Sometimes, a compelling market trend flashes like a neon sign on the Vegas strip.

We’ve seen that a lot with mega trends like artificial intelligence (AI) over the last few years. Just yesterday, Oracle Corp. (ORCL) was rewarded with a 40% post-earnings pop in its stock price after a strong earnings outlook for its AI cloud business.

Other times, you’ve got to do a little work to find out what’s driving a stock’s price higher. And my “New Bulls” list each week is a great place to start.

Let’s see what we can dig up on the latest batch of “Bullish” Green Zone Power Rating stocks…

DASH and LOW Stock Make This Week’s “New Bulls” List

This week, we’ve got another short list of S&P 500 “New Bulls.” As always, I use these parameters when running this screen using my Green Zone Power Rating system.

- The stock must currently rate 60 or higher (that is, “Bullish” or “Strong Bullish”),

- The stock must have been rated less than 60 for each of the last four weeks.

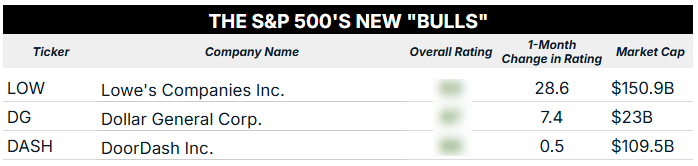

Here are the three stocks that my screen caught:

DoorDash Inc. (DASH) just squeaked over that 60-point “Bullish” line in my system by gaining half a rating point over the last month.

The company is trying to implement autonomous technology into its grocery and takeout delivery services (yes, that means robots and drones delivering your eggs or Big Mac meal), and CEO Tony Xu said the path to progress has “mostly been filled with lots of pain and suffering” during a conference in Park City, Utah, earlier this week.

But it’s not all bad news, as Xu said long-term investments and partnerships on this front are starting to pay off. And investors aren’t shying away from DASH despite these speed bumps, considering the stock is up 50% year to date, crushing the S&P 500’s still respectable 11% gain. Zooming out, the stock is up almost 100% over the last year.

With a “Bullish” rating now in my Green Zone Power Rating system, I would expect that outperformance to continue.

While DASH just squeaked over the line, Lowe’s Companies Inc. (LOW) has rocketed 28 ratings points higher within my system.

Investors have pushed the home improvement retailer’s stock 11% higher over the last month, and its solid quarterly earnings report on August 20 strongly supported this bullish move.

In a move that’s pretty much the opposite of robots delivering Mickey D’s, Lowe’s announced an $8.8 billion acquisition of Foundation Building Materials, a drywall, insulation and other interior building materials distributor.

It’s a prudent move in a home improvement market that Lowe’s CEO Marvin Ellison expects will only improve as mortgage rates fall after the Federal Reserve’s expected interest rate cut later this month.

In a world that seems to be all about AI and innovation, this is a nice reminder that boring business transactions still pay off. I’ve made plenty of “boring” recommendations that have made hay and crushed the performance of more “exciting” stocks.

With a “Bullish” rating in my system, LOW stock should continue to benefit in the months ahead.

22 “New Bulls” Outside the S&P 500

This week, another 22 stocks outside of the S&P 500 improved their overall Green Zone Power Rating by double digits to hit “Bullish” status:

I will note that this list doesn’t pack quite the same punch as previous weeks. Not a single stock on the list above hit a “Strong Bullish” rating of 80 or higher.

There’s nothing wrong with that, of course. All of these stocks are expected to outperform the S&P 500 by 2X based on crossing that 60+ rating threshold.

With a broad number of sectors represented, as well as a good mix of small caps and mid caps, there are plenty of ways to diversify if you’re looking for a new angle into this ongoing bull market.

As always, you can find out exactly where any of the stocks in today’s email land within my system, as well as their individual factor ratings, by joining my flagship investing service, Green Zone Fortunes. Click here to see how.

Once you’re in, you’re just a few clicks away from ratings on thousands of stocks (from these lists or any other tickers that cross your mind).

Have a great rest of your week!

To good profits,

Editor, What My System Says Today