Editor’s Note: Imagine being able to target stocks that are about to shoot up like a rocket, with top gains as high as 430% in only 63 days. LIVE On November 4, Adam O’Dell will reveal how he does it, and how YOU can use this strategy to take advantage of the Perfect Trading Window that’s opening up right now! To reserve a VIP spot for this game-changing live event, click here.

It’s a tricky time to be an income investor.

Bond yields are still near historic lows — and could go lower. Stranger things have happened.

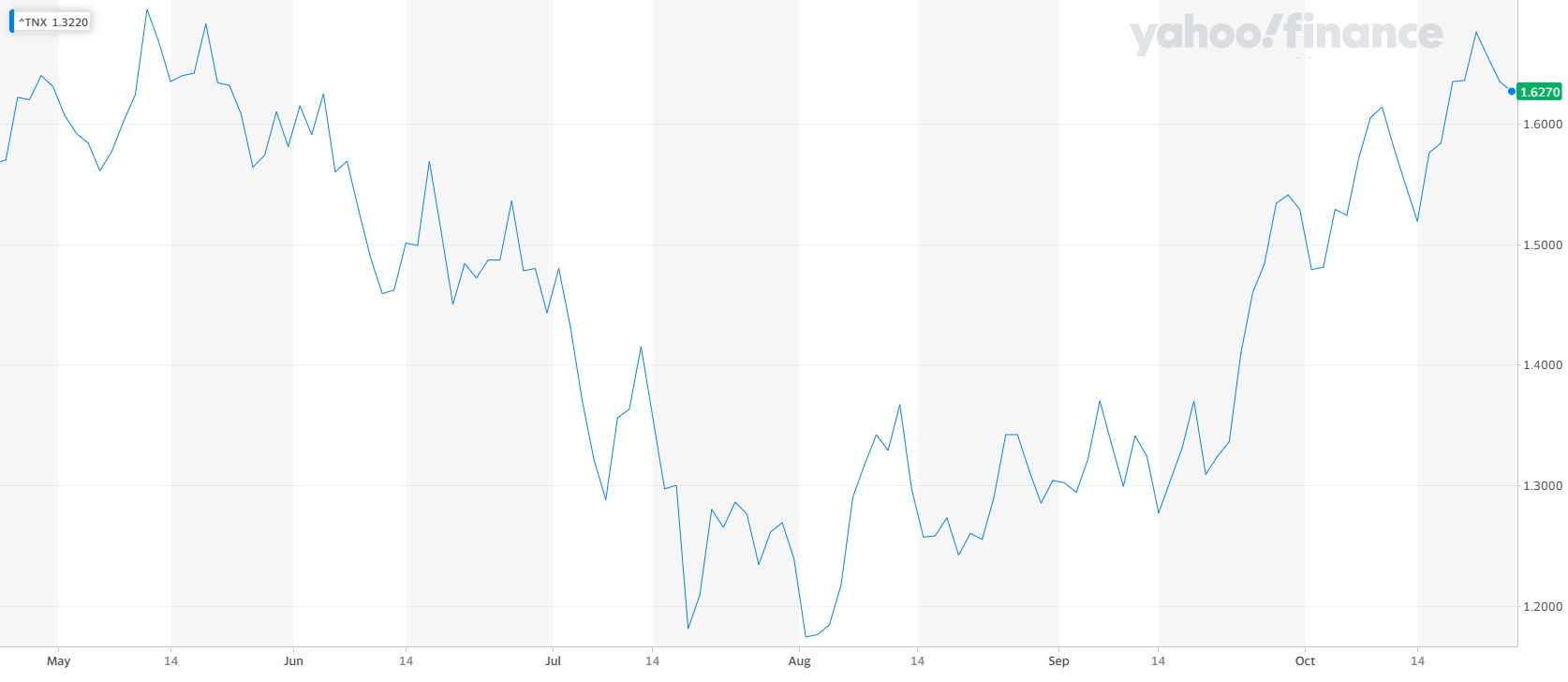

But rising bond yields have been the trend in recent months.

10-Year Treasury Note Jumped 45 Basis Points Since August Low

Source: Yahoo Finance.

And with the Federal Reserve committed to scaling back its monthly $120 billion bond purchases, a major source of bond buying is about to slow significantly.

All else equal, high bond yields mean lower bond prices … and lower prices for dividend stocks that have come to act as substitutes for bonds.

So, an ideal dividend stock in this environment is one with a respectable current yield but, more importantly, a growing business that can stay a step ahead of rising yields.

That’s where Crown Castle International Corp. (NYSE: CCI) comes in.

Crown Castle: A REIT With Bond-Beating Potential

Crown Castle is a real estate investment trust (REIT), but it’s not a conventional one. Rather than own apartments or office buildings, it owns a network of more than 40,000 cell towers and 80,000 route miles of fiber cable.

The growth story here tells itself. Five years from now, do you think you’ll be using more or less mobile data on your phone or other devices than you do today?

Yeah, that’s what I thought. Me too.

Crown Castle’s dividend yield is competitive at 3.3%. That’s not get-rich-quick money, but remember that the 30-year U.S. Treasury yields only 2.1%, and the 10-year is right behind it at around 1.6%.

Unlike those Treasury bonds, Crown Castle should raise its payout in the coming years. In December of last year, the company raised its dividend by 11%, and it raised it by 7% the year before. The company has raised its payout every year since initiating the dividend in 2014.

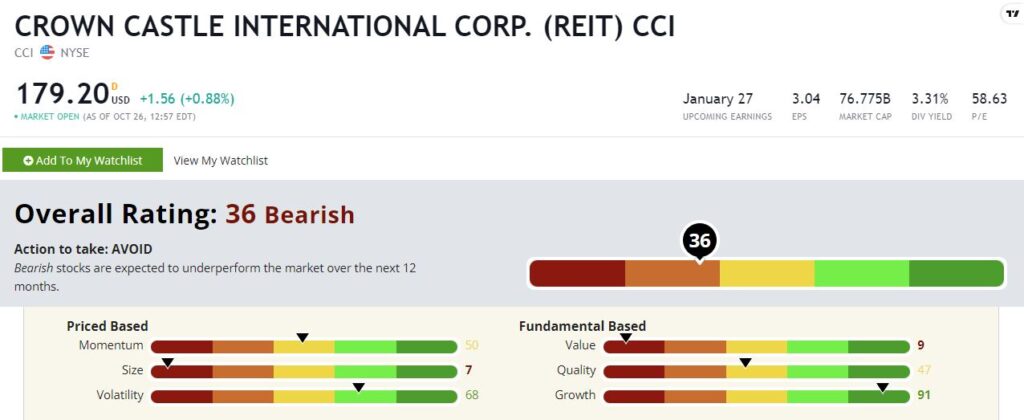

A quick look at our Green Zone Ratings system might give you pause. Crown Castle stock rates a “Bearish” 36 out of 100.

But the devil is always in the details, and Crown Castle rates highly where we want it to rate in this environment.

Growth — CCI rates a solid 91 on our growth factor, which means that the company is growing at a faster clip than all but 9% of the stocks in our universe. I don’t see a reason for it to slow down any time soon. Even though telecommunication is a saturated market in most of the world, we still need more towers by the day to accommodate the rollout of 5G service. Crown Castle is part of that solution.

Volatility — While the company is growing like a weed, the stock has been steady. It rates a 68 on our volatility factor, meaning it’s less volatile than more than two-thirds of the stocks in our universe. That’s what we want in an income stock. We don’t want to risk stomach-churning volatility in pursuit of a 3% dividend.

Momentum — Crown Castle rates a middling 50 on our momentum factor. While obviously not exceptional here, it’s still average. I’m good with that. We don’t need a high-momentum rock star as a dividend stock if we’re getting solid growth and stability.

Quality — REITs get penalized on our quality factor. Quirky accounting depresses reported earnings, and REITs carry a lot of debt in most cases. CCI is no exception here, but it still rates an average 47 on our quality factor.

Value — The same is true of value. Traditional value metrics tend to penalize REITs, and Crown Castle rates a lowly 9 on our value factor. This isn’t a cheap REIT, but we should take its factor score here with a grain of salt understanding that REITs tend to get zinged by the accounting.

Size — Crown Castle is a large REIT with a market cap (total outstanding shares times the current market value) of $77 billion. So, its 7 size rating is not surprising.

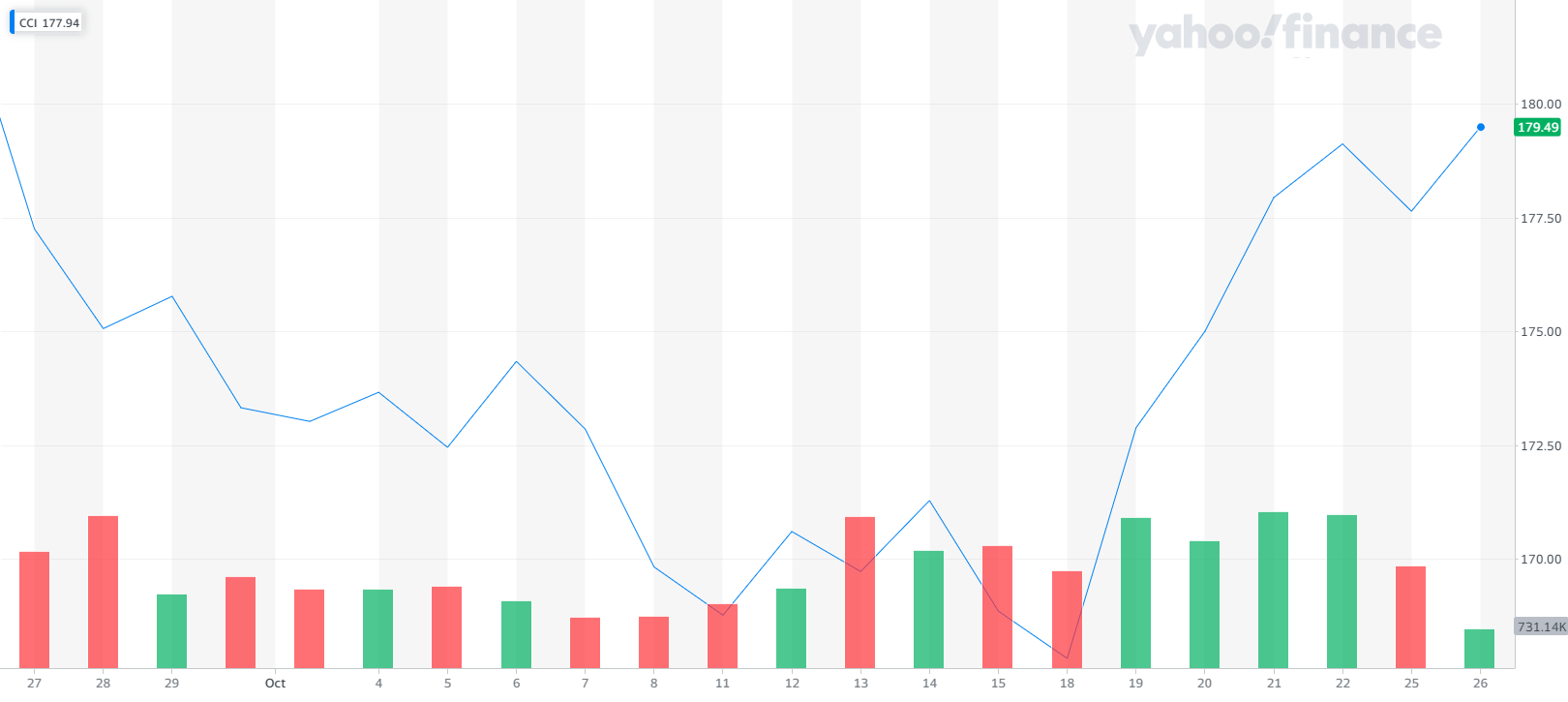

Bottom line: Crown Castle has spent the last few months in correction mode but seems to have found a bottom in mid-October. It’s even gained around 7% in the last week.

CCI Is Bouncing Back

At current prices, we’re getting a solid REIT in a growing industry throwing off a competitive dividend. There’s a lot to like here.

To safe profits,

Charles Sizemore

Co-Editor, Green Zone Fortunes

Charles Sizemore is the co-editor of Green Zone Fortunes and specializes in income and retirement topics. He is also a frequent guest on CNBC, Bloomberg and Fox Business.