We’re bullish on solar energy and solar stocks. Wildly bullish, in fact.

With battery technology improving by the day, the single biggest impediment to greater solar adoption — the fact that the sun doesn’t shine at night — is becoming less and less of an issue.

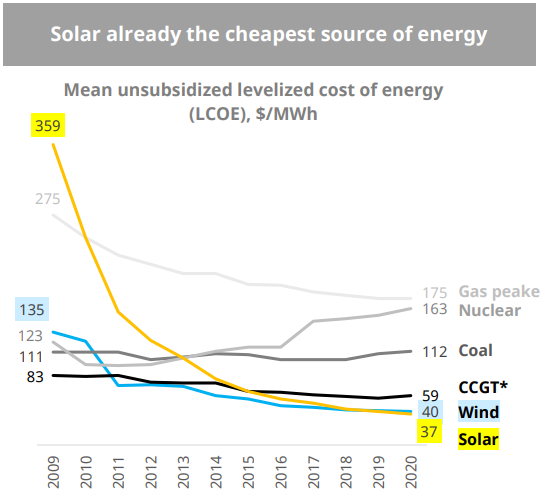

The other impediment — cost — is now an advantage.

Solar energy was always more expensive to produce than energy from fossil fuels, which limited its acceptance. Well, that isn’t the case anymore. Solar power costs have dropped by 85% over the past decade. New solar projects are now cheaper than new coal or natural gas plants … and that’s without subsidies.

Source: Canadian Solar investors presentation, May 2021.

Yes, even coal! Coal — the cheapest and most abundant energy source since the dawn of the Industrial Revolution — is now a more expensive energy source than solar.

Solar Is on Its Way — and Solar Stocks Will Soar Higher

You know the old saying: Money talks and BS walks.

I think most people like the idea of a cleaner, less polluted world. But they’re not going to be motivated to do anything about it until it makes economic sense.

Well, now that solar energy is the cheapest option, it is only a matter of time before it becomes the dominant energy source.

Rome wasn’t built in a day, of course. It will take time for existing plants to be replaced. But as aging infrastructure is phased out, it will be replaced by ever-cheaper solar energy.

Today, solar energy accounts for only 2% of energy globally. That means we have a long runway here as solar gains market share in the years ahead.

Of course, a transformation like this isn’t cheap. While solar is cheaper to produce once it’s in operation, someone still has to pony up the initial capital to build out the infrastructure.

This is an area we’ve been following in Green Zone Fortunes for over a year now, and it’s one we plan to continue following for years to come.

The Global Clean Energy Arms Race

And this brings me to some recent news on solar hardware leader Canadian Solar Inc. (Nasdaq: CSIQ), which I recommended to my readers last July. (We’re up nearly 70% on half of that trade, by the way.)

As its name suggests, Canadian Solar is a Canadian company. But it listed its shares on the U.S. Nasdaq Composite to tap into the vastly larger U.S. capital markets. If you want to raise serious money, America is the place to do it.

But Canadian Solar is raising even more … and they’re doing it in China. A subsidiary of the company has filed the paperwork to issue shares on the Shanghai Stock Exchange.

Now, I’m not going to run out and tell you to buy shares of the Chinese subsidiary once it lists. Buying Chinese shares — or any non-U.S.-traded shares, for that matter — can be difficult for many Americans, and most American brokers lack access.

I’m more interested in the bigger picture here.

China, which has struggled with some of the world’s worst pollution for decades, is “all in” on clean energy. Chinese consumers buy nearly as many electric vehicles per year as all of Europe, and China is already the largest producer of solar energy. While President Biden’s “Build Back Better” initiative aim at putting the U.S. back on top, China has already emerged as the de facto global leader in clean energy.

This new “arms race” between the U.S., China and Europe to be the dominant clean energy powerhouse will create massive opportunities in the years ahead for solar stocks and others.

I already mentioned our open position in CSIQ as part of the Green Zone Fortunes model portfolio. My readers already had the opportunity to lock in 124% gains on the first half of that investment in just under six months.

And we aren’t done with clean energy yet.

In our July issue of Green Zone Fortunes, I recommend one of my very favorite ways to profit from this mega trend. The company I recommend is ready to give Tesla a run for its money. And if you join us now, you’ll be one of the first to find out about this stock when the issue hits inboxes on Friday. Don’t delay!

Click here to find out more about Green Zone Fortunes and the details on my Millionaire Master Class now. Get ready to ride clean energy to new heights in 2021 and beyond!

To good profits,

Adam O’Dell

Chief investment strategist, Money & Markets