At the end of 2021, oil prices started a massive runup as COVID-19 vaccination rates increased, pandemic-related restrictions loosened and the global demand for oil rose faster than the supply.

By June 2022, West Texas Intermediate crude oil prices spiked above $120 a barrel twice — in March and in June.

After the second spike in the summer, oil prices started to decline and flattened out between $70 and $80 per barrel in September.

Now, oil prices are back above $80 a barrel and inching higher.

Even with the spike and pullback of oil prices in 2022, a barrel of West Texas Intermediate crude oil has jumped nearly 23% since 2021.

Oil prices go up for many different reasons:

- Larger demand pushes the price of crude oil higher as supplies fall.

- Supply controls: The Organization of Petroleum Exporting Countries (OPEC) sets production levels. If they cut production, the price of oil goes up.

- Politics: War, natural disasters, new government leaders and any other political upheaval can affect the price of oil.

After price chaos during COVID and the roller-coaster in 2022, oil prices have started to stabilize and even head higher again.

And stability means companies are ready to pursue growth opportunities.

With an influx of cash in their pockets, larger oil companies are snapping up smaller ones to expand their footprint, boost production and … make more money. That, in turn, should push oil stock prices higher.

The Art of the Deal: Oil Style

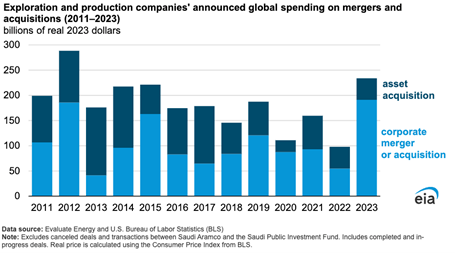

Once oil prices started to settle in 2023, big oil exploration and production companies went on a buying spree.

All told, Big Oil spent $234 billion to buy up smaller companies. This is the most money spent on oil mergers and acquisitions in more than a decade.

Those deals include ExxonMobil’s $60 billion acquisition of Pioneer and Chevron’s $53 billion drop to acquire Hess Corp. Occidental Petroleum and Diamondback Energy also spent $150 billion on several deals to bolster their production capabilities.

All of these deals accomplish one thing: Expand the drilling footprint of already massive oil companies and increase Big Oil’s bets on oil and gas demand.

Then, just last week, ConocoPhillips (NYSE: COP) announced a $17.1 billion all-stock deal to buy Marathon Oil (NYSE: MRO).

With its deal to buy MRO, ConocoPhillips will add new drilling territory in North Dakota’s Bakken region, as well as the Permian Basin and Eagle Ford regions of Texas. It also gives COP shale reserves that are as far away as Equatorial Guinea.

The deal is subject to shareholder and regulatory approval and won’t be complete until the fourth quarter. But a question lingers for investors…

Is COP an oil stock to buy?

COP Stock’s Green Zone Power Ratings Journey

Like with many of its competitors, things haven’t always been rainbows and unicorns for COP.

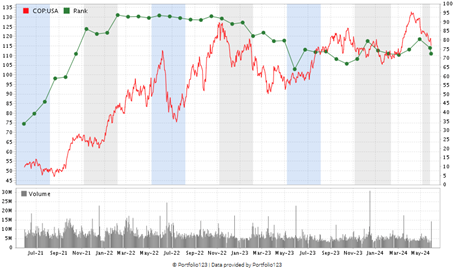

Here’s COP’s ratings journey on Adam O’Dell’s Green Zone Power Ratings system going back three years:

COP Oil Stock Stays In the “Bullish” Zone

When oil prices were below $70 a barrel in 2021, COP was struggling. It rated “Bearish” on the Green Zone Power Ratings system with a stock price under $55 per share.

As the price of oil went up, so too did COP’s price and rating. By the end of 2021, COP was rated “Bullish,” and its share price was closer to $70.

After spending 2022 in the “Very Bullish” category, a pullback in oil prices nudged COP stock down, but the stock remains “Bullish” on Adam’s system.

Going back three years, COP (the green line in the chart above) has surpassed the performance of the S&P 500 (the orange line) by nearly 4X. COP has risen 94.9%, while the broader market has only gained 24.6%.

If you bought it when the Green Zone Power Ratings system first flashed a “Bullish” signal on COP, you’d have a nearly triple-digit gain.

Bottom line: While the price of oil is stable and even growing … oil companies, like COP are doing what they can to increase market share.

This means buying up smaller companies for increased exploration territory and cost savings.

By adding Marathon Oil’s territory in the Bakken, Eagle Ford and Permian Basin regions, COP is making a strong bet on increasing production.

Flashing consistently “Bullish” on the Green Zone Power Ratings system, coupled with this expansion and continued strong demand for oil and gas in the immediate future, spells good news for investors in COP.

Until next time…

Safe trading,

Matt Clark, CMSA®

Chief Research Analyst, Money & Markets