Buying an exchange-traded fund (ETF) can be a great way to gain diversified exposure to a specific sector, industry group or investment “theme.” You can buy a whole basket of individual stocks with just one click of the mouse (or tap of the finger).

For instance, in May, I recommended my Cycle 9 Alert readers make a bullish play on the SPDR Biotech ETF (NYSE: XBI).

I wanted them to have exposure to the entire biotech space during its “search-for-a-vaccine” rally. And even though a viable vaccine has yet to be announced, we rode that rally for a net gain of 113% in just two months! (Note: We bought options on the ETF.)

Of course, while buying a diversified ETF will give you exposure to a broad sector, industry group or theme … you could instead buy only the ETF’s “top” stocks.

That is, if you have a method for determining which of the ETF’s individual stock holdings are “top,” and which are not.

This way, you’ll filter out the companies that will drag down the ETF’s overall performance!

And that’s what my new ETF X-Ray is all about.

I’ll run each of the individual stock holdings of a popular ETF through my six-factor Green Zone Ratings model … showing you which ones are top-rated and which may be best to avoid.

Let’s get straight to it with today’s ETF X-Ray!

Global X Cloud Computing ETF (Nasdaq: CLOU)

Global X manages the Global X Cloud Computing ETF (Nasdaq: CLOU). This fund company focuses on “disruptor” sector ETFs for its investors.

I’ve seen Global X’s president speak at the Inside ETFs conference I’ve attended the past two years. I really like that this suite of ETFs gives investors access to some of the most innovative and cutting-edge investment themes out there right now — including Internet of Thingsand cloud computing (CLOU).

These “Digital 2.0” technologies are growing at double-digit rates and driving innovations across multiple sectors. And Global X’s suite of disruptor-sector ETFs is a great way to gain “one-click” access to them.

That said, let’s take an “X-Ray” look at the Global X Cloud Computer ETF through the lens of my six-factor Green Zone Ratings model.

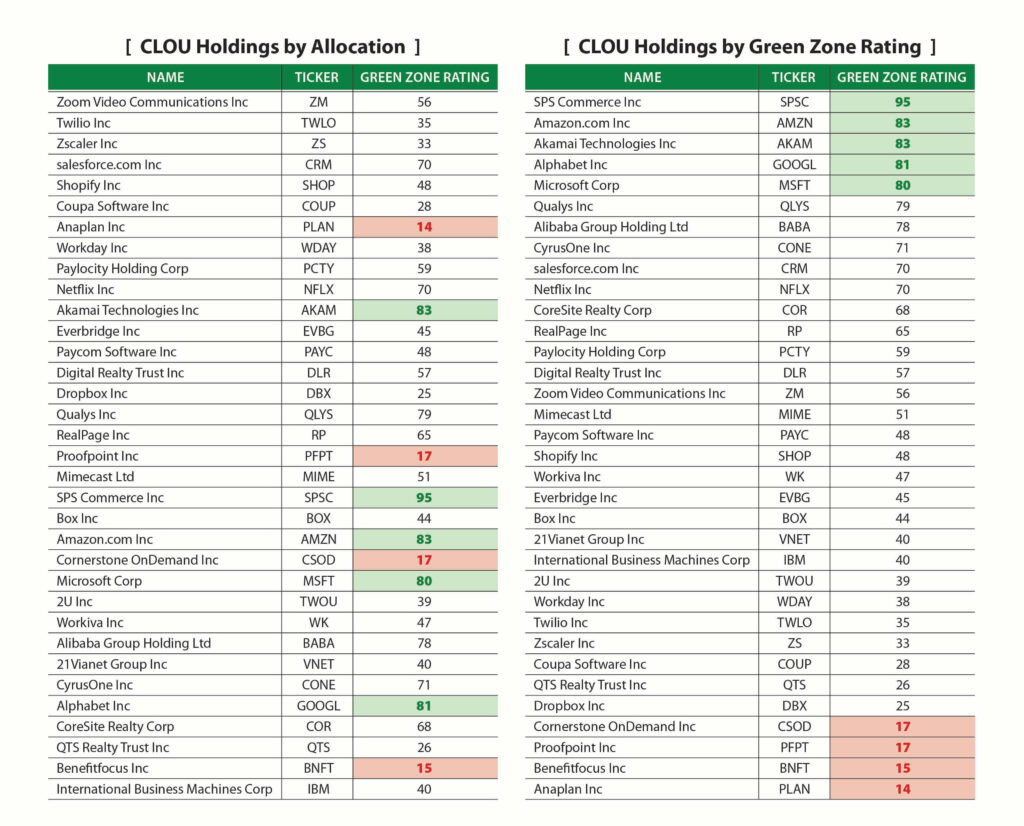

The table below shows the ETF’s individual stock holdings, along with the Overall Rating they’ve earned on my six-factor model.

Note that I’m presenting two tables …

The left side is sorted by the weight that each stock holds in the ETF. The stock at the top (Zoom, ZM) has the largest allocation of the ETF’s assets.

The right side is sorted by my rating system’s Overall Rating, so it’s easy to spot which stocks are “top-rated.”

You’ll see the two largest holdings in Global X’s cloud-computer ETF are Zoom Video Communications (ZM) and Twilio (TWLO), with each stock making up over 6% of the ETF’s holdings.

As I see it, these are companies that benefit from functionality that cloud computing affords and not necessarily “pure-play” cloud companies.

What’s more, while both are hyped “glamour” stocks (and are having great years!) … they aren’t as proven as the likes of Amazon (AMZN), Alphabet (GOOGL) and Microsoft (MSFT), all three of which rate higher than Zoom and Twilio on my quality, value and volatility factor ratings.

One Disruptor Company Worth a Closer Look

Otherwise, one company you may not have heard of before is SPS Commerce (Nasdaq: SPSC). It’s barely grown out of the “small-cap” category, with a market cap of just $2.7 billion.

SPS Commerce offers supply-chain management software solutions on the cloud. And though it’s a lesser-known name, it’s growing like gangbusters … earnings-per-share are up 78% annually for the past three years!

This cloud-leveraging company is certainly worth a close look.

One last thing … a plug for the cloud-computing “consultant” I just recommended yesterday in my Green Zone Fortunes newsletter.

This global-leader tech consultant is an expert in all things “Digital 2.0,” not just the cloud. And Amazon selected this company as a “Premier Partner” of its market-share leading AWS cloud platform, making it the go-to choice for any company wanting to get onto the cloud.

Frankly, I was shocked to find this company isn’t a holding of the Global X Cloud Computer ETF … it rates an 87 overall on my Green Zone stock rating model, and my two-year profit target for the stock is 80% above current prices.

Stay tuned! I’ll have details for how you can sign up to get that pick and many more in the coming days!

To good profits,

Adam O’Dell, CMT

Chief Investment Strategist, Money & Markets