It’s no secret that the world of cryptocurrency holds a wealth of investing opportunities — from individual coins to related stocks and now even exchange-traded funds (ETFs)!

Like Adam O’Dell mentioned earlier this week, I too am not one to either go all in or be 100% bearish on crypto.

If you picked a side, you’d either get burned investing in every unproven coin that’s invented on a whim, or you’d miss out on some of the biggest market wins from the last decade!

The key is using tools, like our proprietary Green Zone Power Ratings system, to know what crypto stocks have the most potential … and which ones you need to steer clear of.

Because with the volatile crypto market, you have to keep a sharp eye out and be strategic in your approach.

Today, I’m going to look at one of the most popular crypto-related stocks, examine its recent price action and run it through our Green Zone Power Ratings system to tell you if this is one of those “tremendous opportunities” Adam mentioned … or a stock to avoid.

The SEC, Cryptos and Coinbase Global

Cryptos received a huge boost last week after the Securities and Exchange Commission approved 11 spot bitcoin exchange-traded funds for trading.

You can now own bitcoin through your stock brokerage account, your 401(k) and invest in funds with exposure to bitcoin’s spot price.

As Adam and I mentioned earlier this week, this is one of the last roadblocks on the road to greater crypto adoption.

But even before these 11 ETFs were approved, there was a stock closely aligned with bitcoin.

This company has grown its market cap to a massive $31.9 billion by offering a platform that allows investors to purchase and use bitcoin. Its tools also allow merchants to accept bitcoin as payment with a single button.

I’m talking about Coinbase Global Inc. (Nasdaq: COIN)…

COIN had a wild fourth quarter last year as news about the potential for a bitcoin ETF swirled. From its recent low of $70.79 in October 2023 to its 52-week high of $186.36 in December 2023, the stock rose 163%.

Since that high, the stock has pared back 30% — at the same time, bitcoin’s price soared higher due to the SEC’s decision.

For the most part, COIN’s price action is closely aligned with that of bitcoin.

But one big difference is that COIN’s stock price has been much more volatile than bitcoin over the last 12 months.

High volatility isn’t always a red flag. It can create incredible opportunities like what happened to COIN to close out last year.

For a better idea of what’s going on, let’s analyze what our Green Zone Power Ratings system says about COIN.

Green Zone Says “No-Go” to COIN

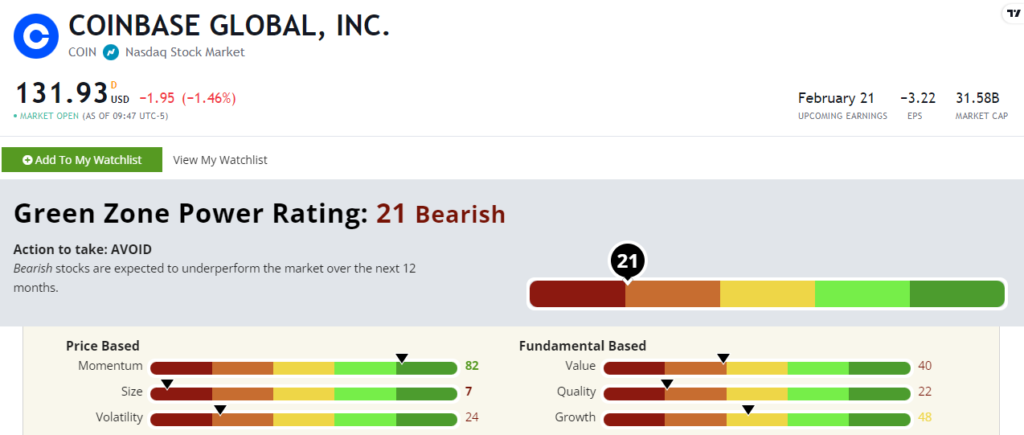

Coinbase stock rates a “Bearish” 21 out of 100 on our Green Zone Power Ratings system. That means we expect it to underperform the broader market over the next 12 months.

Out of the six factors that make up the Green Zone Power Ratings, COIN rates in the green on just one — Momentum.

This is mostly due to the 163.3% run-up the stock had in the fourth quarter last year.

Keep in mind, however, COIN has already given 30% of that back since the start of the year — even with the SEC providing a solid crypto tailwind.

COIN struggles with a 22 on Quality due to a net margin of -26.4% and an operating margin of -26.7%.

This tells me the company is still not profitable even after that strong close to 2023.

The stock also has lofty valuations … as indicated by its 40 on Value.

Because of its lack of profitability, COIN does not have a price-to-earnings ratio, but its price-to-sales is nearly six times higher than the specialty finance industry. COIN’s price-to-book value ratio is more than double its industry cousins.

Bottom line: Cryptos like bitcoin are aiming to become more mainstream forms of payment.

The SEC gave that hope a massive shot in the arm when it approved 11 ETFs for bitcoin trading.

However, the crypto market is still volatile. Investors can lose thousands in a day.

That’s why, if you’re looking for crypto-related stocks, it helps to use the Green Zone Power Ratings system to identify those stocks that can either weather the storm or sink in the flood.

And if you’re looking to go deeper and invest in actual cryptos, I have your go-to guy … Banyan Hill’s Ian King.

He released an exclusive presentation on cryptos that you must watch.

Just like Adam, Ian is my “crypto guy.” When he talks about crypto, I certainly listen.

Make sure to check out his latest insight into the crypto market right here.

Until next time…

Safe trading,

Matt Clark, CMSA®

Research Analyst, Money & Markets

P.S. Have your own thoughts on investing in COIN, or any cryptocurrency? Email me at Feedback@MoneyandMarkets.com!