It’s not enough that the stock market is bouncing like a basketball during the NBA Finals.

One day, the stock market is up. The next, it’s right back down.

As an investor, watching the daily market moves is enough to make your head spin.

It also makes looking for profits that much harder.

That’s why you should look at companies that are less volatile and favor sectors that perform the best during stock market uncertainty.

Banyan Hill Publishing’s Brian Christopher said there are three sectors investors should focus on in times like this: consumer staples, health care and utilities.

“They should remain in demand, said Christopher, the Co-Editor of Profit Line. “That’s why the best names in these sectors are beating the market right now.”

For this list, we looked at companies in those sectors with small amounts of debt that produce a strong dividend.

Dividend Stocks Help Beat Market Uncertainty

Christopher said it makes a lot of sense to look at dividend stocks during times of stock market uncertainty.

In some cases, the dividends companies pay may make investors want to hang on to them for a long time.

He found 33 companies from the three aforementioned sectors that have increased their dividends for at least 27 straight years. Most of those companies are in the S&P 500 or the Russell 2000 index.

“From the market top on Feb. 19, 2020, to the March 23, 2020 bottom, the S&P 500 fell 34% and the Russell 2000 dropped 41%,” he said. “However, the 33 stocks on the list only fell 25%.”

What’s more, from September 2000 to October 2002, while the S&P 500 fell nearly 60%, these stocks actually gained 14%.

Profit From These Dividend Stocks to Weather Stock Market Uncertainty

1. Hormel Foods

Market Capitalization: $25.2 billion

Annual Sales (2019): $9.4 billion

5-Year Dividend Growth: 110%

Annual Dividend Yield: 1.98%

The first on the list is a globally branded food company that spans 75 countries in all.

Hormel Foods Corp. (NYSE: HRL) has brands that include Skippy, Spam and 30 other foods.

After hitting a low in March 2020 of around $40 per share, Hormel jumped 26.6%. It has pared some of those gains back, but it still trades above its 50-day and 200-day moving average.

It’s also a solid value with a price-to-earnings ratio of 27.4, a price-to-sales ratio of 2.6 and a price-to-book ratio of 4.1.

In January 2020, the company raised its dividend payment to $0.23 per share — up from the $0.21 per share it paid in 2019. Hormel carried that dividend into the second quarter of 2020.

What’s even better is its debt-to-equity ratio. Currently, that is at 0.05, meaning the company has very little debt compared to its overall equity. That makes Hormel relatively stable.

That is one reason why Hormel Foods is a dividend stock that can help weather stock market uncertainty.

2. Tootsie Roll Industries

Market Capitalization: $2.2 billion

Annual Sales (2019): $527 million

5-Year Dividend Growth: 29.6%

Annual Dividend Yield: 1.06%

The next dividend stock on our list is one of the nation’s largest candy companies.

Tootsie Roll Industries Inc. (NYSE: TR) produces Tootsie Rolls, Charms, Andes Thin Mints and Junior Mints.

Since its drop in February 2020, Tootsie Roll Industries rebounded by more than 20% in short order.

But what makes this company unique, according to Christopher, is that it pays its shareholders both a cash dividend and a share dividend.

“The stock dividend is different from a normal cash dividend,” Christopher said. “The number of shares you own increases by 3% each year … and you don’t have to do anything.”

Investors also collect dividends on the free shares as well as the normal shares.

The company has a solid value as well with a price-to-sales ratio of 4.5 and a price-to-book ratio of 3.1. Its debt-to-equity ratio is 0.00%, meaning the company has no debt.

That is a big reason why Tootsie Roll Industries is a dividend stock that can help weather stock market uncertainty.

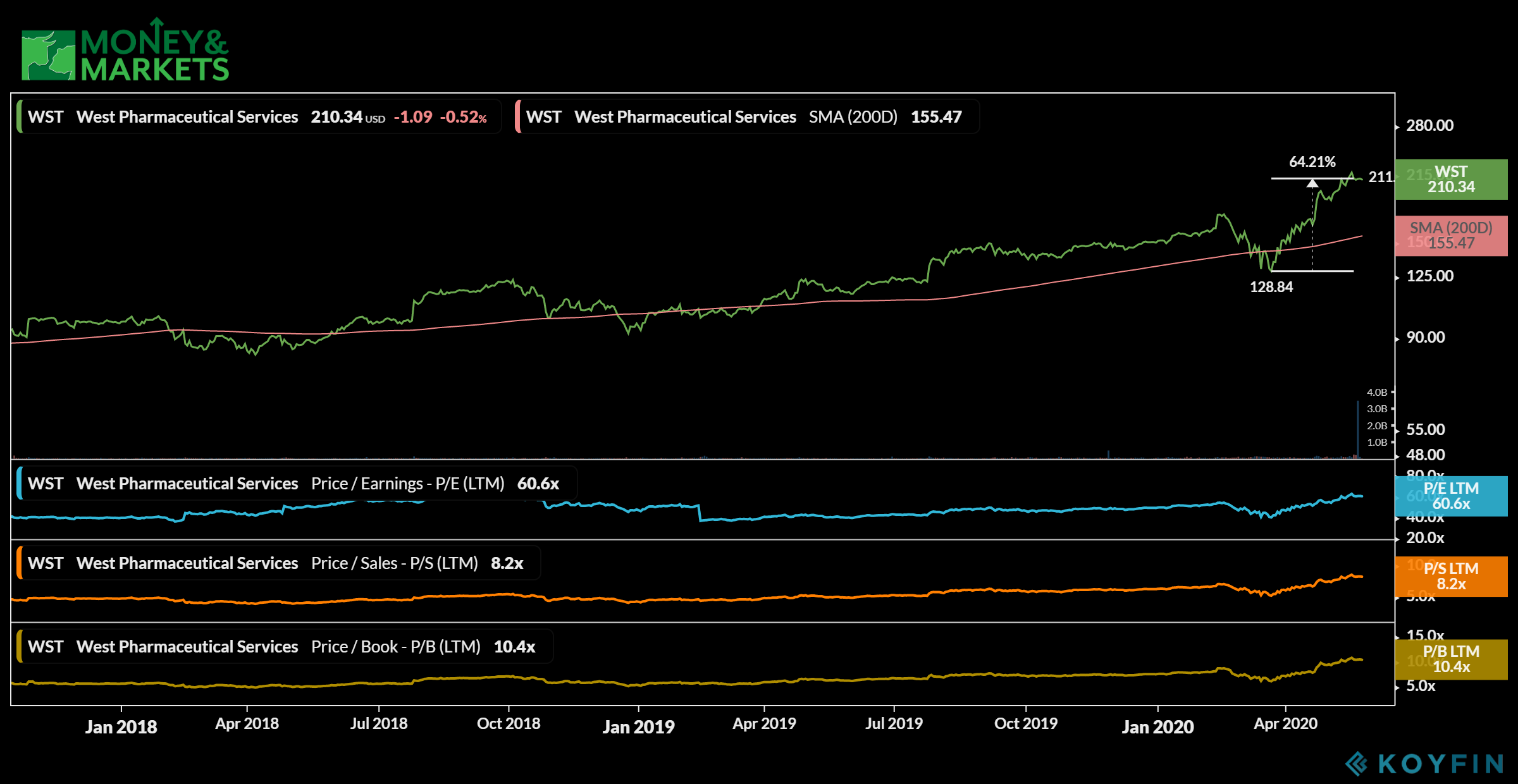

3. West Pharmaceutical Services

Market Capitalization: $15.5 billion

Annual Sales (2019): $1.8 billion

5-Year Dividend Growth: 48.8%

Annual Dividend Yield: 0.30%

The final company on our list comes from the health care sector.

West Pharmaceutical Services (NYSE: WST) is a global drug delivery technology company that manufactures various vaccines and consumer health care products.

Since dropping to around $128 per share in March 2020, West Pharmaceutical has jumped more than 64% and continues to rise. It remains more than $50 per share above its 200-day moving average.

That makes it a bit more overvalued than the previous two companies mentioned. Its price to sales is at 60.7 and its price to book is at 10.4. However, its price to sales is low at 8.2.

It’s debt to equity remains very low at 0.20, meaning it has very little debt compared to its equity.

The company recently paid a dividend of $0.16 per share and has increased that dividend in each of the last three years.

While it may be a bit overvalued, its consistent dividend payout and increase make West Pharmaceutical Services a dividend stock that can help weather stock market uncertainty.

So here you have it; two consumer staples stocks and a health care stock that have little if any debt, and maintain strong dividend performance.

Those are the reasons why these are three dividend stocks that can help weather stock market uncertainty.