With the stock market roiling through the worst month in seven years during October, global trade tensions and political tumult at seemingly all-time highs, savings accounts might seem like a safe place to keep your money.

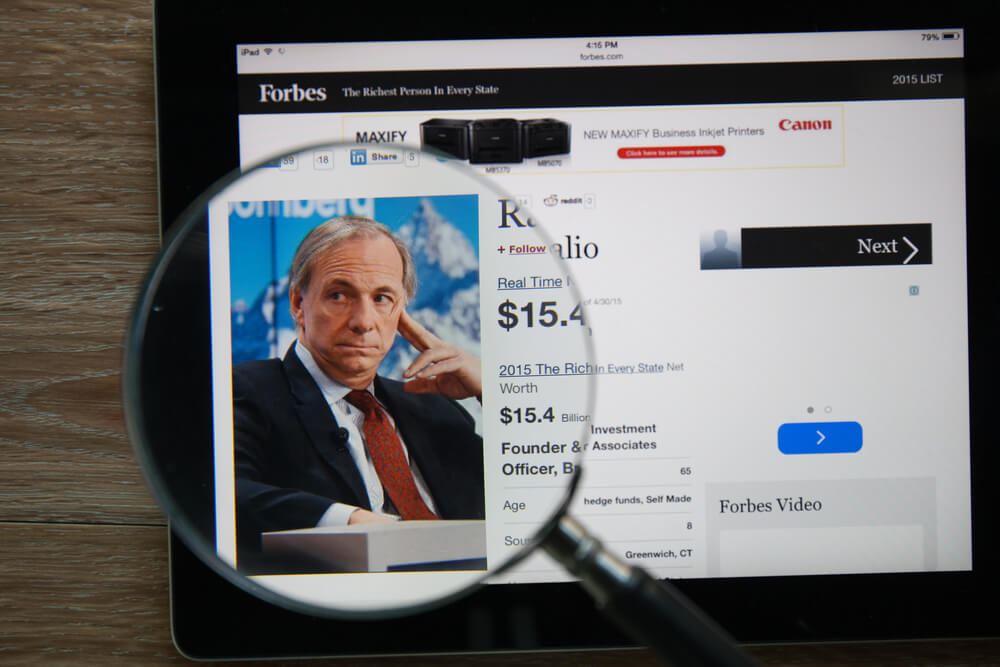

Not so, says billionaire Bridgewater Associates founder Ray Dalio. In fact, holding your money in cash is a terrible idea.

Per a recent interview with CNBC:

“That’s the worst thing you could do because it is the surest tax on your money,” Dalio tells CNBC Make It. “You will bleed slowly to death, because the after-tax returns are lower than inflation by a little per year.”

Which makes sense because over time, inflation causes the price of just about everything to rise relative to the value of the money in your account. For example, it would take saving more than $1,498 in October of 2018 to match the buying power of just $1,000 in January of 2000, according to the Bureau of Labor and Statistics’ Inflation Calculator.

And the more time that goes on, the worse inflation gets. It would take about $10,742 in September of 2018 to hit the level of the buying power of just $1,000 in 1950.

Of course, you earn interest on money in a savings account, but the interest earned is far below the rate of inflation.

“When you put your money in cash or short-term deposit, look at the interest rate you’re getting in relationship to the inflation rate,” Dalio, founder of Bridgewater Associates, explains. “You will see that your after tax return will be below the inflation rate. That means that you’re experiencing a tax on that [money] equal to that difference. So you can’t keep your money in cash. If you think that’s safe, you’re looking at it wrong — it’s a sure losing strategy.”

The current national average interest rate on savings accounts is .09 percent, a far cry from the current rate of inflation, which rose 2.7 percent in the past year according to Consumer Price Index.

Since putting your money in a savings account is akin to setting a large portion of it on fire, Dalio says you have to turn those savings into investments, Dalio says.

“Over a longer period of time, equities [or stocks] will have a higher return, bonds will have a higher return, real estate will have a higher return than cash,” he explains. While there are no guarantees in the stock market, from 1928 through 2017, the S&P 500 index produced a 9.8 percent average annualized total return.

“People with great ideas create productivity and get paid for it,” Dalio says. “It is better to invest in productivity than to not invest in productivity, because otherwise your money will lose buying power.”