Chocolate makers really do have ideal business models. Their products are both recession-proof and future-proof.

They make guilty little pleasures, appealing to your sweet tooth. Consumers splurge on them as impulse buys in the supermarket checkout line. Their products are affordable and quickly consumed.

Even in a rough economy, you’re going to have enough money to treat yourself to a chocolate bar.

And even if AI puts all of us out of work (heaven forbid), chocolate is a fantastic comfort food to help us cope with the anxiety and depression.

At least that was the standard narrative among investors in their stocks.

Then the weight loss drug Ozempic went mainstream about three years ago, and all of this immediately went out the window.

Between the popularity of weight loss drugs, a trend in healthier living, and rising prices crimping consumer budgets, it’s been a rough couple of years for snack food companies.

Most have seen their stocks struggling to trend higher since 2022. At a time when investors are laser-focused on AI-fueled growth, there just hasn’t been a lot of demand for stodgy old consumer staples.

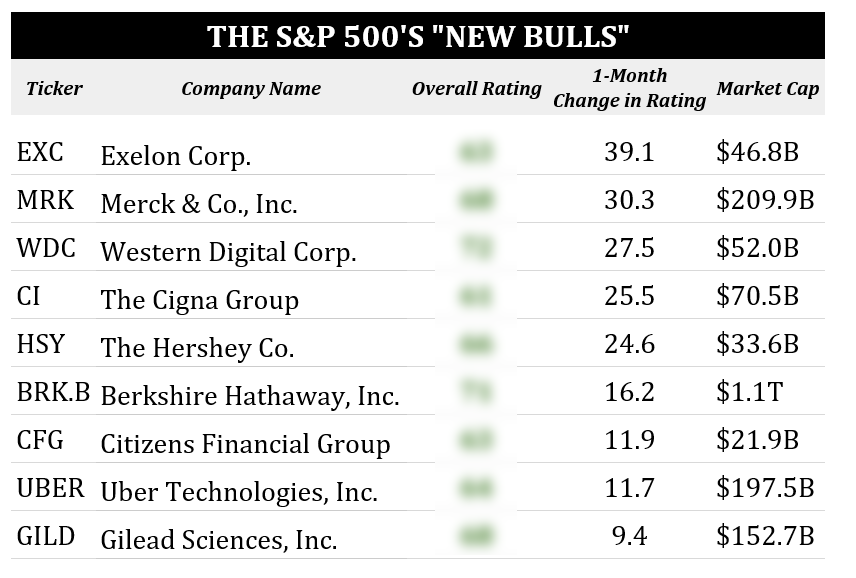

I found it interesting that leading chocolatier Hershey (HSY) appeared on my Green Zone Power Rating screen of newly bullish S&P 500 stocks this week. (Stocks with a score of 60 or higher are rated as “Bullish.)

Hershey has seen its Green Zone Power rating jump over 24 points in the past month and now rates a “Bullish” 66 overall.

Hershey owns some of America’s most recognizable candy brands, including Reese’s, Kit-Kat, and its namesake Hershey among others. And it also owns and markets less sugary options like the popular Skinny Pop popcorn.

The company’s strong branding allows it to charge premium pricing and generate healthy profit margins, contributing to its stellar quality factor score of 90.

Perhaps surprisingly, given the headwinds facing the snack industry, Hershey also rates an exceptional 85 on its growth factor rating and a stable 68 on its volatility factor rating.

Apart from Hershey, there were quite a few other “boring” freshly bullish stocks this week. Apart from Uber Technologies (UBER) and Western Digital (WDC), it’s a distinctly low-tech collection.

Perhaps none is more staid and un-sexy than Warren Buffett’s Berkshire Hathaway (BRK-B). Berkshire Hathaway is a collection of mostly old-economy, middle-American businesses making everything from candy to cowboy boots. Buffett has been a net seller of his growth stocks of late, and Berkshire is sitting on a gargantuan $382 billion in cash.

Interpret that as you will, but the Oracle of Omaha is about as defensively postured as he’s ever been in his long, storied career.

It’s a mistake to read too deeply into a single screen like this. But could this indicate that we may be in the early stages of a market rotation out of the go-go hyper-growth tech sector and into old-economy stocks?

Maybe.

Just for grins, let’s cast the net a little wider. I ran the same screen for new “Bullish” rated stocks outside of the S&P 500.

My first observation is that there were a lot of them this week. To keep it manageable, I limited the list to the top 20 with the largest one-month change in rating.

It’s a distinctly low-tech group this week, dominated by utilities, banks and gritty industrial companies.

Again, we shouldn’t rush to draw conclusions about a single screen. And the emergence of low-tech, newly bullish stocks doesn’t mean that growth-oriented tech stocks are “Bearish.” There are a lot of moving parts here, and this isn’t necessarily indicative of a trend. But it does suggest that maybe – just maybe – the next leg of the bull market might be distinctly low-tech.

To good profits,

Editor, What My System Says Today