I religiously follow technology news.

I’m not looking for the latest gadgets.

I’m looking for tech companies with profit potential.

If you’ve been following financial news, you know there is a bit of panic when it comes to tech.

There is a semiconductor shortage around the world. And that’s a problem.

These are the microchips embedded in your phone, your laptop and even in your car. This tiny tech makes those devices work.

They are essential components. Basically, manufacturers can’t make any of this tech without semiconductors.

And there is a huge shortage of them … everywhere.

I found a company poised to take advantage of this shortage. It should give smart investors strong gains in the coming months and years.

It even rates a 100 on Adam O’Dell’s six-factor Green Zone Ratings system.

I’ll share it with you in a second. But first, let’s see why this chip shortage is a buying opportunity for you.

COVID-19 Puts Pressure on Production

The biggest reason for the shortage of these critical components is COVID-19.

During the height of the pandemic in 2020, factories shut down. Manufacturers canceled orders for supplies as production was slashed … especially in automobile manufacturing.

Semiconductor companies were forced to pivot and focus on producing chips for data centers and laptops.

The problem is different products use different semiconductors.

The semiconductors used in your car are not the same as the ones used in your smartphone.

As we start to return to normal following the pandemic lockdowns and restrictions, car and truck demands have increased.

But companies like Ford Motor Co. (NYSE: F) and General Motors Co. (NYSE: GM) don’t have the semiconductors they need to build new vehicles.

On top of that, new 5G technology infrastructure creates demand for new smartphones and computer chips. And semiconductor companies are racing to meet that demand.

One company is going to profit in that race to meet demand. And that means profit for smart investors like you.

ChipMOS Stock Is on the Semiconductor Fringe

ChipMOS Technologies Inc. (Nasdaq: IMOS) is a Taiwan-based developer and manufacturer of semiconductor testing and packaging for companies that sell semiconductors but don’t actually make them.

Its operation is critical in making sure semiconductors meet specifications. It’s working with some big fabrication companies like Taiwan Semiconductor Manufacturing (NYSE: TSM) and Semiconductor Manufacturing International.

The company has still done well for itself despite the COVID-19 pandemic and this shortage of chips.

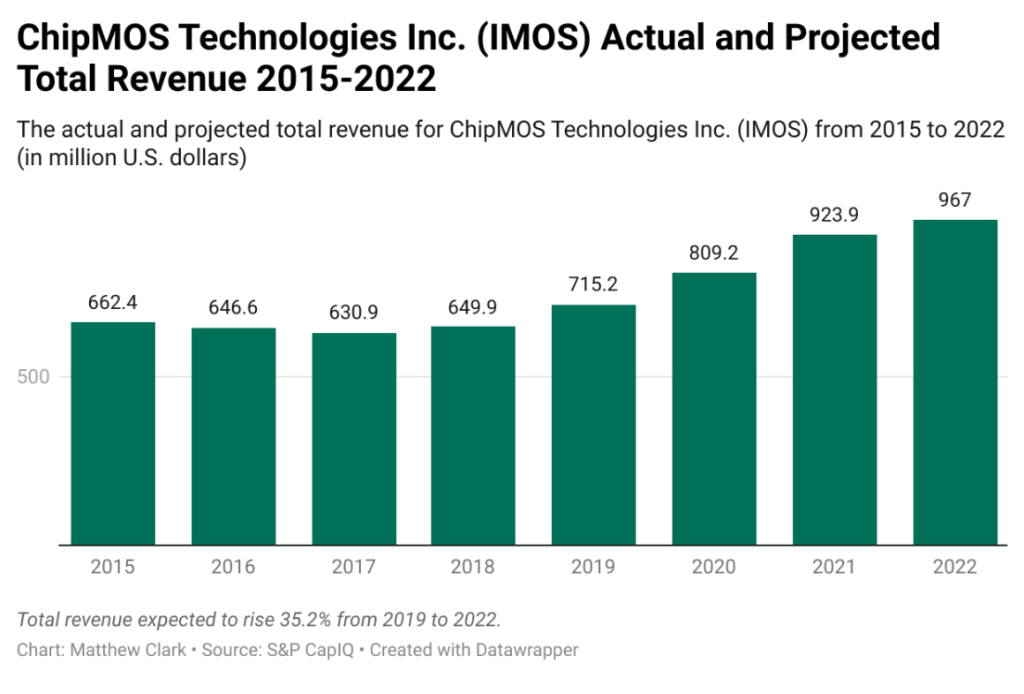

ChipMOS Total Revenue to Near $1 Billion by 2022

Since 2017, the company’s total revenue went from $630.9 million to $809.2 million in 2020.

This chip shortage is going to increase the demand for ChipMOS products. Fabless companies need to test and properly package, or install, these semiconductors for new products.

Total revenue for ChipMOS is projected to hit $967 million in 2022. That’s a 35.2% increase in total revenue from 2019.

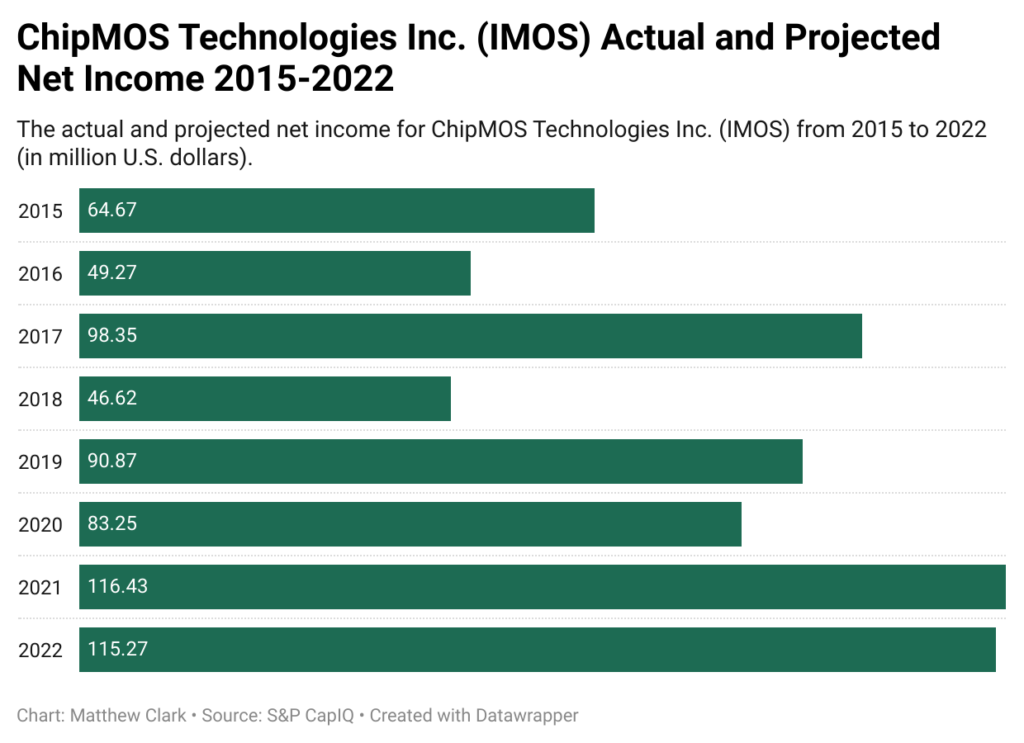

While its revenue grew in 2020, its net income dropped after switching testing instruments.

ChipMOS Net Income to Double From 2018

However, the company expects a swift rebound in net income.

After reporting a net income of $83.2 million in 2020, ChipMOS projected a net income of more than $115 million both this year and next.

That’s more than double their total net income in 2018 and nearly 40% higher than 2020.

It’s a solid growth signal for ChipMOS.

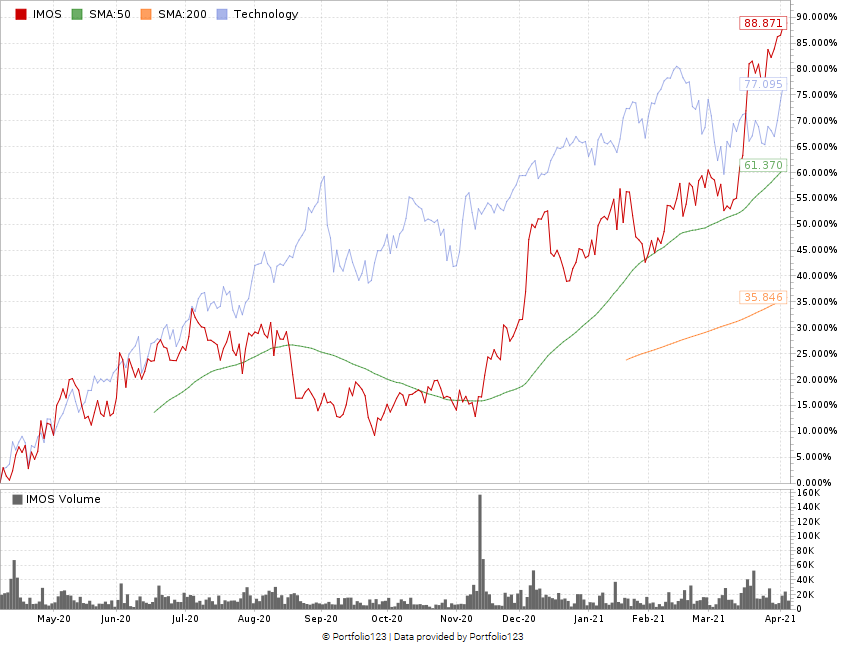

ChipMOS Stock Jumps in 2021

ChipMOS’ stock price bounced nicely off its March 2020 lows — going from $15 per share in March 2020 to $22 per share in July.

IMOS traded flat until a slight drop in August — then it took off in November.

The stock weathered the recent sector rotation. As investors sold off tech to take profits, ChipMOS gained.

It currently trades at nearly $32 per share — 113% higher than March 2020 and 45% up from the peak of its surge in July 2020.

IMOS’ Green Zone Rating is another good sign for its future.

ChipMOS Technologies Inc.’s Green Zone Rating on April 13, 2021.

The stock currently rates 100 overall and is in the green in all six factors.

It means we are “Strong Bullish” on ChipMOS and expect the stock to outperform the broader market by at least three times over the next 12 months.

This stock comes with a solid value (95), with price-to ratios all considerably lower than the broader tech industry average.

The price-to ratios are almost four times less than the tech industry average … a rare find nowadays.

It’s also a great quality stock (89), with returns on assets, equity and investments all better than the tech industry average.

ChipMOS rates an 83 on growth with a one-year annual sales growth rate of 19% and year-on-year quarterly earnings per share growth of nearly 40%.

It’s a solid size (82) with a market cap of $1.16 billion — not too big and not too small.

The stock rates a 97 on volatility as its upward momentum has not met a lot of downside.

The bottom line: There are a lot of companies scrambling to meet the demand for more semiconductors.

ChipMOS is a company that will take advantage of that demand as companies need its testing and packaging.

Safe trading,

Matt Clark

Research Analyst, Money & Markets

Matt Clark is the research analyst for Money & Markets. He’s the host of our podcast, The Bull & The Bear, as well as the Marijuana Market Update. Before joining the team, he spent 25 years as an investigative journalist and editor — covering everything from politics to business.