Editor’s Note: Chad is out in the North Carolina woods fighting off bears and Hurricane Helene. After the Fed’s rate cut last week, we thought it was a great opportunity to revisit his piece from back in July. Check out how these two stocks rate now that inflation and rates are coming down…

Back in January, we were worried inflation was going to tank the market again.

Fast forward to now, and the inflation situation is looking better every month…

We’re still contending with high prices for everything from groceries to insurance, but that hasn’t stopped investors from pushing major indexes higher in 2024.

Did anyone expect year-to-date numbers like this:

- The S&P 500 is up more than 21%.

- The Nasdaq Composite is up a massive 23%.

- The Dow Jones Industrial Average is up almost 12%.

Today, I want to revisit two stocks I wrote about in the early days of 2024. Both were pandemic darlings, and both have a direct correlation to inflation.

Let’s see if either looks any better in Adam O’Dell’s Green Zone Power Ratings system.

The Home Improvement Boom … and Fizzle

My wife and I are working on our townhome … slowly.

We bought during the pandemic, scrounging up just enough to secure a mortgage.

After unpacking and settling, we were finally ready to tackle our first project. The problem was thousands of bored do-it-yourselfers stuck at home due to pandemic lockdown protocols beat us to every last brushed bronze showerhead in South Florida.

By the time we started shopping for our bathroom remodel, material prices were through the roof!

To illustrate the trend, Home Depot’s trailing 12-month revenue was $110 billion on January 31, 2020. That number jumped to $132 billion in January 2021 and then again to $151 billion in 2022! Revenue growth peaked at $157 billion in January 2023 and has been slowly trending lower again.

Why the history lesson?

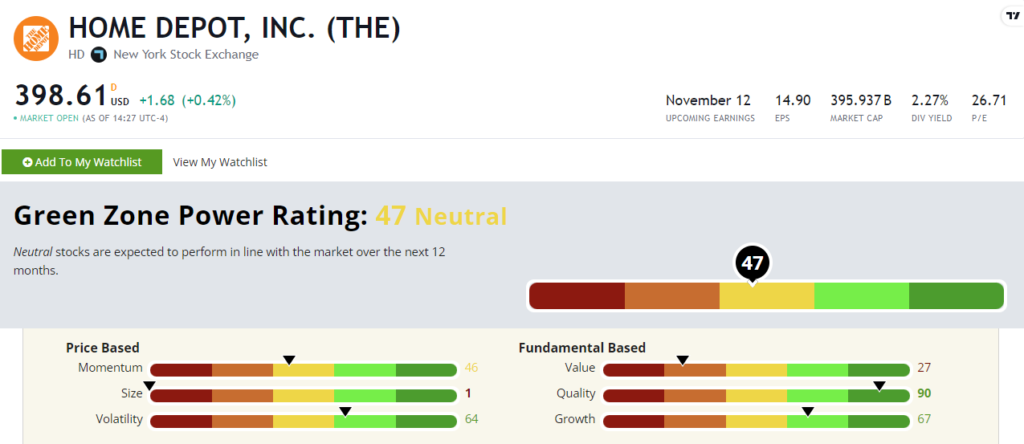

Because Green Zone Power Ratings says Home Depot Inc. (NYSE: HD) still isn’t on pace to crush the market. Back in January, the stock rated a “Neutral” 57 out of 100.

Its rating has declined to 47 out of 100 now.

With a 90 rating on Quality, it’s clear that Home Depot is using that flood of revenue to shore up its business.

What’s most telling about HD stock is its Momentum rating falling to 46 since January. The stock is up 15% in 2024, but that’s still lagging the broader S&P 500’s 21% gain. You would do even better just investing in an index fund.

This was one to watch in January, and judging by its Green Zone Power Ratings, that’s still the case.

The “New” Way to Pay

My wife and I aren’t the only weekend warriors out there, of course. But as I mentioned above, material costs have only gone up.

One way to fund these DIY projects is through “buy now, pay later” payment methods.

And who doesn’t love the idea? Get the thing you want, as long as you promise to pay for it in small chunks over time.

In December 2023, almost one-third of Americans said they were considering buy now, pay later loans to fund certain purchases, according to a LendingTree survey.

With higher prices and stagnant wage growth, this idea could gain more steam.

Let’s see how one of the biggest names in this space looks, according to Green Zone Power Ratings.

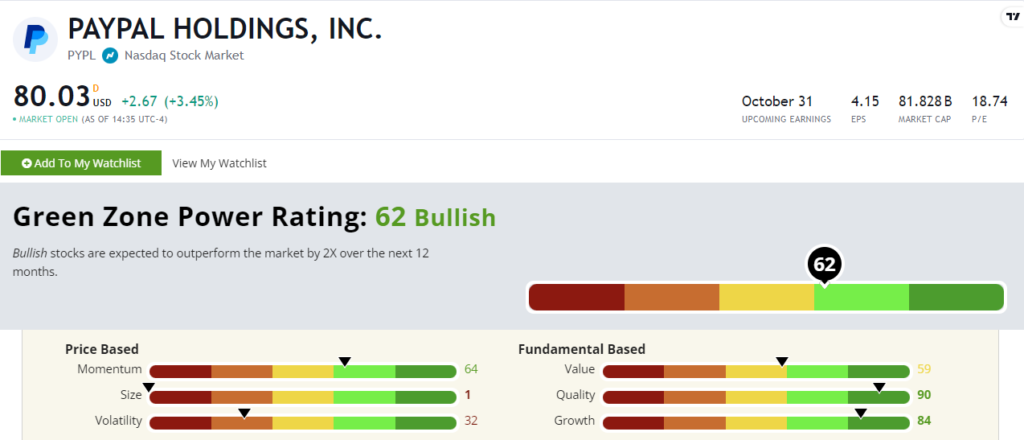

Since January, PayPal Holdings Inc.’s (Nasdaq: PYPL) rating has improved to a now “Bullish” 62 out of 100 on Adam’s system.

On the fundamental side, PYPL is solid. Its Value has improved to 59, and it sports excellent ratings on Quality and Growth.

PayPal’s price-based metrics remain lackluster, but there are signs of life. PYPL’s ratings on Momentum and Volatility have improved (Momentum is now 64 compared to 21 at the start of the year).

And speaking of momentum, investors have been piling into PYPL over the last couple of months. The stock is now 30% higher year to date.

Things may be turning around for PayPal. It’s a solid business based on fundamentals.

If you’re looking to capitalize on consumers turning to buy now, pay later platforms, Green Zone Power Ratings says PYPL is worth a look.

Inflation is trending in the right direction, so it’s always a good idea to see how certain stocks stack up amid changing market conditions.

HD stock isn’t looking better as we head into October, but investors are backing PYPL. And its improved scores on our ratings system prove that.

Until next time,

Chad Stone

Managing Editor, Money & Markets