Cryptocurrency proponents once sold the idea that bitcoin is a strong hedge (aka protection) against inflation.

When it comes to traditional inflation hedges, gold, commodities and even bonds are common trades.

But the idea that bitcoin is inflation-proof is losing steam.

Here at Stock Power Daily, we don’t buy based on theories.

Our proprietary Stock Power Ratings system helps us cut through the noise to find the smartest, highest-potential investments.

While our system doesn’t rate currencies, it does rate stocks tied to them.

Shares of bitcoin wallet provider Coinbase Global Inc. (Nasdaq: COIN) have dropped almost 75% since the start of the year.

COIN stock’s price follows the same trend as the price of bitcoin.

And with how much the crypto has struggled, this tells us the stock is one to steer clear of.

Here’s why.

What Is Coinbase?

Coinbase is a platform that allows users to buy, sell and use bitcoin and other cryptocurrencies.

The company launched in 2012 and provides tools merchants can use to accept payment in bitcoin using one button.

Our Stock Power Ratings system tells you investing in this company is risky.

The stock went public in April 2021 with a lot of hype on the back of bitcoin’s popularity.

As the price of bitcoin fell from $47,000 in January 2022 to $19,500 in October, so has COIN’s stock price.

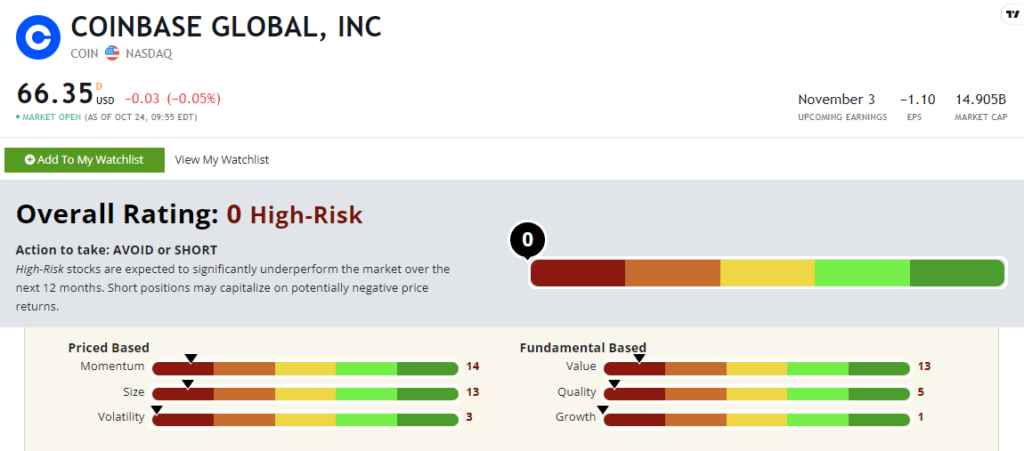

COIN’s Stock Power Ratings in October 2022.

COIN stock scores a “High-Risk” 0 out of 100 on our Stock Power Ratings system, and we expect it to underperform the broader market over the next 12 months.

COIN Stock: Poor Value + Weak Momentum

I like to share exciting findings about our Power Stocks.

But that’s not the case with COIN:

- In its last fiscal quarter, the company reported revenue of $808,325 — a 60% year-over-year drop!

- The company has reported net income losses totaling $1.1 million. That’s down from a $1.6 million gain at the same time last year.

This explains why COIN earns a 1 on our growth factor.

It also scores in the red on our other fundamental factors: quality and value.

COIN’s return on equity is awful, at negative 5.1%.

That’s even lower than its industry peers that average a negative 3.8%.

The company does not register positive price-to-earnings or price-to-cash flow ratios.

This earns it a 13 on value.

These numbers tell us COIN doesn’t make any money from its customer platform.

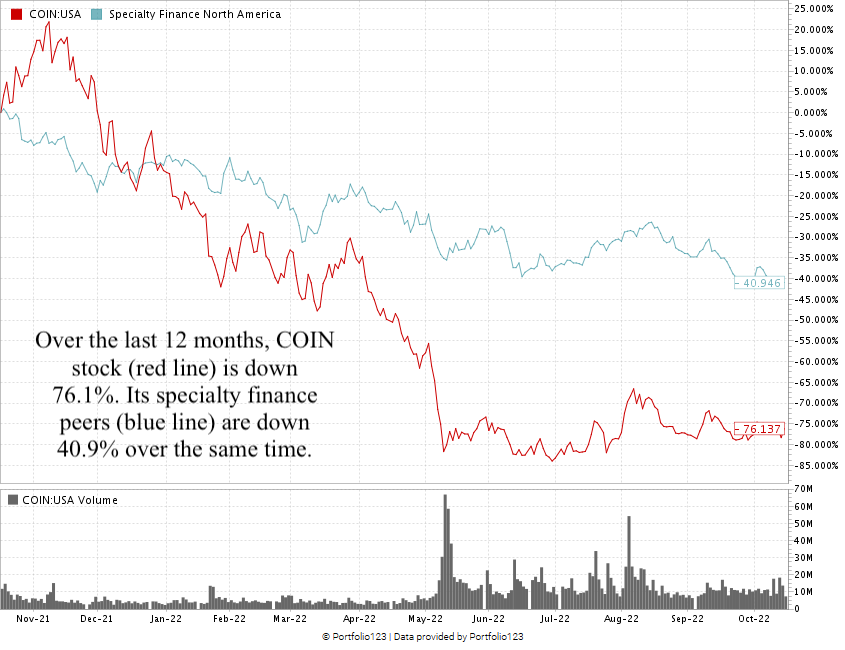

Created in October 2022.

You can see COIN’s fall from grace in the stock chart above.

Over the last 12 months, the stock has had a significant drop.

Its specialty finance peers are down 40.9% over the same time.

Coinbase Global stock scores a 0 overall on our proprietary Stock Power Ratings system.

That means we consider it “High-Risk” and expect it to underperform the broader market.

While bitcoin may be a popular investment, stocks related to cryptocurrency have continued to struggle.

A quick glance at our Stock Power Ratings system shows that the crypto platform stock COIN is one to avoid.

Stay Tuned: “Strong Bullish” Home Health Care Hero

Tomorrow, we’re returning to our original Stock Power Daily format.

Stay tuned — I’ll share all the details on a “Strong Bullish” U.S. home health care provider.

Safe trading,

Matt Clark, CMSA®

Research Analyst, Money & Markets

P.S. I’d love to hear what you thought about my “Stock to Avoid” article today. Was it valuable? Would you like us to continue sharing “High-Risk” stocks on occasion, so you know what to stay away from?

Would you prefer that we only share “Bullish” and “Strong Bullish” stocks?