For months, economists and consumers have disagreed about whether we are in a recession.

Last week, the data took a decisive turn and declared the recession is here.

A group of economists with the National Bureau of Economic Research have an official meeting to determine when recessions begin and end.

The Meeting to Declare a Recession

Economists hold these meetings after they notice a downturn.

But announcements could come even a year after the economy made its turn.

The pandemic caused the most recent downturn when reversals in the economy were easy to spot.

Still, there was a four-month delay between the start of the recession in February 2020 and the official announcement.

And then it took another three months for the economists to agree the recession had ended in April.

More typical was the recession that began in December 2007.

The economists agreed that recession was underway a year after it started.

It took 15 months for them to agree it had ended in June 2009.

The reason for the delay is that processing the collection of data takes time.

Timing Is Everything for Recession Data

These economists will look at income, retail sales, industrial production and employment data.

Academic research has shown that each indicator has a high correlation with the business cycle.

Declines in all of them are associated with recessions.

Growth in the indicators coincides with growth in the economy.

Investors don’t have the luxury of time.

We need a more useful (and timely) indicator.

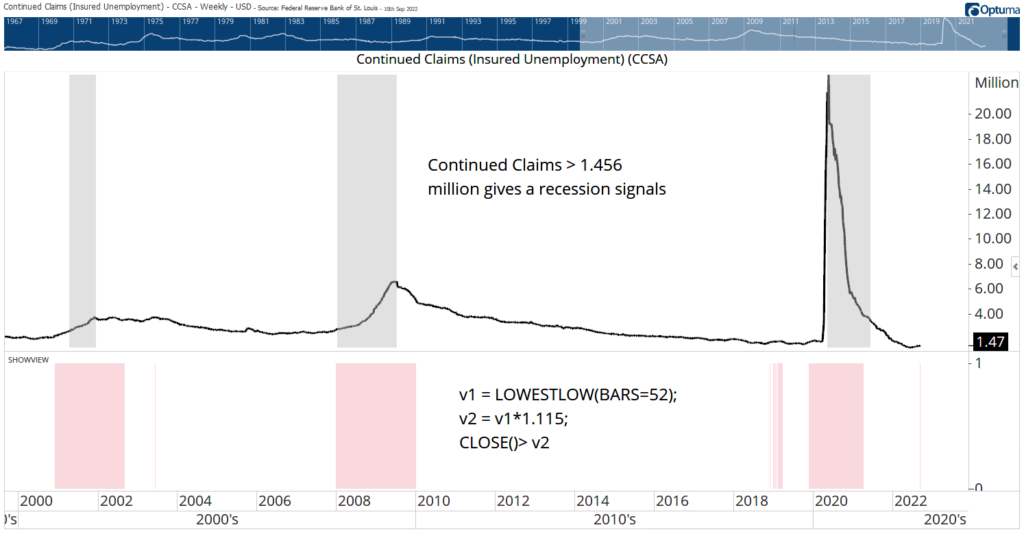

The chart below shows the number of continuing claims for unemployment insurance.

This is released every week on Thursday.

When the number of claims is 11.5% above its low, it’s almost certain a recession is underway.

This is shown as red bars in the chart below.

Grey bars highlight recessions.

Unemployment Insurance Claims Confirm Recessions

Economists will meet in a nice conference room, maybe early next year, to tell us we’re in a recession.

As investors, we know the risks are high.

On average, the S&P 500 drops more than 30% during recessions.

Bottom line: We now have a warning that Tuesday’s crash could be just the beginning…

Now that it’s clear we’re in a recession, you need to click here to check out my proprietary “Black Ops” investing strategy. I approached this system with the same military-grade precision that I used while I was a lieutenant colonel in the U.S. Air Force.

This is the approach I used when I managed over $220 million, and I’m ready to share it with you.

For around $4 per month, I’ll help you target up to 3X better returns than stocks with 4X less risk.

These are conservative investments, but I’m not talking about boring savings accounts or money-sucking mutual funds.

Click here to see how you can get started with “Black Ops” investing today.

Michael Carr is the editor of True Options Masters, One Trade, Precision Profits and Market Leaders. He teaches technical analysis and quantitative technical analysis at the New York Institute of Finance. Follow him on Twitter @MichaelCarrGuru.