Story was originally published on April 20, 2022.

There aren’t too many places to hide from inflation these days.

Unfortunately for income investors, inflation bites hard into bonds and conservative dividend stocks. Our income streams get paid in increasingly less valuable dollars as high inflation continues.

But all is not lost. We just need to change the way we think about our income portfolios.

Commodities are going to help us do that, as many of these stocks come with solid yields and bullish outlooks for the future.

A High-Quality Dividend Machine

Inflation is running hot (over 8%!) in the U.S. And the rest of the world is right there with us.

Commodities are a natural inflation hedge, and many commodity stocks pay handsome dividend yields these days.

Case in point: Consider BHP Group Ltd. (NYSE: BHP), one of the largest industrial metals mining groups in the world.

BHP, like many non-U.S. companies, pays a semiannual dividend each March and September. The dividend will vary based on profitability, but at current levels it yields an impressive 10.3%.

And that’s not all…

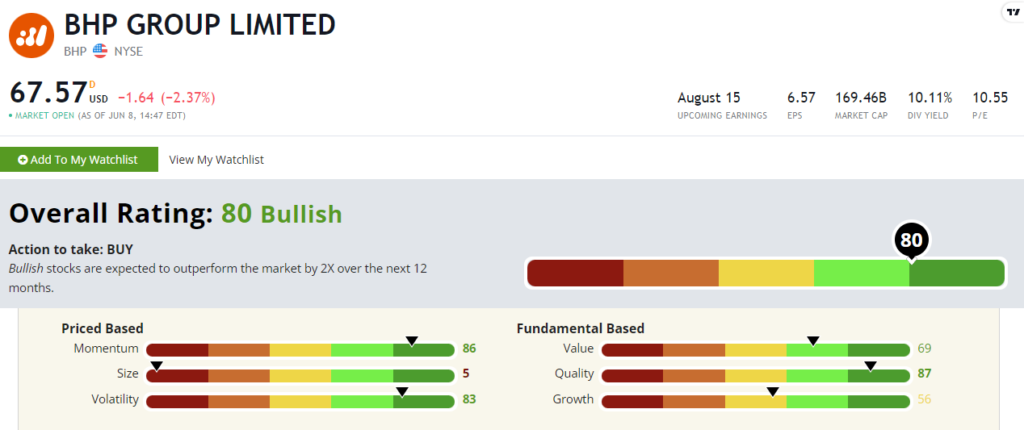

BHP Group rates a “Bullish” 80 on our Stock Power Ratings system! (Any stock rated 61 or higher is Bullish in our system, and any stock rated over 80 is “Strong Bullish.”)

Let’s dig deeper.

BHP’s Stock Power Rating

Quality — BHP rates well at 87 on our objective quality factor.

Its trailing 12-month returns on assets, equity and investment over the past five years are especially impressive, with subfactor ratings in the 80s and 90s.

Momentum — Given that inflation is raging out of control across much of the globe, it’s not at all surprising to see BHP rating well on our momentum factor at 86.

Shares have trended sharply higher since October of last year, and the commodity stock never suffered a heavy setback during this year’s volatile market correction.

Volatility — For a commodity stock, BHP rates highly on our volatility factor with a rating of 83. Remember: The higher the number here, the lower the volatility.

And our volatility factor does more than just measure raw volatility. It also measures how well the stock compensates us for that volatility in the form of returns. The stock rates in the top quarter of all stocks in our universe in both the Sharpe and Sortino ratios (two measures of risk-adjusted returns we use in Stock Power Ratings).

Value — BHP is in the top half on our value factor with a rating of 69.

Commodity company earnings can be notoriously volatile, but BHP’s earnings look strong. And with inflation running hot, that will likely continue for a while.

The stock rates higher on subfactors that use more recent data, such as the trailing 12-month price-to-earnings ratio, where it rates a 69.

Growth — BHP Group rates in the middle of the pack on our growth factor at 56.

That might sound oddly low given how hot commodities have been over the last few months. But our growth factor measures sales and earnings growth over multiple time frames. Some metrics stretch out a full 10 years.

BHP rates higher in the short-term growth subfactors. As examples, it rates an 88 and an 87 on the 3-year and 5-year compound annual earnings growth rates, respectively.

Size — BHP Group is a massive global company with a market cap of $168 billion. This isn’t some under-the-radar small cap waiting to be discovered. It rates a 5 on our size factor.

Bottom line: I should be clear that BHP is more of a capital gains play than a pure income play.

But if we can capture a nice 10% yield with this commodity stock while also enjoying market-beating returns, I don’t see anyone complaining!

To safe profits,

Charles Sizemore

Co-Editor, Green Zone Fortunes

Charles Sizemore is the co-editor of Green Zone Fortunes and specializes in income and retirement topics. He is also a frequent guest on CNBC, Bloomberg and Fox Business.