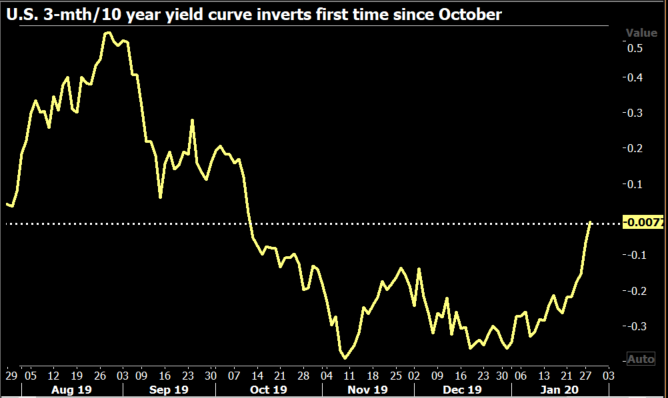

The yield curve between the three-month and 10-year Treasury bonds inverted Tuesday for the first time since October amid rising fears due to the coronavirus outbreak in China that has sent stock markets around the globe sinking this week.

An inverted yield curve, where the yield on the long-term bond falls below the yield on the short-term bond, has been a traditionally accurate precursor to a recession — though, it is generally a year or even two before the recession hits.

The Federal Reserve also closely watches the yield curve and an inversion now could mean an upcoming cut to its benchmark interest rate.

The death toll from the new virus strain has jumped above 100 and it has spread to more than 10 countries, including the U.S., France and Japan, rattling world markets already under strain due to the ongoing trade war between the United States and China.

As is always the case when something like the coronavirus pops up, investors start to sell equities and turn to safe-haven assets like gold and Treasurys.

The yield on the 10Y fell Tuesday to 1.57%, its lowest level since October, and the inversion between the 10Y and the 3M briefly dipped to -0.015 basis points before ticking up to 0.01 basis points.

“The movement in the curve is probably telling us we are seeing an increasing shift away from risk assets to safe assets, including Treasuries, and the entire curve is being pulled down,” Ivestec chief economist Philip Shaw told Reuters. “If the signs were to multiply, there could be a more severe impact not just in China but globally. Markets are starting to speculate the Fed could bring rates down by summer.”

The gap between the 2Y-5Y Treasury also inverted Monday, and the 2Y-10Y — the main curve experts look at — was at its flattest level since Nov. 29.

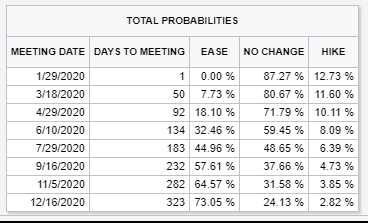

While the Federal Reserve has indicated a pause in its interest rate cutting and raising for the foreseeable future, markets are now pricing in a 25-basis-point cut this year, with a 50% chance of a second cut later in the year.

According to the CME FedWatch Tool, there is a 12.73% chance of a rate hike after this week’s meeting and an 87.27% chance rates stay the same.

According to the CME FedWatch Tool, there is a 12.73% chance of a rate hike after this week’s meeting and an 87.27% chance rates stay the same.

The most likely point for a cut is the Sept. 16 meeting, where the FedWatch Tool predicts a 57.61% chance of a cut, a 37.66% chance rates stay the same and a 4.73% chance of a rate increase.