Okay, quick poll!

How many of you use Netflix? Amazon Prime? Uber Eats?

I’m guessing a lot! The truth is, digital subscriptions are an essential part of many of our daily lives now.

We gravitate to companies that allow us to pay for services rather than pay a flat fee for everything.

Subscription services are also known as “Subscriptions as a Service” (SaaS). And it offers variety, convenience and cost savings.

In fact, according to the Subscribed Institute, as of 2020, 78% of adults worldwide pay for a subscription service.

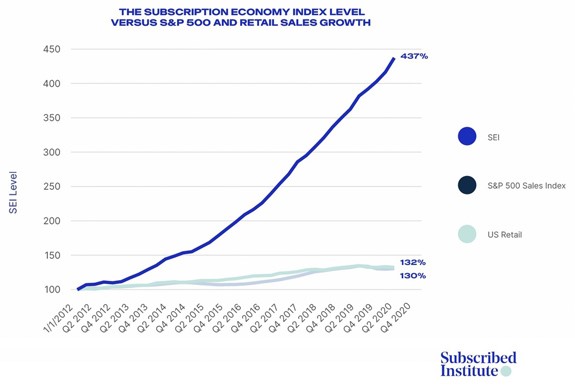

This growth in consumer participation translates into a booming SaaS business.

Over the past nine years, subscription businesses have grown nearly six times faster than the S&P 500, topping a 437% increase.

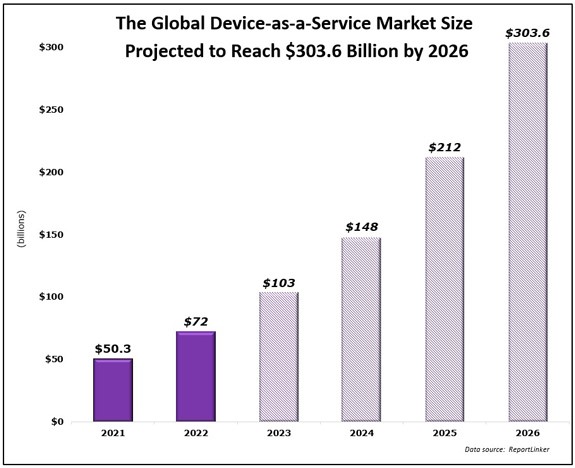

Now imagine if I tell you there’s another “as a service” business that’s projected to rocket higher over the next five years — growing at a compound annual growth rate of 43.2% and reaching $303.6 billion by 2026.

Of course, you’d want in! And I’ll tell you how to buy into the biggest underlying mega trend fueling this rise.

Make Room for This Market in Your Portfolio

Based on my personal experience, a company would make big information technology (IT) investments in upgrading their staff’s desktop computers, desk phones and computer operating system software every few years due to outdated or aging equipment.

These physical upgrades were a massive undertaking that would take weeks or even months to complete, with tons of human power and strategy meetings.

Very America 1.0.

Now, that’s where our next “as a service” market comes in … “Device as a Service” (DaaS).

DaaS offers a flexible tactic for businesses, small and large, to manage their computer hardware and software infrastructure.

It eliminates the stress and high cost of physically updating office communication equipment.

The DaaS model helps customers update and refresh IT devices in accordance with their life cycles.

All it takes is a customized subscription fee, and all IT device needs are handled.

Parallels, a global leader in cross-platform solutions, sums it up like so:

…DaaS is more than just leasing of hardware and software as a paid subscription service. Based on the provider and the package you select, DaaS may also provide extra services. Some of these services include security and compliance reporting, inventory monitoring, network analytics, remote device management, and software updates, among others. In other words, DaaS is not just the leasing of hardware and software — it’s a complete IT management package.

Now in America 2.0, we can’t just stop there. We have to take it to the next tech level at Bold Profits.

Smartphones.

Smartphones are like small, powerful PCs that can handle many daily work-life requirements.

As found by ReportLinker, many of today’s employees collaborate with each other through their smartphones.

DaaS solutions for smartphones, where users pay a subscription fee for the latest devices, provides businesses with “lower costs, access to recent technologies, more predictable prices and strong enterprise security.”

Also per Parallels, businesses that make DaaS solutions the nucleus of their IT infrastructure have the opportunity to:

- Reduce the total cost of ownership of the hardware life cycle.

- Eliminate the end-of-life equipment and device challenges by shifting the costs and responsibility of secure device disposal to the DaaS provider.

- Increase device choice among employees and business productivity.

- Simplify the management of software updates and patches.

- Increase flexibility: “Unlike traditional IT infrastructures, the DaaS model allows organizations to ramp the number of devices up or down as the need arises.”

No. 1 DaaS Tech to Invest in Today

Here’s how you can invest in the technology behind this.

It’s called cloud computing.

Cloud computing is when data is stored over the internet versus physical, in-house hard drives. It’s transformed businesses such as Netflix, Instagram and Dropbox.

And it’s necessary for the “as a service” markets.

To invest in the growing DaaS market, consider buying shares in the Global X Cloud Computing ETF (Nasdaq: CLOU).

This exchange-traded fund (ETF) invests in companies involved in delivering computing services, servers, storage, databases, networking, software, analytics and more.

Key players in the DaaS market are presented in this ETF.

DaaS is an ideal service for today’s companies navigating the ever-evolving America 2.0 and Fourth Industrial Revolution landscape.

Also, to get the latest news and developments on our Bold Profits’ America 2.0 and Fourth Industrial Revolution mega trends, please feel free to follow me on Twitter @ALancasterGuru.

Until next time,

Amber Lancaster

Director of Investment Research, Banyan Hill Publishing