In September 2020, I told you why I thought buying shares of LyondellBasell Industries (NYSE: LYB), a petrochemicals and oil refining company, was a smart move.

LyondellBasell stock wasn’t popular at the time.

Anything related to energy was way out of favor in 2020. Despite that, I knew LYB was a high-quality value stock that paid a strong dividend … and given time, the market would appreciate the value.

Indeed it did. The shares are up 55% since my article. This doesn’t include the $7.81 in regular dividends and the one-time $5.20 special dividend it paid just a few days ago.

These cash payments add another 18.5% to the returns.

More Dividend Growth AND Capital Gains on the Way

LYB’s CEO Peter Vanacker noted in last month’s press release:

LyondellBasell established new records for cash generation in 2021 and we have a strong outlook for our company. Capital returns have always been an important component of LyondellBasell’s value proposition for shareholders. 2022 will mark our 12th consecutive year of regular dividend growth. The combination of today’s special and quarterly dividends returns $2.1 billion to shareholders.

That’s excellent news for anyone who bought shares of LYB when I wrote about them!

At current prices, LYB’s shares yield a solid 4.3%. If recent history is any guide, more dividend growth is near.

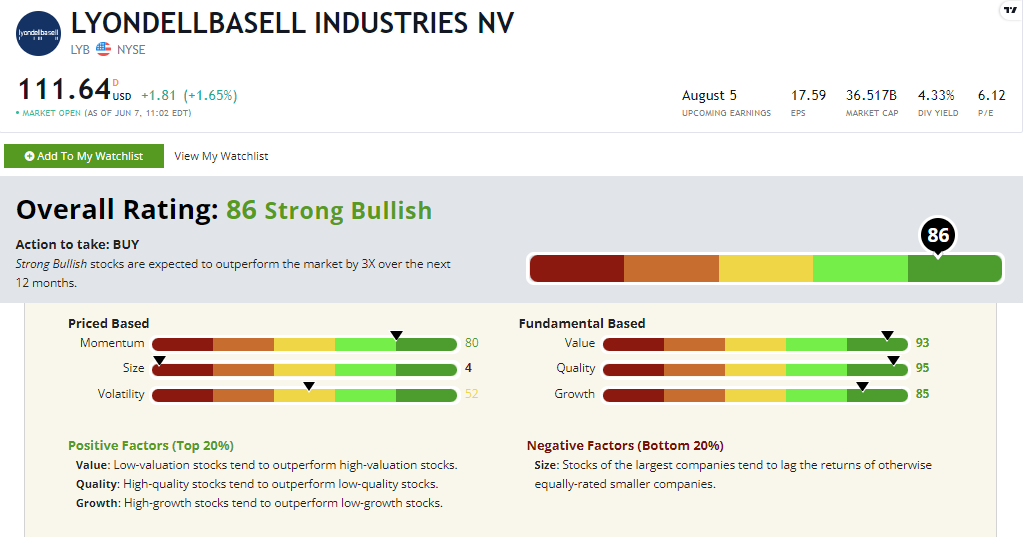

Plus, based on our proprietary Stock Power Ratings system, LYB’s move is just getting started. The stock rates a “Strong Bullish” 86 out of 100.

History shows that “Strong Bullish” stocks crush the broader market three times or more over 12 months.

Let’s dig deeper.

LyondellBasell’s (NYSE: LYB) Stock Power Rating

LYD Stock Power Ratings in June 2022.

Quality: You might not think of petrochemicals as a “quality” business. Chemicals are a commoditized business, and it’s not easy to charge premium pricing. Yet LYB’s focus on specialty chemicals allows it to enjoy fat margins, and the stock rates a stellar 95 on our quality factor.

Value: Even after a 55% run-up in price, LYB is a cheap stock, with a value factor rating of 93. Remember, a stock’s share price doesn’t make it “cheap.” That value is relative to sales, earnings or other fundamental factors.

In LyondellBasell’s case, those fundamentals improved along with the stock price. So as the price has soared, the shares have traded at an attractive price.

Growth: LYB might be an inexpensive value stock, but that doesn’t mean it’s boring. The stock rates a solid 85 on our growth factor.

LyondellBasell’s businesses are somewhat cyclical, so the growth story may change if the economy slides into recession. But right now, the shares look good.

Momentum: As many of the tech and growth names of the past five years struggled in 2022, LyondellBasell pushed higher.

As a result, it rates a Bullish 80 on our momentum factor with no sign of slowing.

Volatility: LyondellBasell rates an average 52 on volatility, meaning its volatility is in line with the broader market.

As a rule, we avoid the highest-volatility stocks (those with ratings of 20 or lower). An average rating here is nothing to fear.

Size: LYB is a large $36 billion company, so it comes as no surprise that it rates a 4 on our size factor. That’s OK! We at Money & Markets are big fans of diversification, so you’d be wise to own a few big names to round out the high-growth small-cap stocks.

Bottom line: I can’t tell you for sure whether the bear market is over or just taking a break. But I can say LyondellBasell stock looks strong whether a bull or bear market lies ahead.

This is a high dividend-yielder with the potential to beat the pants off the S&P 500 over the coming months.

To safe profits,

Charles Sizemore, Co-Editor, Green Zone Fortunes

Charles Sizemore is the co-editor of Green Zone Fortunes and specializes in income and retirement topics. He is also a frequent guest on CNBC, Bloomberg and Fox Business.

P.S. Did you buy shares of LYB when I wrote about the stock in 2020? We’d love to hear how you did and whether you took profits or are still holding! Reach out to Feedback@MoneyandMarkets.com to tell my team and me about your experience with LYB or any of the stocks we feature!