My grandfather was an aerospace engineer after he retired from the U.S. Air Force.

For more than 40 years, he worked for The Boeing Co. to design nacelles for aircraft engines (think the housing of an engine that protects it from the elements).

He loved what he did even after he retired.

Here’s something you may not know: Even aerospace giants such as Boeing outsource different pieces of aircraft for third-party companies to build.

And aerospace parts manufacturing is a booming industry:

Statista projects the value of aerospace parts manufacturing in the U.S. to reach $264.5 billion by 2024.

That’s a 16.7% increase from 2020.

And certain companies will play an important role in that growth.

Today’s Power Stock engineers and manufactures parts for the aerospace industry in the U.S.: Ducommun Inc. (NYSE: DCO).

DCO specializes in electronic and structural systems for both commercial and defense aerospace companies.

Fun fact: Ducommun was founded in 1849 … making it the oldest company in California.

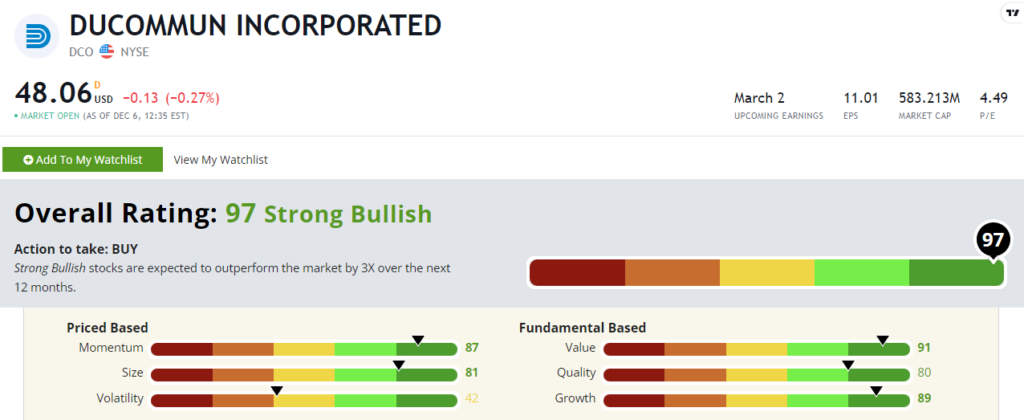

DCO stock scores a “Strong Bullish” 97 out of 100 on our Stock Power Ratings system. We expect it to beat the broader market by 3X in the next 12 months.

DCO Stock: Great Value + Upward Momentum

Here’s what stood out from DCO’s most recent earnings report:

- Net revenue reached $186.6 million — up 14.3% year over year!

- DCO’s commercial aerospace revenue grew by $27.2 million, thanks to higher orders for parts and systems.

Those figures illustrate why DCO earns an 89 on our growth factor.

DCO is also a great value stock.

Its price-to-earnings ratio is nearly six times lower than the industry average.

What’s more, DCO’s price-to-cash flow ratio is 3.78 compared to the industry average of 18.63.

It tells me DCO is an excellent value compared to its peers.

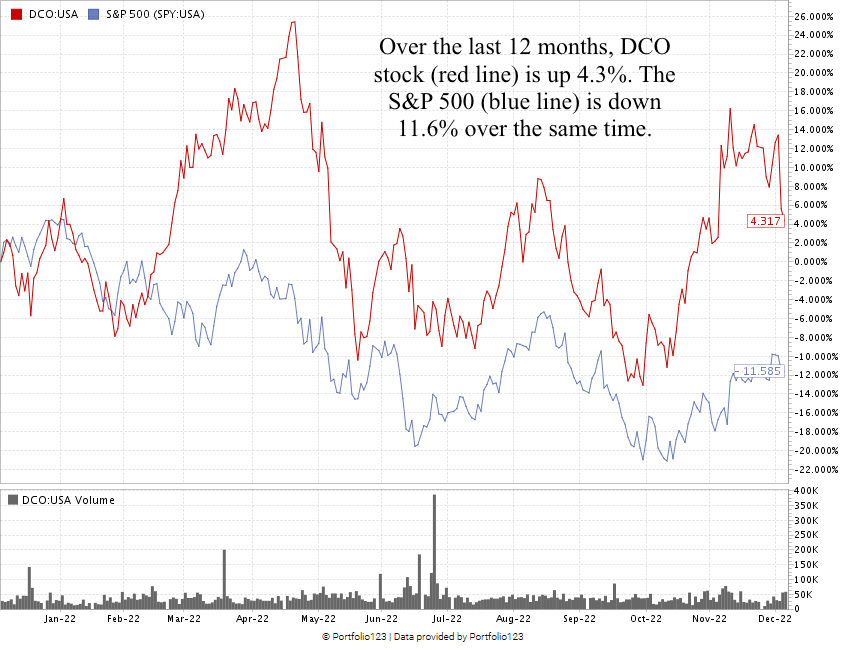

As I write, DCO stock is up 4.3% over the last 12 months. The S&P 500 is down 11.6% over the same time.

DCO jumped 33.7% from its September 2022 low to its most recent high in November!

Ducommun stock scores a 97 overall on our proprietary Stock Power Ratings system.

That means we’re “Strong Bullish” and expect it to beat the broader market by at least 3X in the next 12 months.

The market for building parts and systems for the aerospace industry continues to grow.

DCO is the oldest company in California and one of the oldest companies that manufactures aircraft parts and systems.

With that kind of history — and its strong stock value — you can see why DCO stock is a great addition to your portfolio.

Stay Tuned: A Global Leader in Oil Transport

Remember: We publish Stock Power Daily five days a week to give you access to the top companies that our proprietary Stock Power Ratings identify!

Stay tuned for the next issue, where I’ll share all the details on a company that ships oil and gas worldwide.

Safe trading,

Matt Clark, CMSA®

Research Analyst, Money & Markets