You know my shtick. I love dividends. I like scoring capital gains too, of course. Selling stock for more than you bought it for feels great.

But I love dividends. I love when that cash hits my account each quarter.

So given that I love dividends, it shouldn’t be surprising that real estate investment trusts (REITs) are some of my favorite assets to buy. Because REITs avoid U.S. federal income taxation at the corporate level, they tend to be some of the highest yielders in the market.

A high yield doesn’t always represent the best value. Some of the best REITs, and those enjoying fantastic industry tailwinds, are some of the lowest yielding.

For example, consider logistical REIT Prologis Inc. (NYSE: PLD). Prologis owns logistical properties (think massive warehouses) used by Amazon.com and other major online retailers. If you believe, as I do, that internet commerce will only increase over time, then buying the e-commerce landlord only makes sense. Yet Prologis yields a rather uninspiring 2%. If you buy the stock, you’re buying it for growth. The current yield just flat out isn’t there.

High Yield Isn’t Everything

Meanwhile, some of the high-yielders are REITs you’d be better off avoiding. As a case in point, consider Simon Property Group (NYSE: SPG).

Simon is one of the largest mall REITs. Malls have had a rough time. While most cities still have successful premier malls, the sector has been overbuilt for decades, and lower-tier malls have struggled.

The Simon Property REIT yields an attractive 4.3%. All else equal, I’d love to enjoy a dividend that size. I wish every stock in my portfolio yielded that high or better.

But that’s not the case, and you’re better off looking elsewhere for yield.

Let’s play with the numbers.

Simon Property REIT’s Green Zone Rating

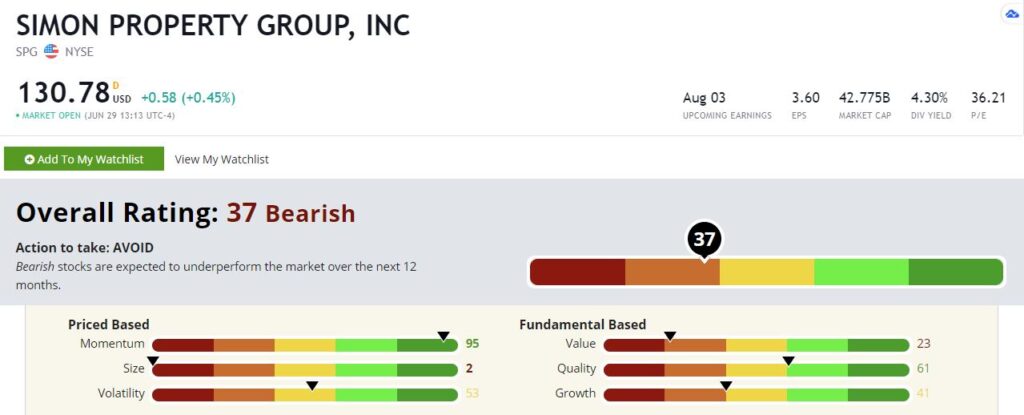

The Simon Property REIT rates a 37 on our Green Zone Ratings scale, putting it in “Bearish” territory. That’s not a stock we’d normally want to own. But just for grins, let’s see why it rates so low.

Momentum — Simon rates well based on momentum with a score of 95. Shares got obliterated during the pandemic crash, but they’ve rallied ever since. An object in motion tends to stay in motion, and Simon may push higher for another several weeks or even months. But a high momentum score alone isn’t enough for a long-term dividend stock. That’s a short-term trade at best unless we have high ratings on the other factors, which isn’t the case for Simon.

Quality — The next highest score is quality at a very modest 61. REITs get penalized on the quality score due to their high non-cash expenses that distort reported earnings. So Simon Property stock’s score of 61 is a little more impressive than it might look at first glance. But it’s still nothing to get excited about.

Volatility — It just continues to sink from there. Simon scores a 53 on volatility, putting it in the middle of the pack. I can tolerate a mediocre volatility rating in many stocks, but I need to see better than that for a long-term dividend.

Growth — Simon rates a 41 on growth. I’m a little surprised it rates even that high. Regional malls have been in decline for decades. This is not a growing industry, and it may never be one again.

Value — Yet despite the lousy growth profile, the Simon Property REIT isn’t cheap. In fact, it’s quite expensive. It rates a 23 on value, meaning it’s more expensive than 77% of the stocks in our universe.

Size — Simon is a large $40 billion company and rates a 2 on size. Not only is this a mediocre company, but it’s also far too large to be undiscovered.

Bottom line: I wish Simon and its management the best of luck. It’s far better for the health of America’s cities if its malls are in good financial condition. But when investing, there isn’t much room for altruism. We buy the stocks we buy to make money. And right now, that looks doubtful for Simon.

By all means, fill up your retirement portfolio with high-quality REITs. But Simon is one to keep on the shelf.

To safe profits,

Charles Sizemore

Editor, Green Zone Fortunes

Charles Sizemore is the editor of Green Zone Fortunes and specializes in income and retirement topics. Charles is a regular on The Bull & The Bear podcast. He is also a frequent guest on CNBC, Bloomberg and Fox Business.