Inflation is a growing concern for policymakers, analysts and consumers. While the first two groups talk about inflation, it’s the consumers who have to deal with it. Consumers have limited resources and must make sacrifices as prices rise.

The latest inflation reports raised concerns that consumers might already be falling behind. In September, the consumer price index jumped 5.4%, which CNBC noted was “the highest since January 1991.”

As usual, economists highlighted that the data includes good news: “However, excluding volatile food and energy prices, the CPI increased 0.2% on the month and 4% year over year, against respective estimates for 0.3% and 4%.”

Consumers Undeterred By High Inflation

Of course, as consumers, we know that we can’t exclude food and energy from our budgets and we must deal with the inflation we find at the grocery store and the gas pump.

The price of gas was up 1.2% in September and is up 42.1% compared to a year ago. As winter approaches, fuel oil used to heat many homes is already up 42.6% compared to 2020. At the supermarket, consumers noticed meat prices increased 12.6% year over year.

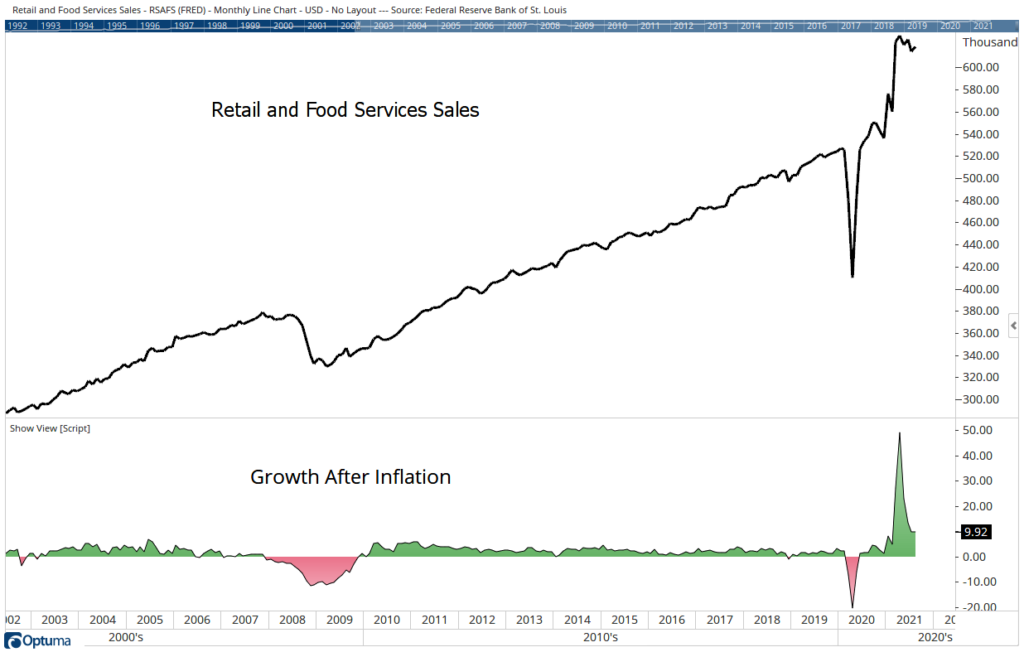

This means it was no surprise that retail spending is also higher when compared to a year ago. When prices rise, consumers spend more. But even after inflation, consumers are still spending more. In September, retail sales were 13.6% higher than they were a year ago.

The chart below shows that spending increased 9.9% when the effects of inflation are removed from the data.

Higher Spending Despite Higher Inflation

Source: Optuma.

Higher sales seem to conflict with other news. After all, wages are up just 4.6% in the past year. This means sales growth must be driven by savings.

The Wall Street Journal confirms this, noting: “Economists expect the boost to spending provided by stimulus payments and more-generous unemployment benefits will start to fade, but many stores are still finding consumers ready to spend.”

While the current trend is unsustainable, stores are happy to profit from consumers as long as the trend lasts.

Michael Carr is the editor of True Options Masters, One Trade, Peak Velocity Trader and Precision Profits. He teaches technical analysis and quantitative technical analysis at the New York Institute of Finance. Follow him on Twitter @MichaelCarrGuru.

Click here to join True Options Masters.