Editor’s Note: Have you missed any of Mike Carr’s charts in Money & Markets Daily? We’ve got you covered. Monday to Friday, Mike highlights a chart that catches his eye — and what it could mean for markets or the economy going forward. Check out his analysis from the last week below.

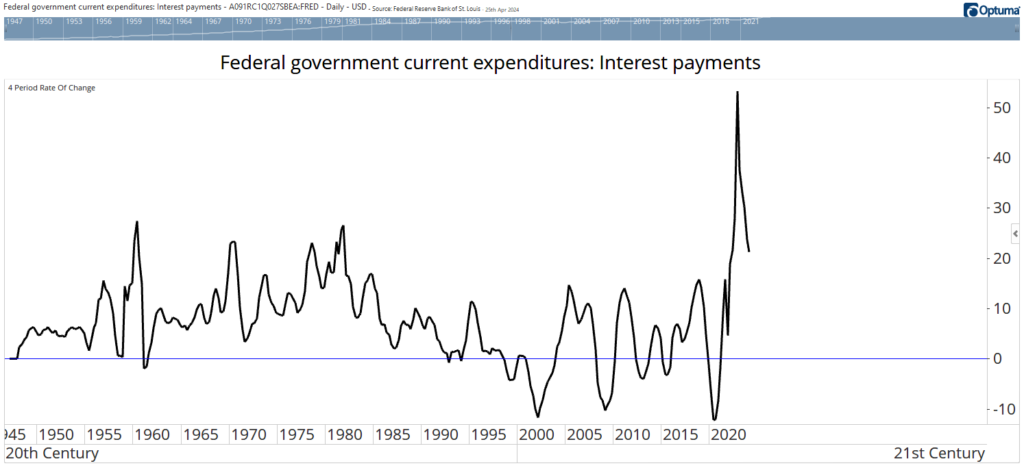

Debt Service Costs Are Now a Problem

There’s a famous Ernest Hemingway quote about bankruptcy. In The Sun Also Rises, an interlocutor questions another on how he went bankrupt, resulting in the now well-known response: “Two ways. Gradually, then suddenly.”

The chart below shows that the U.S. government could be in the second (“suddenly”) phase of its bankruptcy journey. It tracks the year-over-year change in interest payments. In the first quarter, interest cost the government $1.06 trillion. That was 33.6% of tax receipts, indicating that the government may need more revenue to meet its ever-growing interest tab.

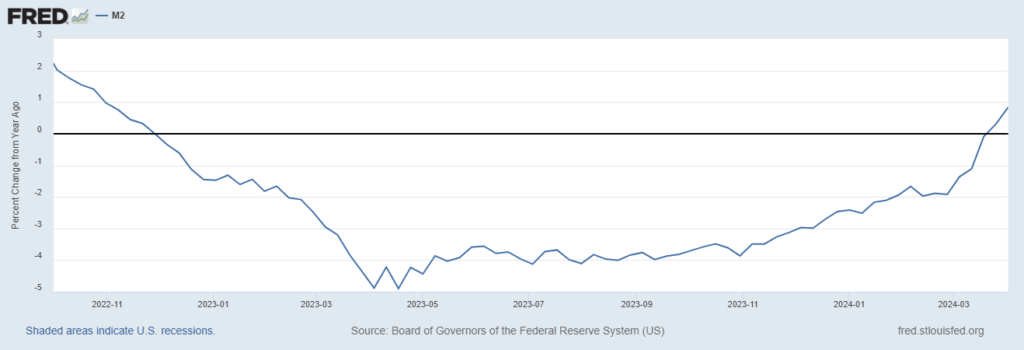

The Fed’s Not That Worried About Inflation

In Washington, it’s best to watch what policymakers do rather than say. That’s because public statements are often at odds with behind-the-scenes action.

Federal Reserve officials have been making statements about interest rates remaining higher for longer. But quietly, officials have been increasing the money supply. The chart from the Fed below shows the year-over-year growth rate of M2 — a broad measure of the money supply. It just turned positive after 17 months in negative territory.

Expanding the money supply is one way to boost economic growth, just like cutting interest rates. So, while the Fed is talking tough about fighting inflation, it’s also taking steps that could reignite higher prices.

Growth Rate of M2 Turns Positive

Salaries Keep the Fed Under Pressure

Economists believe wages are an important factor in inflation. Workers naturally want higher salaries when prices rise. However, higher salaries raise costs for employers. And they often raise prices to maintain their profits. In this way, higher wages contribute to inflation.

The latest data on employment costs indicate that wages are still growing at a potentially inflationary pace. In the first quarter, the Federal Reserve’s Employment Cost Index for wages and salaries rose 4.3% compared to a year ago.

The cost of benefits increased 3.5%. This is bad news for Fed officials fighting inflation and indicates price pressures, and higher interest rates, could persist for at least a few more months.

Employment Cost Index Rose 4.3% From Year Ago

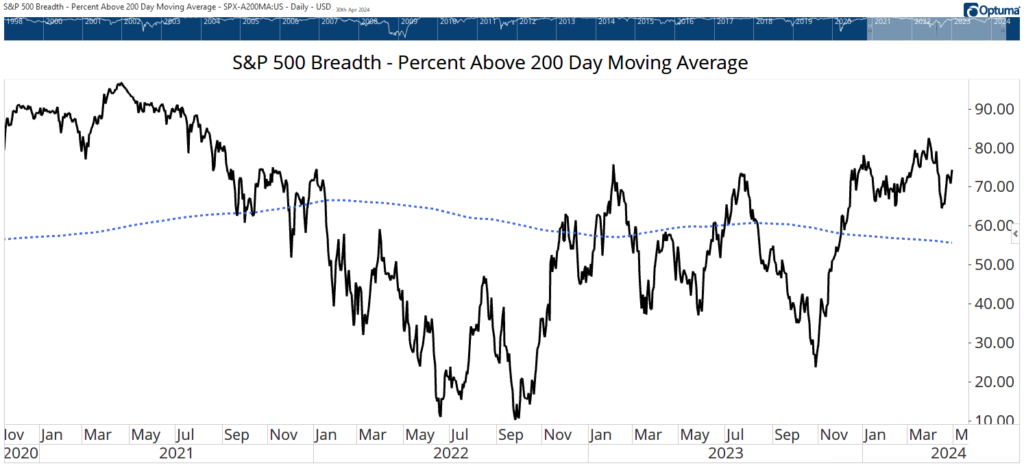

Are We Still in a Bull Market?

Analysts often try to make market analysis difficult. They use advanced math to unlock deep mysteries, or they present countless facts to argue their point. They forget that sometimes analysis can be simple.

The chart below is a simple look at whether we’re in a bull market or not. The black line shows the percentage of stocks in the S&P 500 Index above their 200-day moving average (MA).

This MA is used to define the direction of the trend. When it’s above 50%, most stocks are in uptrends. Right now, about 74% of the stocks in the index are trading above their 200-day MA. The percentage is rising, which means most stocks are in uptrends and more are joining them.

Bottom line: This is a bull market.

Percentage of Stocks Above Their 200-Day MA

A Weak Yen Could Mean Another Tech Rally

The Japanese yen reached 160 yen to the dollar earlier this week — making a new multi-decade low. New lows mean new highs in the dollar. Now’s a good time to review what happened the last time the dollar was this strong, which was in the late 1990s.

The chart below shows the yen falling from 1995 to 1998. It shows yen to the dollar — so higher values are associated with a falling yen and a strong dollar.

The dollar’s strength was good for the stock market, especially tech stocks, which delivered average annual gains of more than 40% during that time. History never repeats itself exactly, but the dollar’s strength against the yen could be bullish for tech.

Tracking Yen to the U.S. Dollar

That’s it for this week’s edition of Chart of the Day.

Until next time,

Mike Carr

Chief Market Technician