Nvidia (NVDA) is on one of the hottest runs in stock market history — soaring nearly 1,800% over the last five years alone.

So why is the company’s founder, Jensen Huang, selling his shares?

As a matter of fact, he’s not just selling … he’s dumping $14 million in shares on an almost daily basis!

He’s not alone, either.

Following the legendary run of mega-cap “Magnificent Seven” tech stocks, I started taking a closer look at SEC Form 4 reports from these companies’ insiders and top investors.

The SEC created Form 4 following the Great Depression to track and publicize insider trading so that no company’s employees or directors would have an advantage over investors like you and me. You can even search up specific Form 4 filings at SEC.gov, though you might not want to (it’s dreadfully boring, trust me).

After weeks of extensive research, I found no fewer than 21 different billionaires and powerful insiders dumping some of their most successful investments on the open market.

Some of these trades made big headlines — like Warren Buffett’s sale of 600 million shares of Apple (APPL), a move that’s already cost him $35 billion in missed profits, according to Barron’s.

Meanwhile, Apple CEO Tim Cook’s sale of $50 million in shares very nearly slipped under the radar.

With all these billionaires rushing for the exit, you might be starting to wonder whether they know something we don’t…

Tech History Repeating (Look at Cisco)

Late last year, Money & Markets welcomed forecasting legend and top economist Andrew Zatlin to the team.

As you might know, Andrew’s one of the most successful jobs forecasters on the market — routinely reaching the top of Bloomberg’s terminal rankings and bucking the crowd with an approach based on cutting-edge, real-time data.

When we first met, Andrew explained that his unique data expertise stretched back decades … all the way back to the 1990s and his early career working at none other than Cisco Systems.

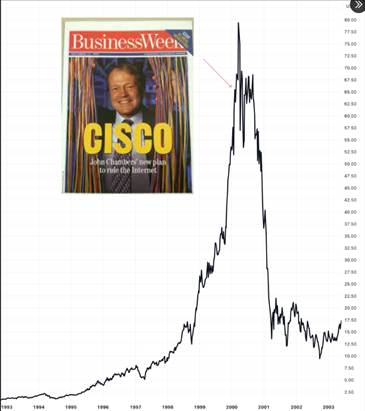

These days, you barely hear about Cisco. But back then, it was a Tech Titan. Much like Nvidia, Cisco surged past established tech leaders like Microsoft, eventually becoming the largest company in the world with a market capitalization of $500 billion in 2000.

Like Nvidia, Cisco’s success at the time was unmatched. At its peak, Cisco’s $536 billion market cap was worth an unbelievable 5.5% of the U.S. economy.

While Nvidia’s story is still unfolding, we already all know how Cisco ended up:

The dot-com crash lopped roughly $460 billion off Cisco’s market cap. Today, 25 years later, Cisco’s shares are still well below their dot-com peak. Meanwhile, Nvidia has surged to a $3.2 trillion market capitalization.

It all seems so obvious in hindsight … that technology would eventually evolve “past” Cisco’s critical hardware advantage.

Yet, as Andrew shared from his own personal experience, it certainly wasn’t obvious at the time.

Cisco wasn’t just on top of the market; it was on top of the world. Divisions were eagerly plotting out new long-term projects, employees were plotting out successful careers, and investors were plotting out years of continued growth.

Longtime readers will know that I frequently caution against investing too heavily in Magnificent Seven stocks for a variety of reasons.

But now, for the first time in years, I want to be clear that I’m broadcasting a specific WARNING against these stocks.

To see why, check back here in Money & Markets Daily on Thursday.

To good profits,

Adam O’Dell, CMT

Chief Investment Strategist, Money & Markets