While all oil comes from the ground, it’s pulled differently depending on the type.

To produce traditional crude oil, you must drill a hole and pump oil from the ground at depths of around 6,000 feet.

Then we have tight oil, aka shale. Trapped in shale, we need to fracture (“frack”) tight oil to recover it. Companies can drill as low as 9,000 feet into the ground to find it.

Like crude, we use shale oil for gasoline, jet fuel and diesel.

The chart above shows the amount of shale gas and oil produced in the U.S.

In 2021, companies pulled out 24.9 trillion cubic feet of shale oil and gas. Analysts expect that to grow to 33.7 trillion cubic feet by 2050 — a 35.2% increase in what we pull out of the ground.

Today’s Power Stock is one of the biggest producers of shale oil and gas: ConocoPhillips (NYSE: COP).

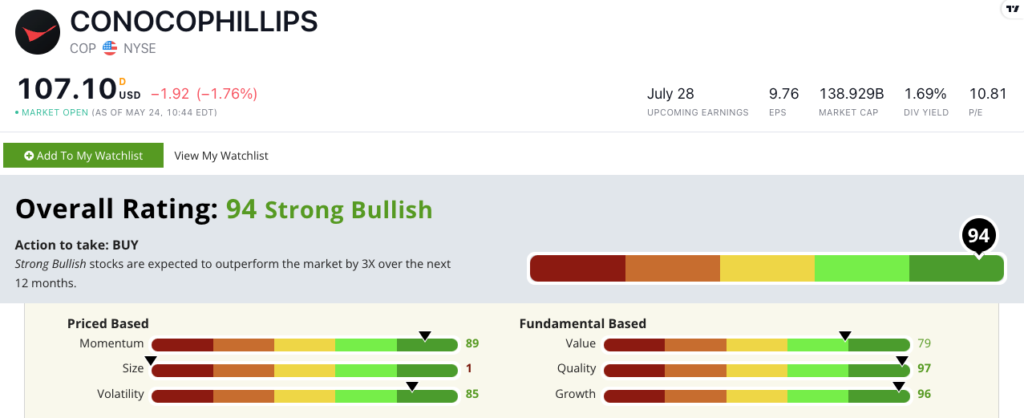

COP Stock Power Ratings in May 2022.

In addition to traditional oil and gas, ConocoPhillips is one of the largest producers of shale gas and oil in the U.S.

COP scores a “Strong Bullish” 94 out of 100 on our Stock Power Ratings system, and we expect it to beat the broader market by 3X in the next 12 months.

COP Stock: Upward Momentum + Fantastic Quality & Growth

Here’s what I found researching ConocoPhillips stock:

- In the first quarter of 2022, COP reported total revenue of $19.3 billion — that’s 40% of what the company reported in all of 2021.

- The company allocated $200 million to advance its net-zero energy transition in 2022.

When you think of oil and gas in the U.S., one of the first names that comes to mind is ConocoPhillips. It’s supplied oil and gas in the U.S. and abroad since 1917.

The company’s quality rating is exceptional — earning a 97 on the metric. This is thanks to outstanding returns on assets, equity and investments.

COP’s return on equity is 27.8% — double the average of the fossil fuel exploration sector (13.4%).

It also operates with a net margin of 23.8%, while its peers average just 3.5%. So ConocoPhillips is raking in profits at a strong rate!

COP’s one-year annual sales growth rate of 145.4% and earnings-per-share growth rate of 342.8% make it an outstanding growth stock to boot.

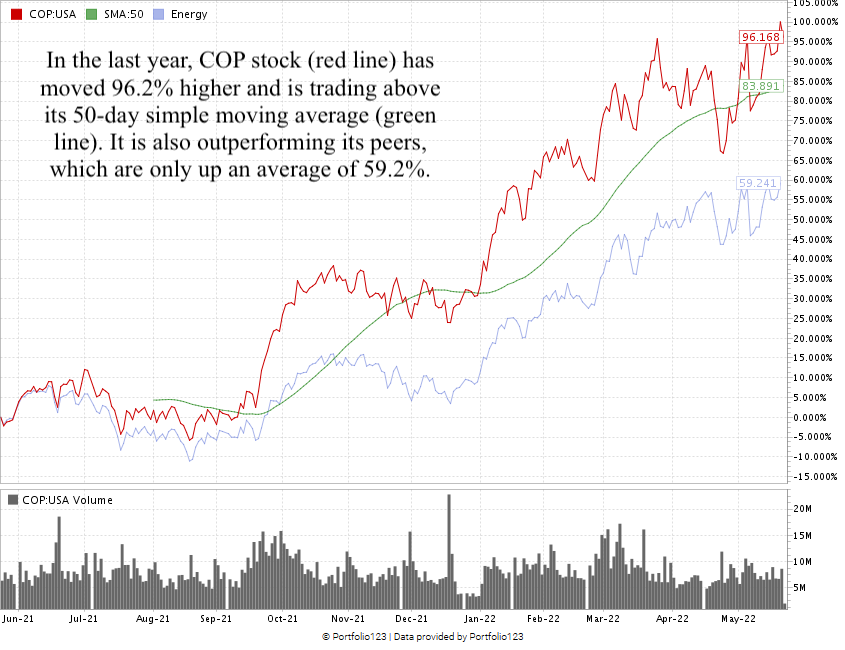

Despite the downturn in the market, COP stock continues to climb, reaching a recent 52-week high.

The stock trades more than $6 above its 50-day simple moving average — a bullish indicator.

Up 96.2% in the last year, it crushes its fossil fuel exploration peers, which are up 59.2%.

ConocoPhillips stock scores a 94 overall on our proprietary Stock Power Ratings system.

That means we’re “Strong Bullish” and expect it to beat the broader market by at least three times in the next 12 months.

The transition to renewable energy is a slow process. Our demand for oil-based products won’t go away anytime soon.

COP is a strong stock for your portfolio.

Bonus: COP’s forward dividend yield of 2.79% means the company will pay you $3.04 per share, per year to own the stock.

Stay Tuned: Strong Bullish Chemicals Stock

Remember: We publish Stock Power Daily five days a week to give you access to the top companies that our proprietary Stock Power Ratings identify!

Stay tuned for the next issue, where I’ll share all the details on a solid chemicals stock to consider.

Safe trading,

Matt Clark, CMSA®

Research Analyst, Money & Markets

P.S. Got a comment about Stock Power Daily? Reach out to my team and me at Feedback@MoneyandMarkets.com!