As we noted yesterday, oil prices and the energy sector have been pushed into the spotlight as investors speculate on the United States’ eventual involvement in the Israel-Iran conflict.

Naturally, it’s time to take a closer look at how energy stocks are positioned. We’ll do that with a Green Zone Power Rating “x-ray.”

A Surprisingly “Bullish” Energy Sector

Broadly, the energy sector’s trend is still in “repair” mode.

See, shares of Energy Select Sector SPDR Fund (XLE) fell 24% between last November and the early-April “Liberation Day” panic lows.

Since then, the sector has gained roughly 14%, while the S&P 500 has gained 21%.

Neither XLE nor the S&P 500 have fully reclaimed their “uptrend” status, per the parameters I use in my option-trading service, Max Profit Alert. However, they’re close … and I estimate that, barring a steep downturn, both the S&P 500 and the energy sector will be back in a medium-term uptrend within the next two weeks.

That’s encouraging and, particularly now that oil prices are on the move, warrants a closer look at individual stocks within the sector, which is generally called breadth analysis.

If a majority of individual stocks within the sector are sending a “bullish” message, there’s a good chance we can trust the bullish uptrend that appears to be re-establishing itself.

The results, here, are also encouraging…

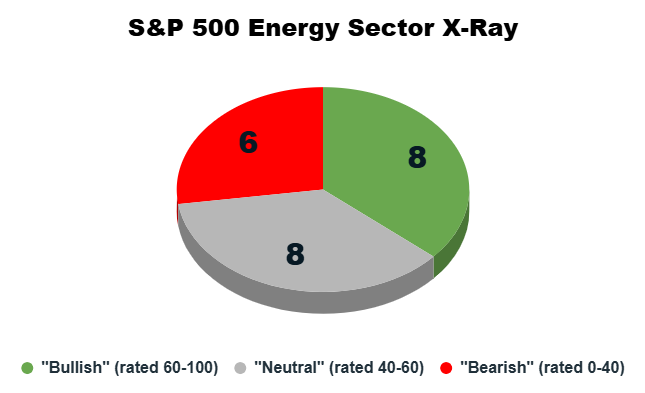

Check out the energy sector’s breakdown, which, as always, can broadly be categorized into one of three buckets:

- Bullish (rated 60 – 100).

- Neutral (rated 40 – 60).

- Bearish (rated 0 – 40).

The pie chart below effectively “x-rays” the 22 energy sector stocks in the S&P 500, asking how many of them currently rate Bullish, Bearish or Neutral.

Have a look…

Realize that many of the S&P 500 sectors we’ve x-rayed in recent weeks have shown a greater number of “bearish” stocks than “bullish” ones.

That’s not what we’re seeing in the energy sector, where “bullish” stocks actually outnumber “bearish” ones, according to the overall rating of my Green Zone Power Rating system.

This tells me this sector is chock-full of potential. It’s just a matter of digging deeper to find the stocks with the highest probability of outperformance ahead.

Let’s do just that using my Green Zone Power Rating system now…

“Bullish” on Most Factors — 1 Stands Out

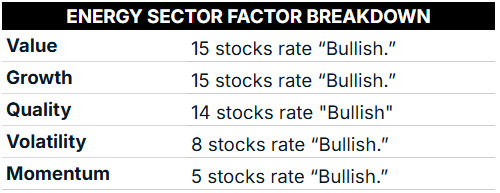

Listed in order, from the factor with the most “bullish” stocks down to the factor with the least number of bullish stocks, here’s how the energy sector looks today:

These are incredible stats on my fundamental factors (Value, Growth and Quality).

Almost 70% of S&P 500 stocks in the energy sector boast “Bullish” ratings on Value and Growth, while 63% fall into that category on Quality.

But as I’ve already mentioned, investors aren’t picking up on it yet, evidenced by a much smaller number of S&P energy stocks currently rating bullish on Momentum.

Of course, I could see sentiment changing rapidly, especially considering the Trump administration is far more supportive of the industry.

Best of all … there’s a trove of cheap energy stocks, just waiting to be picked up!

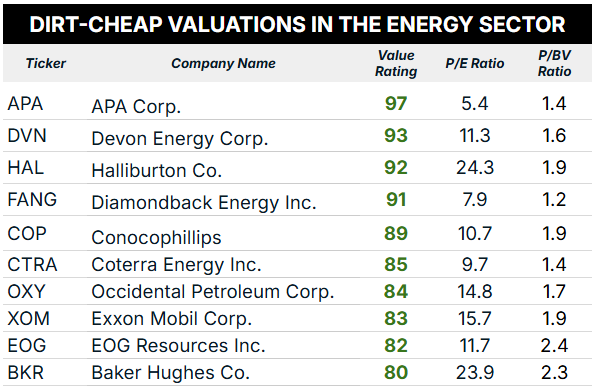

This is where my Value factor comes in. Below you’ll see the 10 energy sector stocks that currently rate “Strong Bullish” on this metric:

I’ve also included each stock’s price-to-earnings (P/E) and price-to-book value (P/BV) ratios — two popular valuation metrics.

Consider this:

- The S&P 500 currently trades at a P/E of 25.4 and a P/BV of 5.1.

- The energy sector (XLE) trades at a P/E of 3 and a P/BV of 2.1.

As you can see, above, every stock in the table beats both the S&P 500 and energy sector averages on both value metrics. That’s fantastic!

So here’s the real question: Is your portfolio sufficiently stocked up on high-quality, dirt-cheap energy stocks?

And if not, then what are you waiting for?!

With my Green Zone Power Rating system in hand, you can find some of the best deals the energy sector has had on offer for many years.

To good profits,

Editor, What My System Says Today

P.S. If you want to see the overall rating on any of the stocks above (or look up thousands of other tickers in my system), click here to see how to join up in Green Zone Fortunes now. Along with full access to Green Zone Power Ratings, you’ll also find my model portfolio full of my top recommendations in multiple market sectors and mega trends.