— Gabriel Zucman (@gabriel_zucman) October 14, 2019

The three leading candidates and Trump have plans that are all quite different, so the two economists treated private health insurance premiums as a tax on U.S. households. Their analysis also assumes different rates of tax evasion and avoidance, according to how they calculated the tax burdens.

This chart is the exact reason why big-money Wall Street and banking executives are speaking out against the candidacy of Sanders and Warren, in particular. Some big-time Wall Street Democrats have even gone to far as to say they’ll sit out the election — or even back Trump — if Warren wins the nomination.

The Zucman and Saez model isn’t without its critics, such as former Treasury Secretary Larry Summers, who considers their estimates to be overly optimistic, according to CNBC. Critics also point out that it will be difficult for the government to enforce the plans and the wealthy will just find ways to avoid paying the tax.

The biggest differences between the Warren/Sanders plans and what Biden has put out is the wealth taxes the two senators are looking to soak the rich with. Biden is considered a far more centrist candidate, while Sanders’ plan would amount to an effective tax rate of 97.5% for billionaires, cutting the number of billionaires in half in about a decade, while Warren’s plan would have an effective tax rate of 62% on billionaires.

Here is the chart outlining the three top Democratic candidates’ plans alongside Trump’s current plan.

Click here to learn more about the plans.