Bear markets create opportunities.

With the S&P 500 and Nasdaq both well into bear market territory, I see attractive prices on certain stocks for the first time in years.

I’m recommending several new positions that are poised to buck the market’s overall bearish trend. (Click here to join Green Zone Fortunes and access my latest inflation-proof stock recommendation.)

But certain companies will fare better as this bear market continues, while others will continue to struggle. That’s why I developed the Stock Power Ratings system. It helps us find profitable companies within any market — up, down or sideways!

Before you rush in to buy the dip in your favorite stocks, I recommend you avoid one iconic American blue chip: 3M Company (NYSE: MMM).

Here’s why.

Inflation Cuts Into 3M’s Bottom Line

If you’re like me, you have a plethora of 3M products in your home, office or garage. Its brands include Post-It notes, Scotch tape, Ace bandages, Bondo and more. 3M also produces specialized equipment, such as hazmat suits and medical supplies.

Its product line is diverse, but one prevailing issue hammers away at 3M’s bottom line: inflation!

Its raw materials costs are rising, pandemic-related shortages have turned its logistics system upside down and 3M is dealing with the same labor issues that plague the economy as a whole.

3M’s shares were the proverbial canary in the coal mine. Its stock price drifted lower about a year ago as investors put inflation risk on their radars.

MMM shares have only continued to slide. As I write, the stock is down around 34% from its June 2021 highs.

3M’s Stock Power Rating Is a Warning

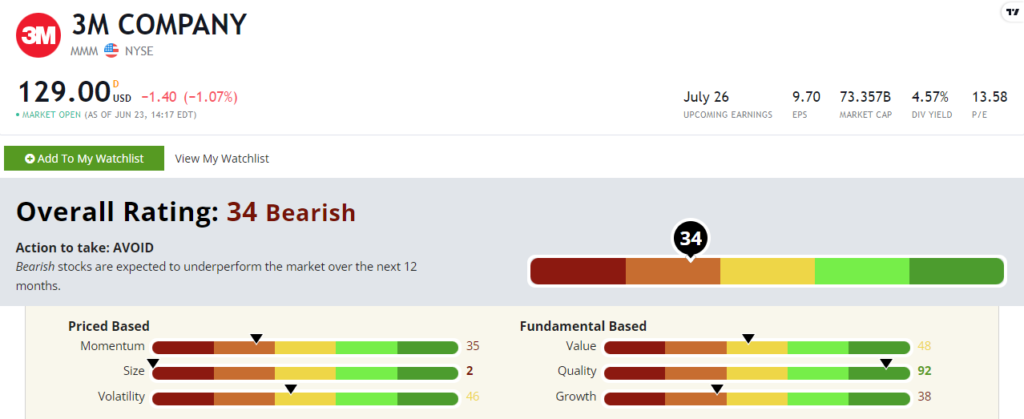

3M is a fantastic company with a strong collection of brands. That’s reflected in its quality factor, where it rates a strong 92. 3M’s brands come with a good reputation, which allows it to charge premium prices relative to its peers. That premium means higher measures of profitability, which in turn lead to a higher quality rating within my system.

Unfortunately, 3M is limited in its ability to raise prices. And management has telegraphed this shortfall in earnings calls for the better part of a year.

Looking past quality, 3M doesn’t have much going for it.

It rates a “Bearish” 34 overall and lands in the middle of the pack on my value and volatility factors. Beyond this, it rates a lowly 35 on momentum and 38 in growth.

In other words, 3M is an average-priced, slow-growth company that’s trending in the wrong direction.

Bear markets tend to favor staid, established companies with staple products — companies like 3M! Yet 3M’s shares have underperformed during this bear market. The company is sensitive to inflation, and that’s a serious warning sign.

3M stock will be a buy again one day. Stock prices tend to recover before companies report improving fundamentals. It’s possible that 3M’s shares find a bottom tomorrow and start to trend higher again.

Until we see evidence of sustained momentum higher, it’s best to avoid 3M.

Of course, we aren’t idling as the bear market continues.

In Green Zone Fortunes, Co-Editor Charles Sizemore and I just recommended a stock that is well set to outperform in this inflationary environment.

It’s in a boring industry. But as we’ve said before, boring companies help us weather the market storm so we can be in the best position for when stocks head higher overall again.

If you want to join us in Green Zone Fortunes and see how our latest high-conviction recommendation is working to offset inflationary pressure, click here.

To good profits,

Adam O’Dell

Chief Investment Strategist