According to a recent study, for about half of the 4 hours and 23 minutes we spend on our mobile devices every day, we’re listening to audio or watching videos.

Consumers want the best sound quality when we’re watching or listening.

We all have our favorite brand of headphones. (I’m a Beats fan.)

The chart above shows the number of headphones bought and shipped worldwide from 2019 to 2024.

By 2024, that number will increase 69.3%.

All of these headphones require special technology to create a top-notch listening experience.

I found a company that provides such tech.

Today’s Power Stock is Cirrus Logic Inc. (Nasdaq: CRUS), a global provider of technology used in headphones, earbuds and smartphone sound systems.

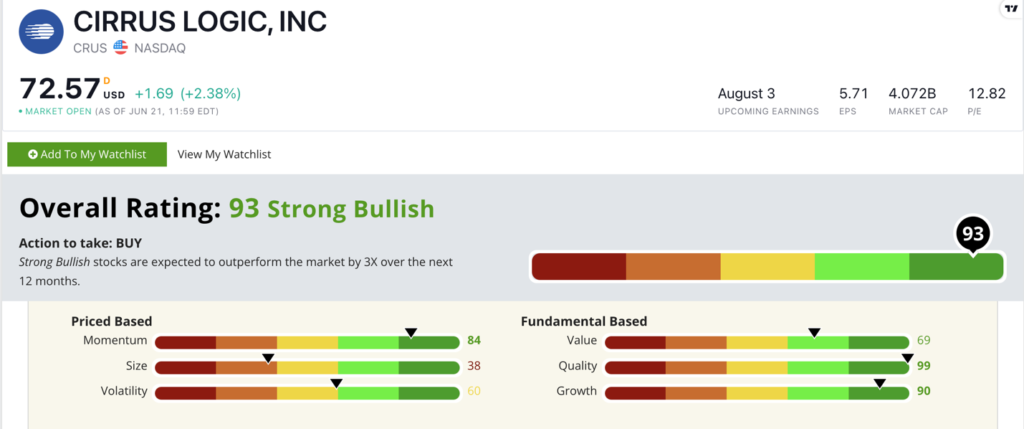

CRUS Stock Power Ratings in July 2022.

Now, Cirrus makes semiconductors.

But its chips are in smartphones, wireless headsets, earbuds, laptops and car entertainment systems.

Cirrus Logic stock scores a “Strong Bullish” 93 out of 100 on our Stock Power Ratings system, and we expect it to beat the broader market by 3X in the next 12 months.

CRUS Stock: “Strong Bullish” Quality and Growth

Cirrus Logic just closed out a monster year.

Highlights include:

- The company reported revenue of $1.78 billion — a 30% increase over last year.

- Of the $490 million it earned in the last quarter, 77% came from its business with Apple Inc. (Nasdaq: AAPL).

CRUS is an outstanding quality stock — ranking in the top 1% of all stocks we rate on the metric.

Its return on equity is 21.8%, which is three times more than the industry average. The company’s return on investment is a solid 19.8% — almost five times greater than the 4.1% peer average.

CRUS’ operating margin is a strong 20.6%, while its peers average negative 2.8%.

The company’s growth is terrific as well: Its one-year annual sales growth rate is 30.1%, and its earnings-per-share (EPS) growth rate is 52.5%.

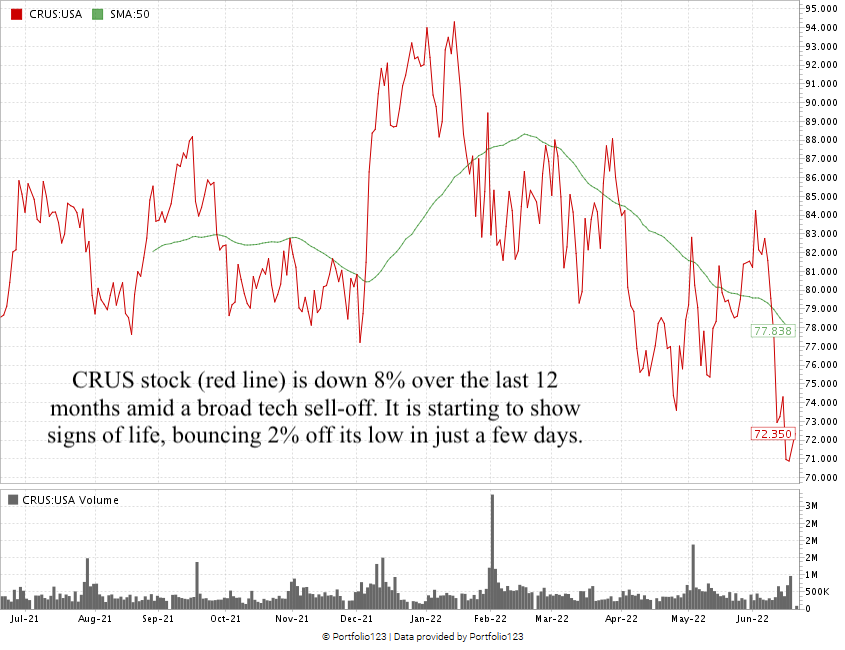

Over the last 12 months, CRUS is down 8%. But it gained 2% in a day after hitting its 52-week low in late June.

The stock is beating its semiconductor manufacturing peers, whose stocks are down 13.1% on average over the same time frame.

Cirrus Logic Inc. stock scores a 93 overall on our proprietary Stock Power Ratings system.

That means we’re “Strong Bullish” and expect it to beat the broader market by at least three times in the next 12 months.

We love listening to music and videos on our smartphones.

We want the best possible audio experience when we do that.

Cirrus Logic is a leader that provides tech to improve that experience — and it’s a strong contender for your portfolio.

Stay Tuned: “Strong Bullish” Food & Beverage Stock

Remember: We publish Stock Power Daily five days a week to give you access to the top companies that our proprietary Stock Power Ratings identify!

Stay tuned for the next issue, where I’ll share all the details on an excellent beverage company.

Safe trading,

Matt Clark, CMSA®

Research Analyst, Money & Markets

P.S. Got a comment about Stock Power Daily? Reach my team and me anytime at Feedback@MoneyandMarkets.com.