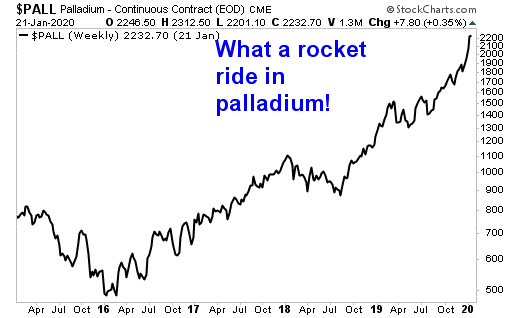

The price of palladium is soaring like a rocket. It’s up 25% in just two weeks and hit a record $2,577.27 an ounce Monday. That’s on top of a 54% rally last year. All told, palladium is up 357% from its bottom in 2016.

Just take a look at this chart. It shows palladium’s rip-ride higher …

As investors, seeing such a spike should inspire us to ask some important — and potentially very profitable — questions. Such as:

- Is it too late to play this lustrous white metal?

- How would you play a potential rally even higher?

Well, for today’s column, I have some thoughts for how to answer these.

I’ve heard rumors about some hedge fund blowing up on a bearish palladium bet. That may yet turn out to be true. Nonetheless, the bottom line is that palladium is seeing a good ol’ fashioned supply/demand squeeze.

Why? Well, palladium is THE BEST metal to use in catalytic converters for gasoline-powered vehicles. And strong vehicle demand is at the heart of the palladium price rocket. A whopping 85% of palladium demand comes from the auto industry.

The rally in palladium cost the world’s car companies $18 billion just in the last year. But it’s still not enough of a pinch to make them retool to start using some other metal, like the cheaper platinum, in fuel emission systems for gasoline-powered cars and trucks.

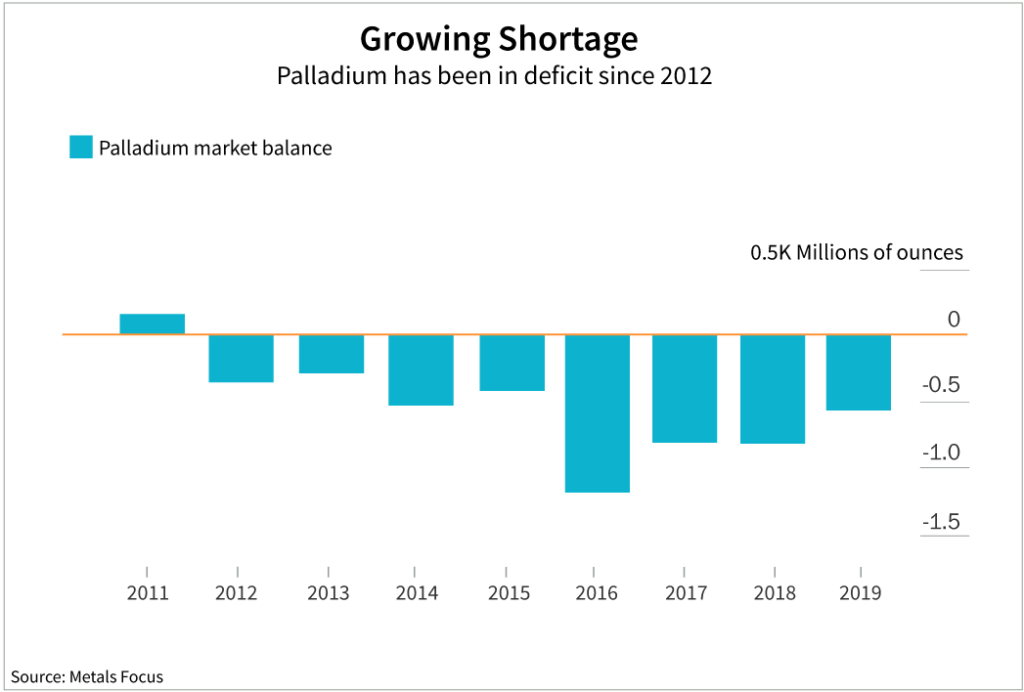

Over the past decade and a half, the amount of palladium coming out of mines every year has dropped by 1 million ounces, or 12%. That’s according to estimates from UBS Group AG. Over the same time, demand for palladium has risen 4 million ounces, or 57%.

And this triggered a supply/demand gap. One that has lasted for EIGHT long years!

Production is forecast to fall short of demand AGAIN in 2020. That would make this the ninth year in a row.

Will the supply/demand squeeze get worse? It certainly could. China, India and Europe are rolling out tighter emissions standards for cars. That means MORE appetite for palladium.

Meanwhile, above-ground stockpiles of palladium are shrinking. Over the past decade, total stockpiles have been cut in half. They now stand equal to 14 months of demand.

Does that sound like a lot? It might … to the average person. But not to auto manufacturers. They’re planning out the next couple years of production, so 14 months doesn’t cut it.

The world’s top palladium producer, MMC Norilsk Nickel, usually fills the gap by selling ounces from its own hoard. In November, the company said it would release 300,000 to 500,000 ounces from its supply in the “mid-term.” But there was no elaboration on when that would be.

Palladium’s extraordinary rally has the potential to go even higher and test $3,000 an ounce, according to Goldman Sachs.

What happens then? Goldman thinks the price will fall. And sure, that could be true. All prices fall eventually.

For you as an investor, picking the turning point is be the real trick. Bull markets — and bubbles — can run further and last longer than most people think possible.

So how can you play this?

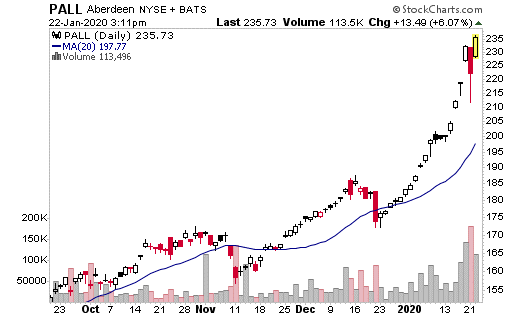

An easy way is the Aberdeen Standard Physical Palladium Shares ETF (NYSE: PALL). Again, we have a timing problem. Palladium has rallied 95% off its 52-week lows. So, the big question is WHEN should you buy it?

Let’s look at a chart of PALL through Wednesday …

You can see that it is soaring. But PALL — which tracks palladium closely — pulls back pretty regularly. It looks like it’s due for a pullback now.

What I might do is wait for a pullback to the 20-day moving average — the blue line on the chart. Buy a test of the 20-day MA. As long as your holding time is longer than a week, you should do OK.

There are also great, small miners of platinum and palladium. I may be looking at those more closely in the future for my subscribers. If you’re doing this on your own, be diligent in your research.

And good luck! It’s going to be a wild ride. But it sure looks like palladium has higher prices yet ahead.

All the best,

Sean

Editor’s note: Be sure to check out Money and Markets’ Closing Bell feature each day after the stock market close to follow the price of palladium and other precious metals like gold, silver and platinum.