The COVID-19 trade is dead, folks. It’s time to get in place for the next massive trend in biotech investing.

After mRNA vaccine pioneer Moderna Inc. (Nasdaq: MRNA) topped out at $497 this year, shares fell by more than half. And there’s no indication that the bleeding will stop.

Moderna launched one of the first two COVID-19 vaccines late last year, and it seemed like the stock would soar for a long time.

But after an earnings miss this past quarter and a spat with the government over vaccine patents, MRNA has lost its appeal.

It’s not the only one.

BioNTech SE (Nasdaq: BNTX), which collaborated with Pfizer Inc. (NYSE: PFE) to create the other groundbreaking mRNA vaccine, is trending in the wrong direction now as well.

You can see how far MRNA and BNTX have plunged from their August highs in the chart below:

I don’t recommend “fighting the tape.” Momentum drives my investing strategy, and neither of these stocks is trending in the right direction.

But don’t look away!

I still believe that genomics — DNA-based science — represents the single biggest investment opportunity of our lifetimes. (Watch my presentation on this tech, which I call “Imperium,” to find out more.)

That’s not hyperbole.

When it comes to investment opportunities, I expect the genomics revolution to be more massive than cryptocurrencies, electric cars and even the internet itself.

COVID-19 Vaccine Was the Spark

I won’t be cavalier. A lot of people are still getting sick and even dying from COVID-19.

And I take that seriously. As an act of decency to my fellow man, I think it’s important to try to avoid getting infected and spreading the virus.

But as an investment theme, COVID-19 is done.

Most of the adult population is vaccinated. Boosters may become an annual ritual, but that’s not a source of growth. It’s maintenance at best.

This is why we see weakness in stocks like Moderna or BioNTech.

But it’s also a case of investors putting far too much emphasis on the immediate short term. They fail to see the much bigger picture.

The COVID-19 mRNA vaccines were a proof of concept for mRNA technology: It works, we can mass produce it, and it’s economically viable.

The pipeline of potential therapies is almost unlimited.

As cases in point, Moderna has promising mRNA treatments in the pipeline for cancer and HIV along with a flu vaccine that could hit the market as soon as 2023.

That’s just the start.

The Next Step for Genomics

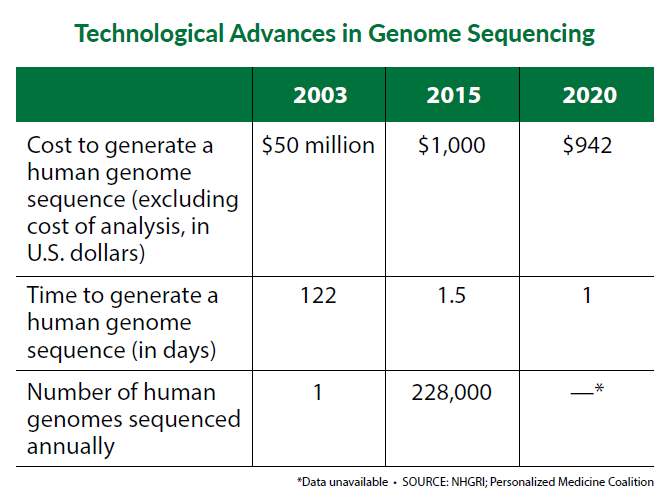

Last month, I shared the table below with readers of my premium research service, Green Zone Fortunes.

You can see the massive advances the technology has made in under 20 years.

The cheaper it becomes, the more practical applications we’ll see.

Think back to the early days of the internet. Data was expensive, and the speed was painful. Remember how long it took to dial into the internet using a modem on your home’s landline?

But as communications costs dropped, new applications became the norm.

Hailing an Uber or streaming a video on Netflix would have been impossible with data cost and speeds circa 1999. Today, we just expect it.

Last month in Green Zone Fortunes, I recommended a leader in genetic testing technology. Like Moderna and BioNTech, the company rose to prominence during the pandemic, as people the world over needed access to cheap and effective COVID tests.

But the story here is much bigger than COVID. The company used its pandemic windfall to fund the next major stage of its growth: Screening for cancer and for genetic-based diseases.

And this stock is still well within my buy zone. In fact, I expect it to more than double in the next two years.

To find out how you can gain access to this stock recommendation, along with other DNA science stock recommendations (including my No. 1 genomics stock), click here to watch my “Imperium” presentation now.

You’ll learn why the genomics stock mega trend will be bigger than investing in internet stocks in the ‘90s. Click here to join us now!

To good profits,

Adam O’Dell

Chief Investment Strategist