Editor’s note: Check out the first installment of Adam’s Coinbase analysis here.

Yesterday I laid out the rules of the IPO math game I designed.

The goal is to figure out what to do about last week’s Coinbase Global Inc. (Nasdaq: COIN) listing.

Is it a buy?

And at what price?

I started with the premise that Coinbase is a must-buy.

It does have the potential to do for crypto what Google did for search … what Facebook did for social networks … what Amazon did for e-commerce.

And those initial public offerings (IPOs) made early investors massive profits.

Indeed, buying mega-winner IPOs can lead to life-changing gains.

But what if you have the opportunity to increase your total returns on these IPOs, by 27%, by using a simple yet unconventional entry technique?

The Strategy

I ran an analysis on the IPOs of 20 randomly selected stocks from the Nasdaq 100 index.

The rules of my bracket-entry strategy were:

- Buy shares of the IPO if they fall 50% from their debut open price.

Or:

- Buy shares of the IPO if they climb 50% from that price.

Of course, scenario A is far more favorable.

But there’s no guarantee the stock gives that opportunity. We must prepare for the potential that scenario B unfolds instead.

Are we OK with that trade-off?

Is it a good idea, economically?

The Results Are In

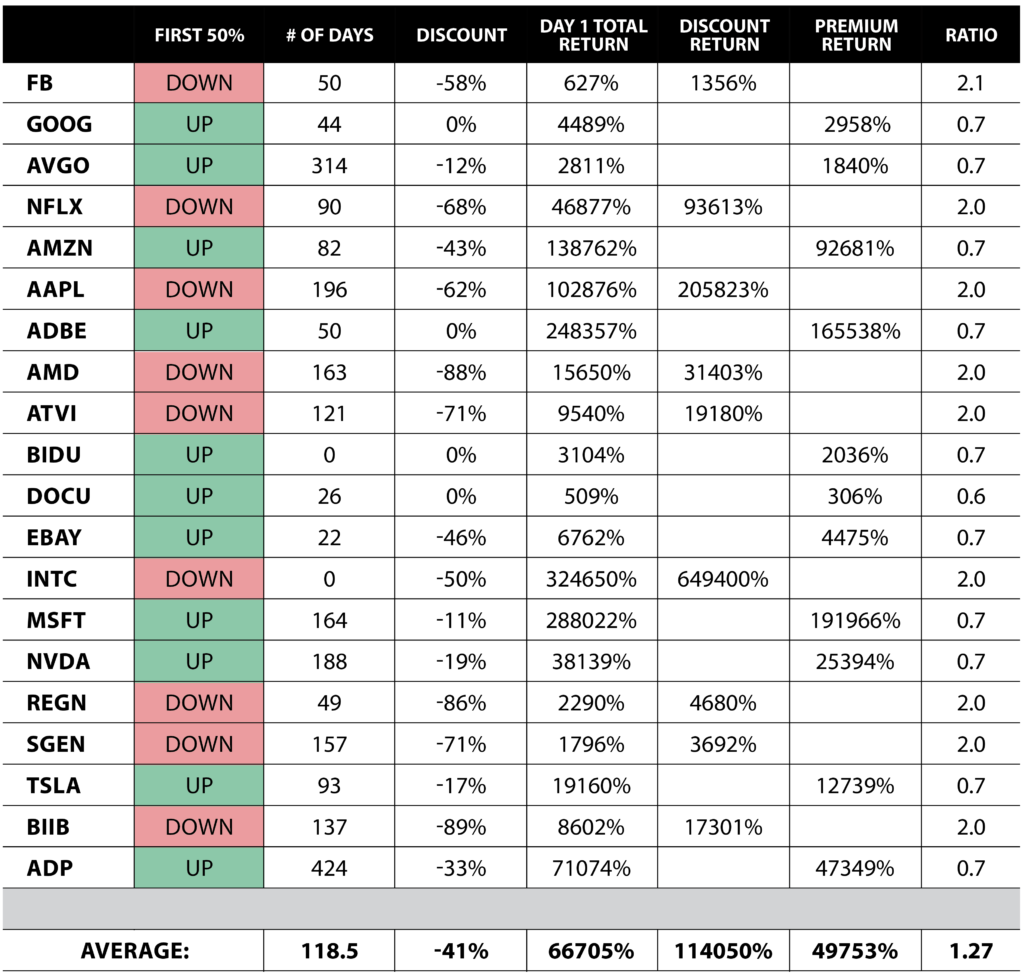

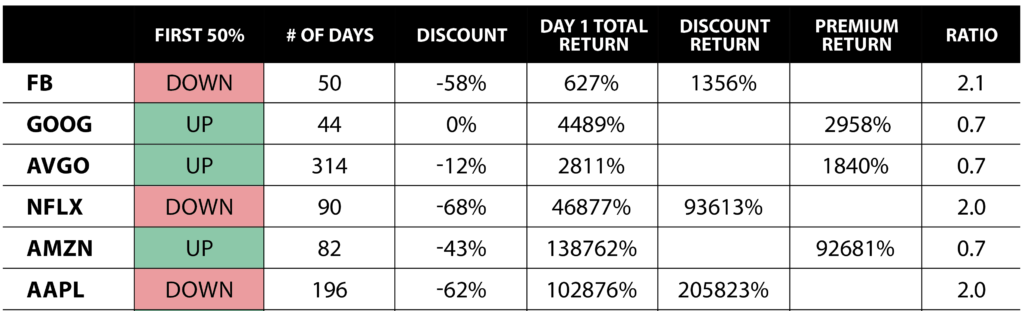

Here is a table showing the raw data of my analysis:

Let’s start by looking at the “First 50%” column. It shows whether the stock moved “UP” or “DOWN by 50% first.

45% (9 out of 20) went down 50% first, giving the opportunity to buy the IPO for half its original price.

The other 55% of IPOs (11 out of 20) went up 50% first. That means a higher entry price and, therefore, lower total returns.

You might think this bracket-order strategy is a bad idea based on these numbers. At first blush, it appears to pay off (i.e., offer a lower entry price) less than half the time.

That may be true, but we would need to run this analysis on hundreds of IPO instead of 20. I suspect the numbers would work out very close to 50/50 if we did that.

To me, it appears to be a “coin toss” whether the IPO first goes up or down by 50%.

But here’s the important part: Even if this strategy were to give you the opportunity to buy the IPO at a 50% discount less than half the time, you can still come out ahead …

That’s because the size of the pricing advantage is far better when you buy at a 50% discount versus when you have to pay a 50% premium.

Look at the “Ratio” column above. This shows each IPO’s ratio of the bracket-order strategy’s total return relative to the total return earned if you’d simply bought on Day 1.

For “DOWN” IPOs, we’re comparing the “Discount Return” (since you could have bought at a 50% discount) to the Day 1 total return. For “UP” IPOs, we’re comparing the “Premium Return” (since you had to pay a premium above the IPO price) to the Day 1 total return.

As you can see, the more favorable “DOWN” IPOs generate total returns 2.0-times the size of Day 1 total returns … which makes sense because we got to buy the IPO at half the price!

And here’s where the math gets almost magical …

The less-favorable “UP” IPOs generate total returns 0.7-times the size of the Day 1 total returns. Said another way, the total return you achieve after buying the IPO at a 50% premium is reduced by 30%.

So, you suffer a 30% reduction in total profits when you’re forced to “buy high,” while you enjoy a 100% increase in total profits when you’re able to “buy low.”

That’s a favorable asymmetry. And it explains why this bracket-order strategy makes sense, even if you weren’t able to “buy low” every IPO (or even half of them).

You see, the average of the ratio column comes out to 1.27. That means you would have earned a 27% greater total return had you bought all 20 IPOs with this bracket-order strategy, relative to the total return you’d have earned if, instead, you had bought each of these 20 IPOs on Day 1.

Will This Apply to Coinbase?

Yes and no.

Realize, the math behind this bracket-order strategy works in aggregate. Meaning, if you buy 100 IPOs this way, you’re likely to earn higher profits than if you’d bought them all on Day 1.

You’d pay 50% more for some of them, 50% less for others … and overall, you’d come out ahead.

But, on any single IPO investment, you face a roughly 50% chance you’ll end up getting in at a higher price and, thus, reducing your overall total return.

And of course, specific to the Coinbase listing, we have no way to determine whether it will first offer a 50% discount or require a 50% premium.

If I Had to Bet on Coinbase

My hunch is that COIN will first trade to a 50% discount.

At least, that’s the level where I’d feel far more comfortable making an investment, since as I talked about in a recent episode of our The Bull & The Bear podcast … Coinbase’s public-market valuation is extremely rich, already at more than 10-times its private-market valuation.

What’s more, a full 86% of Coinbase’s revenue comes from transaction fees. Those fees are currently 300-times larger than the transaction fees earned by the New York Stock Exchange and the Nasdaq exchange. Increased competition should pressure Coinbase’s margins lower.

And finally, Coinbase’s active users sank 67% during the 2018 bitcoin sell-off. Its transaction volume also sank 80% as the dominant cryptocurrency fell 72%.

So, all told, you have to hope and pray that nothing goes wrong if you’re buying Coinbase at its priced-to-perfection debut in the mid-$300s.

I have an alert set for a trade down through $190 (minus-50% of its public-market debut) … and I’ll let you know if, or when, it’s hit.

To good profits,

Adam O’Dell

P.S. Check out the latest edition of my YouTube series, Ask Adam Anything, where I address questions about Coinbase and options trading! Write to feedback@moneyandmarkets.com if you have a question for me.

Adam O’Dell is the chief investment strategist of Money & Markets and has held the title of Chartered Market Technician for nearly a decade. He is the editor of Green Zone Fortunes, the trend and momentum options-trading powerhouse Home Run Profits and the time-tested switch system 10X Profits.