The “death cross.” It’s an ominous name, one that sounds more at home in a medieval torture room than a trading floor. Essentially, a death cross is when an asset’s 50-day simple moving average (SMA) crosses below its 200-day SMA.

In layman’s terms, this means that the short-term price action of the asset has deteriorated to such a degree that it is now trading below long-term averages.

To traders that deal with technical analysis, a death cross is bad news. It is both a signal that something has gone wrong with short-term asset prices, and a signal that more losses could be on the way. Typically, we see death crosses in the occasional stock when earnings reports go awry or during periods of company restructuring. When it happens to multiple stocks in a particular sector, it’s a sign of a systemic problem within that sector.

All technical jargon aside, death crosses are bad. Multiple death crosses are even worse.

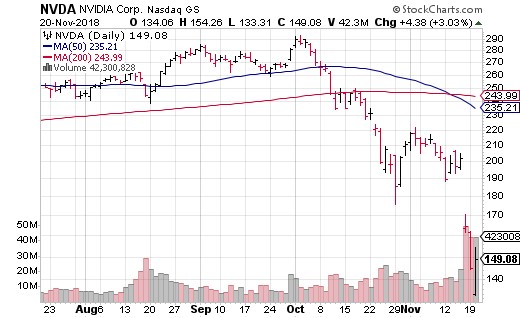

In the past month, we’ve seen a string of these technical formations pop up in the technology sector. The two most notable in the past week came from momentum stocks Netflix Inc. (NASDAQ: NFLX) and Nvidia Corporation (NASDAQ: NVDA). Both stocks have been officially trading in bear market territory for a while now, with NFLX down about 37 percent from its 52-week highs and NVDA off a whopping 49 percent from its annual peak.

But the problem is much, much larger. Three of the four FAANG stocks — Facebook, Amazon, Apple, Netflix and Alphabet (Google) — have now experienced death crosses. In addition to Netflix, both Facebook Inc. (NASDAQ: FB) and Alphabet Inc. (NASDAQ: GOOGL) have seen their 50-day and 200-day moving averages cross bearishly. Both also are officially trading in bear market territory, down 39 percent and 20 percent from their 52-week highs, respectively.

The two remaining FAANGs, Apple and Amazon, aren’t far behind. Both also are officially trading in a bear market.

The most concerning aspect of this breakdown in the technology sector is that FAANGs have almost exclusively led the market’s bull run for the past five years — and especially in the past two years. In short, market leadership has broken down and another sector has not stepped up to take over the reins.

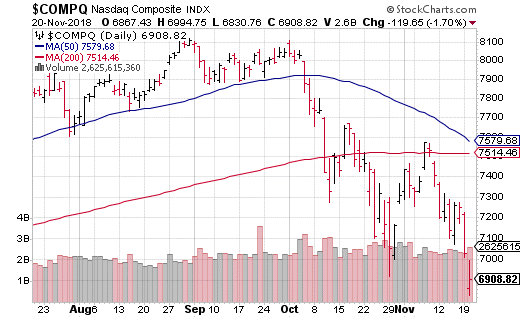

As a result, it’s only a matter of time before major indexes succumb to the bear market. The Nasdaq Composite may well be the first. In fact, the Nasdaq’s own 50-day and 200-day moving averages are just days away from their own death cross. What’s more, the Nasdaq has fallen more than 15 percent from its 52-week high, putting the tech-laden index just 5 percent away from an official bear market.

When the Nasdaq breaks, the S&P 500 Index won’t be far behind. In fact, the S&P also is frighteningly close to its own death cross, which could happen as early as January or February next year if support in the 2,600 region gives way.

So, what does this mean for you? What impact will all these fancy technical terms and charts have on your portfolio? The answer is simple. Whether or not you believe the current hype in the financial media surrounding a bear market, FAANG leadership has already given way. You need to start preparing for what could happen and protect your wealth now.

Keep scrolling down to read more investment tips from Thomas Lancaster on Money & Markets.