ConocoPhillips (NYSE: COP) is an international energy company with operations in more than 30 countries. But does that mean COP stock is worth a look?

The company has a long history dating back to the late 19th century. And it’s one of the largest independent exploration and production companies in the world today.

ConocoPhillips reported strong earnings for the third quarter of 2022, due largely to higher oil and gas prices.

Here’s a look at the company’s background and recent financial performance.

ConocoPhillips: An American Oil Giant

ConocoPhillips has been an energy giant for decades, and it’s no wonder why.

As the third-largest corporation in the energy sector in the U.S., ConocoPhillips produces and distributes crude oil, natural gas and petrochemicals all over the globe.

It operates in more than 20 countries, employs more than 10,000 people, and serves as a major supplier of fuel to many aviation companies as well.

COP Stock: A Massive Independent Pure-Play on Oil Exploration

ConocoPhillips is a global production and exploration energy leader.

As the world’s largest independent pure-play (meaning, it only focuses on one industry segment) exploration and production company, ConocoPhillips has operations in 29 countries across the Americas, Europe, Africa, Asia Pacific and the Middle East.

ConocoPhillips operates through three main business segments:

- Exploration and Production (E&P).

- Refining and Midstream businesses.

- And technology organizations.

ConocoPhillips has one of the industry’s strongest portfolios with more than 20 billion barrels of oil equivalent resources from asset positions such as deepwater projects, shale developments and refining operations, giving it a diverse portfolio that provides resiliency for even volatile markets.

Major Merger Created ConocoPhillips

Conoco Inc. and Phillips Petroleum Co. merged in 2002, forming ConocoPhillips.

With the expertise of Conoco Inc., the stability of Phillips Petroleum Co., and their two distinct perspectives, ConocoPhillips has become one of the largest energy companies in the world.

In 2012, ConocoPhillips spun off its downstream operations into a separate company called Phillips 66.

By doing so it was able to focus on upstream operations including oil and natural gas exploration and production, while Phillips 66 specialized in refining, marketing, midstream, chemicals and specialty products businesses.

The split provided unique solutions for each of ConocoPhilips and Phillips 66 shareholders by creating value for specific investments. It has since resulted in ConocoPhillips becoming an industry leader as an exploration and production company, while Phillips 66 is now one of the largest refiners in the world.

COP Stock Power Ratings

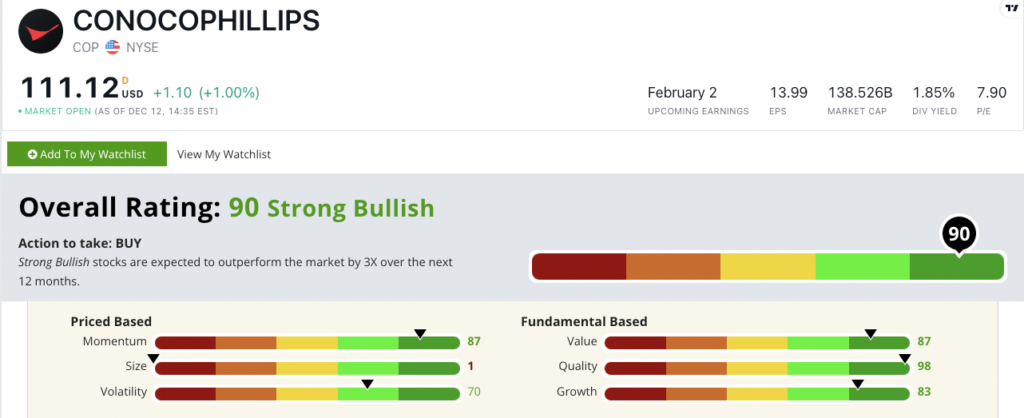

ConocoPhillips stock scores a 90 out of 100 on our proprietary Stock Power Ratings system.

That means our system is “Strong Bullish” on the stock and expect it to outperform the broader market by 3X over the next 12 months.

COP’s highest marks come on our quality factor, where it scores a 98.

Its returns on assets, equity and investment surpass the averages of the fossil fuel exploration industry.

COP’s net and operating margins are also higher than its peer average.

The company’s growth is also strong with an 83 on our growth factor.

As I write, COP’s one-year annual sales growth rate is 145.4%, while its earnings-per-share growth rate is 342.8%.

ConocoPhillips’ management knows how to turn a profit.

The bottom line: Given that ConocoPhillips is the world’s largest independent pure-play exploration and production company, it holds a unique place in the energy market. It’s also in the top 10% of stocks rated in our system.

Let’s see where COP stock heads next.

P.S. Adam O’Dell is watching the oil market closely. He sees a “Super Bull” forming in the coming months.

And when it hits, he expects this No. 1 stock to soar 100% higher in just 100 days. Click here to sign up for his upcoming presentation.