We’re seeing signs every day that this pouting market is way oversold — and contrarians that we are, we’re going to work this sentiment to grab stout closed-end funds (CEF) paying dividends yielding north of 7% that have been unfairly beaten down.

Here’s my take on how far off-base today’s investor mood is. In a moment, we’ll dive into two CEFs yielding up to 8.5% we can buy to cash in.

- Inflation is not hurting corporate profits. If anything, profits are going up across the board. Many companies have seen their profits — and profit margins — rise in the earnings season that’s currently underway.

- Supply chains have challenged businesses, but they haven’t caused the economy to grind to a halt. And these challenges are starting to disappear as more spending shifts from goods to the reopening services sector.

- Panic selling over the Fed, inflation and omicron has served up plenty of bargains, even among the most closely analyzed stocks.

Apple Tells the Tale

These three points are borne out by the latest earnings from the most closely analyzed stock of all, Apple Inc. (Nasdaq: AAPL), which were reported late last month. As you may recall, Apple reported $124 billion of revenue in its quarter ending December 25, up 11% from a year ago. So we can see right away that inflation and supply-chain woes are far from problems for the company.

Apple CEO Tim Cook himself said the supply-chain problem is resolving: “We do see an improvement in the March quarter, in terms of the constraints going down versus what they were in the December quarter,” he said on the post-earnings conference call.

Then there’s Apple’s net profit margin, which jumped from 30% at the end of 2021 to 33.2% at the end of 2022. If inflation and supply chains were biting into Apple’s business, we’d be seeing this number going in reverse. The opposite is true.

Source: CEF Insider.

So how are we going to profit from these overwrought investor fears?

Most people would simply buy an index fund like the SPDR S&P 500 ETF Trust (NYSE: SPY), or cherry-pick U.S. large caps like Apple itself. But of course, you’d have to settle for the paltry 1.3% dividend the typical S&P 500 stock pays (or Apple’s even sadder 0.5%).

I don’t know about you, but I want more of my return in cash! Which is why I urge you to go with a CEF instead. The two we’ll discuss next are great options. One is ripe for buying now; the other should be on your list for a few weeks or months down the road.

CEF No. 1: A Growing 6.9% Dividend From Apple

If you want to get exposure to Apple through a CEF, the Eaton Vance Enhanced Equity Income Fund (NYSE: EOI) is a good choice. It yields 6.9% today and Apple is its second-largest holding. EOI also pays a monthly, rather than a quarterly, dividend and recently raised its payout by 22%, to $0.1095 a share every month from $0.0898.

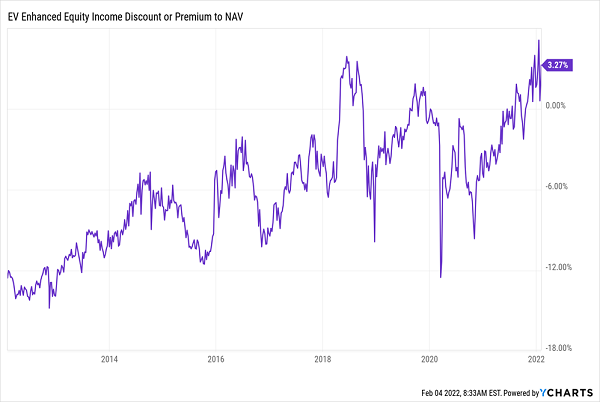

The only snag? Other CEF investors have caught on to the fact that EOI is a great way to hold strong blue chips right now, and they’ve bid its premium to net asset value (NAV, or the value of the stocks in its portfolio) up to 3.3% as I write this. That’s another way of saying that investors are paying more than $1.03 for every dollar of assets!

That’s a high valuation for a fund that usually trades in discount territory, and it could cap the fund’s upside from here, so you may be best to put this one on your watch list and buy on the next dip:

EOI Is Pricey Now, but It’ll Likely Be Cheaper Soon

But don’t worry. I’m not going to leave you hanging here, because our second option trades at a discount, and a big one at that.

CEF Pick No. 2: Get Apple for 15% Off (and With an 8.5% Dividend!)

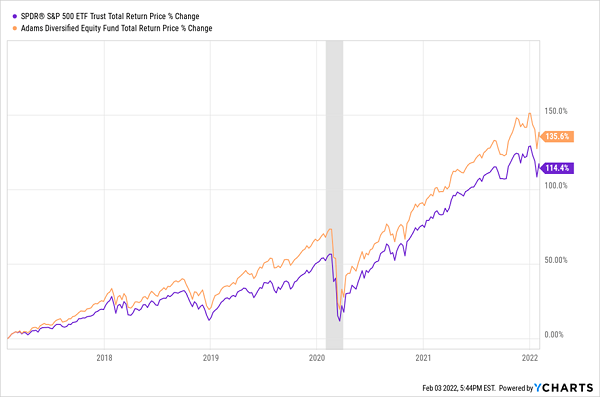

The value investment–focused Adams Diversified Equity Fund (NYSE: ADX) trades at an astounding 14% discount to NAV, despite actually beating the S&P 500 over the last five years:

ADX Crushes the Index

Why is ADX so cheap? Partly because of the fund’s dividend policy: It pays out the bulk of its dividend as a year-end special payout. Investors turn up their noses at that, preferring a regular quarterly or monthly dividend. But they shouldn’t, because ADX has a history of massive trailing-12-month yields, including an outsized 15.7% annualized payout in 2021! (The fund calculates its annual payout by taking its total dividend for the year and dividing it by the fund’s average month-end market price for the 12 months ended October 31.)

Over the next 12 months, I have it forecast to deliver a still-hefty 8.5% payout.

The fund focuses on large-cap U.S. stocks, with Apple as its second-largest holding, at 5.28% of the portfolio. In other words, buying Apple through ADX is like getting the stock for 14% less than it trades today, which would be where it traded well before the stock lurched higher on its blowout earnings report.

To learn more about generating monthly dividends as high as 8%, click here.