Renewable innovation is everywhere. I just found out a cement maker and energy producer are developing sustainable jet fuel!

And that’s just the start.

I’m no stranger to renewable energy. I talk about it all the time because I know it’s one of the biggest investment themes of our lifetimes.

Apart from the obvious benefits of cleaner air and bluer skies, renewable energy will massively lower the cost of a major monthly expense for most families and businesses.

Every dollar not spent on a frictional cost like energy is a dollar that can be better spent on something you want or need.

And as the costs of energy transmission and storage plummet, the potential for virtually unlimited energy becomes closer to reality by the day. Harnessing the power of more accessible sources like the sun or wind makes a lot more sense than pulling oil and gas out of the ground and moving it halfway across the globe.

All of that said, there are pockets of the economy that can’t escape the need for hydrocarbons. It’s hard to imagine solar-powered commercial jets being possible anytime soon.

Although, even here we’re seeing innovation that would have looked like something from a futuristic sci-fi movie not long ago.

Renewable Innovation: A Cement-Powered Jet?!

Just this month, Mexican cement maker Cemex SAB de CV (NYSE: CX) announced a partnership with South African chemicals and energy giant Sasol Ltd. (NYSE: SSL) to make “sustainable” jet fuel.

Here’s how it works.

Cement making produces a lot of carbon dioxide, which — if not dealt with — ends up seeping into the atmosphere and potentially contributing to climate change.

But this carbon dioxide can be processed with hydrogen to make e-kerosene, which can in turn be blended into jet fuel. Clean wind and solar energy can provide that much needed carbon.

So Cemex is taking normally harmful waste and recycling it into something useful!

We don’t know the costs involved. I can imagine this being incredibly expensive at today’s prices. On top of that, in 2019, the last year of pre-pandemic data, the world consumed 95 billion gallons of jet fuel. I don’t think Cemex will produce anything close to those numbers for a while.

But if you think back, electric cars were a novelty for environmentalists and tech geeks not that long ago. Today, nearly one out of 20 cars sold in the United States is electric. That number gets higher every year.

Wind and solar were almost nonexistent two decades ago. The two sources combined make up 12% of the electric grid … and that number is growing by the day!

So don’t be surprised at all if your next vacation to Europe is fueled by cement emissions waste!

Cemex and Sasol Aren’t the Play Right Now

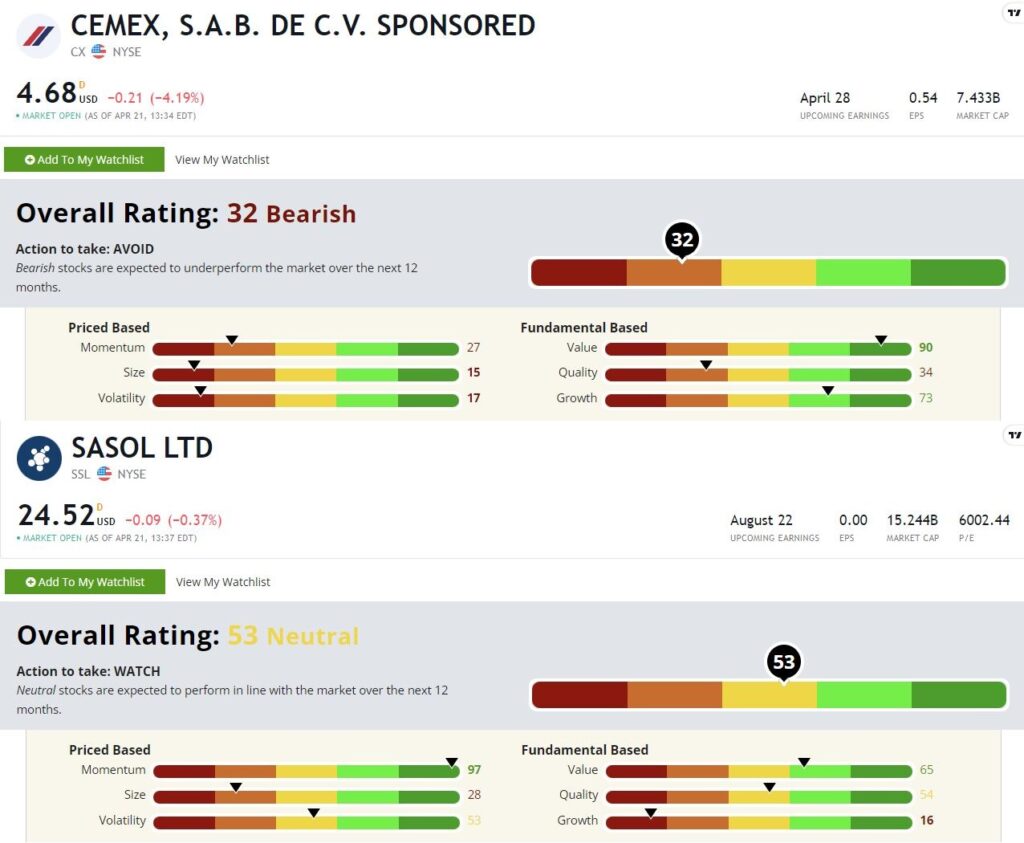

I’m not rushing to buy Cemex or Sasol just yet. My proprietary Stock Power Ratings system tells us why.

While Cemex rates an excellent 90 and 73 out of 100 on its value and growth factors respectively, it rates a “Bearish” 32 on its overall score. I’d like to see it rate better on the momentum factor before I would even consider putting any money into the stock.

Sasol rates a little better, with a composite rating of 53. But that’s still only a “Neutral” rating in my system.

While these two companies don’t make the cut for now, I’ve identified another fantastic opportunity in the renewables space…

It’s the focus of my April issue of Green Zone Fortunes. This stock is a part of multiple mega trends moving markets right now.

Electric vehicles (EV) get a lot of hype within the renewables space, but there’s a much bigger mega trend developing at the same time: energy storage.

To find out more, watch my “Infinite Energy” presentation now. You’ll learn the details on how to join Green Zone Fortunes and gain access to April’s pick (plus so much more).

I hope to see you there.

To good profits,

Adam O’Dell

Chief Investment Strategist