Editor’s Note: If private markets have ever piqued your interest, I urge you to check out this urgent presentation from our friends at Crowdability now. The window on this “72-hour profit-alert” is closing fast…

Hey, it’s Matt. Welcome to the Earnings Friday edition of What My System Says Today.

I’m going to start today by looking at the earnings of some of the biggest companies in the market … the Magnificent 7.

These stocks — Alphabet Inc. (GOOGL), Amazon.com Inc. (AMZN), Apple Inc. (AAPL), Meta Platforms (META), Microsoft Corp. (MSFT), Nvidia Corp. (NVDA) and Tesla Inc. (TSLA) — gained notoriety as they helped drive most of the S&P 500’s rally since 2023.

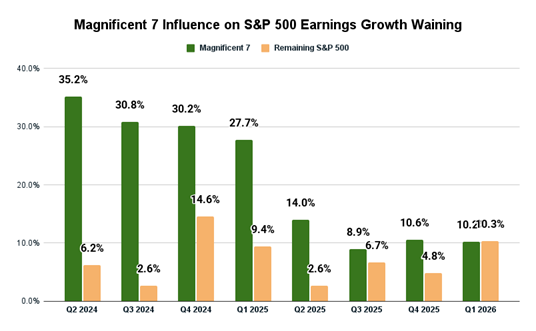

Now that all seven companies have reported quarterly numbers, I wanted to talk about an earnings trend I’m seeing in the chart below…

The Magnificent 7 stocks have had a significant influence on the earnings growth of the broader index.

In the first quarter of 2025, the Mag 7 stocks grew earnings by 27.7%, compared to the rest of the S&P 500 companies, which came in at just 9.4%.

However, estimates show that by Q1 2026, Magnificent 7 earnings will grow by just 10.2%, while the rest of the S&P 500 company earnings will grow 10.3%.

This is a great sign because it means that earnings growth will be broader across the market instead of concentrated in seven stocks.

Before I discuss bullish and bearish earnings next week, let’s review a company’s earnings that I paid particular attention to this week.

Dollar Tree Hits All the Marks on Earnings

Last Friday, I mentioned I would be watching Dollar Tree Inc. (DLTR) after it landed on our “bullish” earnings screen.

The company reported -$17.18 earnings per share in the previous quarter, and I expected dramatic improvement as discount retailers benefit from higher foot traffic amid higher inflation and sagging consumer confidence.

Dollar Tree didn’t disappoint, reporting EPS of $1.47 for the second quarter, with an 11.7% increase in profit and a 20-basis-point expansion of its profit margin.

Interestingly, during its earnings call, Dollar Tree CEO Michael Creedon told analysts the chain has seen a marked increase in the number of higher-income customers coming through its doors as same-store sales increased 5.4%. The other thing I watched for was the company’s forward guidance — what it expected for the rest of 2025.

Dollar Tree reaffirmed its annual guidance of net sales ranging from $18.5 billion to $19.1 billion with a net sales growth between 3% and 5%.

While this speaks well for Dollar Tree, it also provides a stark message on how Americans feel about the state of the economy.

Continued uncertainty over tariffs and inflation is driving more Americans to discount retailers like Dollar Tree as they try to stretch their paychecks further.

Now, let’s see which companies could face a bearish earnings swing on next week’s earnings calendar.

“Bearish” Stocks to Watch

For our “bearish” earnings screen, we’re only looking for two things:

- 10 or more analysts must cover the stock.

- The average analyst estimate for the current quarter’s EPS is less than the previous quarter’s.

We want companies that are covered by a sufficiently large group of Wall Street analysts who collectively expect the company to report a quarter-over-quarter decline in earnings.

As Adam mentioned yesterday, our reports are primarily focused on members of the S&P 500 to capture the largest publicly traded stocks.

It keeps things simple, but it also only gives part of the picture. So, for today’s screens, I broadened our scope to analyze all stocks that meet the above criteria.

Our screen brought back three companies:

RH (RH) and Academy Sports & Outdoors (ASO) being on the list doesn’t necessarily surprise me.

RH specializes in producing for the luxury lifestyle market, while Academy Sports leans into consumer discretionary. Both areas are being hit by tariff uncertainty and inflation woes.

The bigger surprise here is Casey’s General Stores Inc. (CASY).

Casey’s operates a chain of convenience stores across the Midwest and the southern U.S.

While its inside and gasoline sales are expected to increase, the biggest hit to Casey’s earnings per share is expected to come from its 2024 acquisition of Fikes Wholesale — owner of CEFCO Convenience Stores located in Texas, Alabama, Florida and Mississippi.

The acquisition was the largest in Casey’s history, bringing the number of stores under its umbrella to 2,900. It cost $1.14 billion.

That will put a dent in Casey’s earnings per share and could negatively impact its “Strong Bullish” rating on Adam’s Green Zone Power Ratings system.

The stock earns strong ratings on Momentum, Volatility, Quality and Growth. (To look up CASY’s complete ratings — as well as the rating on thousands of other tickers — click here to see how you can gain unlimited access to Adam’s system now.)

I’m keeping an eye on how Casey’s management expects this acquisition to impact future earnings per share.

“Bullish” Stocks to Watch

The last part of our analysis focuses on companies expected to beat their previous quarter’s earnings and, thus, potentially trade higher if those expectations are met … or even exceeded.

For this screen, stocks must meet four criteria:

- The stock is covered by 10 or more analysts.

- The average analyst recommendation is a “Buy.”

- It BEAT analysts’ EPS estimates for the previous quarter.

- The average analyst estimate for the current quarter’s EPS is greater than the previous one.

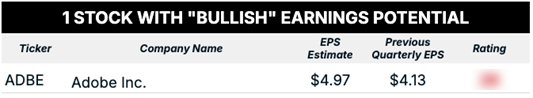

Here is the one company that made the list:

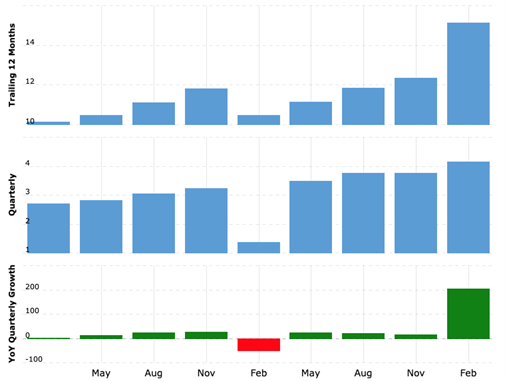

Adobe Inc. (ADBE) is a California-based software company that offers a wide range of creative programs for everything from web design to photo editing.

The company has spent considerable resources implementing artificial intelligence into its Creative Cloud and Experience Cloud platforms. These platforms help operators generate AI images and enhance workflows.

In the last two years, the company has only reported a decline in its earnings once, in February 2024.

Going back five years, the company has reported an earnings drop just four times.

With its continued implementation of AI tools in its suite of products, Adobe will continue to benefit from its strong position as a provider of creative tools for web, video and photo creation.

I am interested in seeing if this potential earnings rise will be enough to push Adobe stock out of the “Bearish” range on the Green Zone Power Rating system.

That’s all from me today. I hope you all have a great weekend!

Safe trading,

Matt Clark, CMSA®

Chief Research Analyst, Money & Markets